By understanding and using accounting standards, nonprofits can often cut the strings attached to donations and grants.

It would be a wonderful world in which all donors — foundations, individuals, government agencies, and corporations — gave nonprofits only general operating grants with no restrictions whatsoever. In the meantime, while we nudge the world in that direction, nonprofits can take a proactive approach to living with and working with contributions that do carry donor-imposed restrictions. The key is to carefully shape our asks — to intentionally craft proposal narratives and budgets that allow restricted gifts to act as much like general support funding as possible. To realize this kind of flexibility in restricted grants, nonprofits will want to understand accounting standards related to grants and contributions and to revenue recognition for contracts.

The wonders of general support funding

For good reason, nonprofits hold donors that provide general operating grants — grants without restrictions on their use or timing — in high esteem. Funding received without restrictions places trust in the nonprofit to use its discretion when deploying its financial assets. General support funding allows a nonprofit to be the most flexible and creative in the use of its resources. A gift without restrictions can be used to cover the whole range of expenses related to the nonprofit’s program work. When confronted with unforeseen circumstances, having unrestricted funding allows nonprofits to respond quickly and innovatively.

Understandably, many donors have their own strategic plans that guide their funding choices. With their own priorities in mind, funders often target their contributions for use on specific programs, mission goals, kinds of projects, and even specific types of expenses. While it takes more capacity and care to account for grants with restrictions, nonprofits can learn to craft their proposal narratives and budgets to make even these types of funds behave as flexibly as possible.

Sometimes our restrictions are of our own making

Unless we take proactive steps to avoid it, the restrictions we endure are sometimes more of our own making than of our donors. Often the grant award notice or contribution cover letter we receive from a donor simply references our proposal and proposal budget. It may say something like, “This award is in support of [insert project title here] as described in the grant application.”

While it is the donor’s intent that creates the restriction on any gift, the wording that describes that intent is often found within our request. We can set up restrictions (too often inadvertently) based on how we word the ask in our proposals, our campaign letters, or on our websites. Even the way we format our proposal budgets can become the basis of grant restrictions, since the budget commonly becomes an addendum to the award agreement.

One strategy is to write proposal narratives and their accompanying budgets to include the broadest possible description of our mission goals. If we make our budgets too detailed, we may be held to using the money exactly like we show in the budget. If we limit the use of funds to just one large line item or a small group of direct expenses, then we might not be able to use the grant to pay for other shared costs that support the program and the organization.

Full collaboration and communication between CEOs, development staff, program managers, and the finance department is crucial to developing clear, effective grant budgets. A disconnect between any of these parties and we risk developing budgets that:

- Do not cover the full costs of the work being proposed

- Describe work that is outside of our stated mission

- Do not sync with accounting standards that rule the release of these funds

- Risk obligating the organization to work it does not have the capacity to complete

Developing a flexible grant budget

Proactively managing how and when contribution revenue is received, recognized, and released from restriction allows nonprofits to avoid being a victim of their own grant writing and accounting. Nonprofits have an obligation to honor donor-imposed restrictions on the gifts they receive based on the purpose of the funds and time period in which the funds are expected to be used. Having a financial system sophisticated enough to track and report the receipt and satisfaction of restricted revenue is a crucial investment for any nonprofit — as is investing staff time in learning the accounting standards that govern how to report on the use of those funds. Knowing the accounting at play will inform better strategies for creating our proposals.

A key principle is to write narratives and build budgets that capture the broadest view of our mission work and organizational activities, even when we are writing about a single program within our organization. Building holistic budgets that capture all of our program costs begins with building elegant cost centers into our accounting systems. A smart strategy is to outline program work that we routinely perform. Even if the award letter restricts the use of the grant to those purposes, it will act much like a general support grant — it will pay for a broader spectrum of what we are already doing.

We should also be sure to build our proposal budgets to reflect the full costs of providing the program activities we describe in our narratives. If our budget includes the core infrastructure and administrative costs that support the program work, then any restricted funding received for this program will happily cover the full cost of doing the work. We should avoid defining the scope of our work too narrowly, or worse yet, limiting our proposal budget to only a few direct expense line items. If we do, we will have restricted the use of the grant in such a way that we are likely to lose money on the program.

Curtis Klotz presented this topic at the 26th Annual Nonprofit Conference, where this session was graphically recorded by Sherrill Knezel.

What does a full-cost program budget look like?

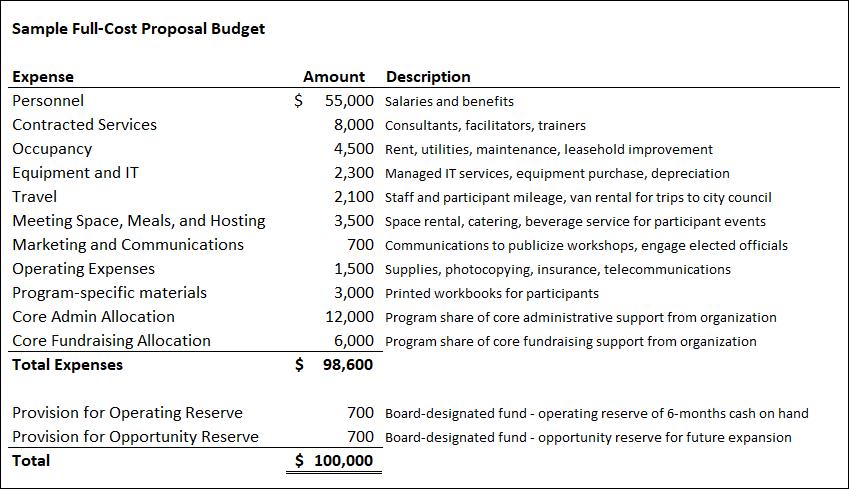

Nonprofits often design their proposal budgets to show line-item detail of the costs involved in a program or project. This seems logical, and it can be sufficient, but only if the line item budget also has the full costs of running the program and supporting the larger organization built into it.

A line item budget that does not include the proportionate cost of key organizational infrastructure — administration, fundraising, communications — sets the nonprofit up for financial failure right from the start. Even the best line-item proposal budgets typically leave out amounts designated for growing financial reserves or paying for research and development or investing in progressive staff development activities. These are all expenses that for-profit companies take for granted. So should nonprofits. But we often leave them out, thinking that our donors value frugality over sustainability and innovation. That may be true, but we will not know what our funders truly value or how deeply they support our mission and financial success until we ask them. A full-cost budget is a clear way to ask.

Nonprofits rarely include provisions in their budgets for building reserves. One way to do so would be to add line items like “Provision for Opportunity Reserve,” or “Program Contribution to Operating Reserve.” Another approach to building a reserve is simply to develop a budget with a surplus bottom line. In the real world, budgets don’t magically balance to zeros. If we build cost-based budgets and only ask for the exact amount needed to cover the costs of a project, how will our organizations ever accrue reserves?

Planning for subsistence is not a smart long-term strategy. Giving the majority of our funders a pass on contributing to our reserves while expecting a few rare “general support” grantors to fund them is neither a fair nor sustainable financial strategy.

Here is a simplified example of a full-cost proposal budget. Our sample nonprofit has civic engagement as its mission. It is proposing to offer 10 educational workshops about city government and two guided tours of city council meetings to teach residents how to better engage with their elected officials. The budget asks for $100,000 and is designed to fully fund the work and contribute appropriately to the financial needs of the entire organization.

Using accounting standards to inspire alternative proposal budget formats

Another strategy for creating flexible grant proposals involves adapting Accounting Standards Update (ASU 2014-09), Revenue from Contracts with Customers (Topic 606), to the language we use in our proposal narratives. While this standard addresses revenue recognition for contracts and does not directly apply to the release of restricted grant funds, some of its key provisions provide a creative way to format nonprofit grant budgets. A smartly crafted alternative budget format can influence when and how program activities satisfy grant restrictions.

In ASU 2014-09, recognizing revenue from contracts involves five distinct steps.

- Identify that a contract with a customer exists

- Identify performance obligations

- Determine the transaction price

- Allocate the transaction price

- Recognize revenue when a performance obligation is satisfied

Another, more recent Accounting Standards Update (ASU 2018-08), Not-for-Profit Entities (Topic 958): Clarifying the Scope and Accounting Guidance for Contributions Received and Contributions Made, clarifies the circumstances under which transactions between donors and nonprofits are treated as either contributions or exchange transactions. If a transaction fits the definition of an exchange, then the five steps outlined above would apply to recognizing revenue related to that contract.

The type of transactions suggested in this next example are intended to represent contributions, not exchange transactions. The grantor or donor is not receiving something of commensurate value in exchange for the contribution to the nonprofit. Yes, good work is being performed with the funding, but the nonprofit is not performing services directly on behalf of the donor.

In our example, we are assuming that there is no contract between the funder and the nonprofit. This is not a vendor and customer arrangement, but is a typical grant award. Given that the transaction is considered a contribution, step one of the revenue recognition process for contracts would not apply. But the remaining steps outlined in this standard can be improvised to lay out an alternative proposal budget that impacts how restricted funds would be released.

The process for recognizing contract revenue can be translated into the language of a grant proposal.

Step 1 — Instead of a contract, we are considering a grant agreement or contribution receipt or award transmittal letter.

Step 2 — Nonprofit would use its proposal narrative to describe the deliverables it would provide to accomplish its mission (in lieu of performance obligations). In the case of our sample civic engagement organization, the deliverables are 10 workshops and two guided tours.

Step 3 — Nonprofit would establish the total amount of support being asked for in the proposal (transaction price). In this case, that amount is $100,000.

Step 4 — Allocate the total amount of support (transaction price) to the various deliverables (performance obligations). In this case, the nonprofit determines that each workshop requires $9,000 of support and each guided tour requires $5,000.

Step 5 — Receive the grant award and book it as a restricted contribution. Managing the restriction is quite simple — the nonprofit simply releases the allocated amount of revenue each time one of the deliverables is completed.

Developing a deliverable-based budget

Building deliverables into a grant proposal could seem to blur the line between what is a contract and what is a contribution. In our example below, we are attempting to shape how the grant funds are released from restriction, not create a contract with the donor. Contracts are generally more specific and have the character of an entity paying for work to be done directly on its behalf for a set price. There is a difference in intent and mechanics between a contract and a typical contribution.

The sample deliverable-based proposal budget shown below is requesting funding for the same work as was the full-cost proposal budget shown previously. The proposed budget asks for $100,000 and is designed to fully fund the work and contribute appropriately to the financial needs of the entire organization. The beauty of a deliverable-based budget design is the ease of tracking and releasing the restrictions on the award. As long as the total amount requested was properly planned and calculated to cover the full costs of the proposed program, then the incremental release will cover the direct program expenses and the necessary core infrastructure costs and reserves of the organization.

Unforeseen consequences of large, multi-year grants

Occasionally, our biggest challenge is not having too little funding, but so much restricted funding in the current year that its release from restriction plays havoc on our financial statements for one or more years to follow. In certain circumstances, we may decide it is better for our financial story and our strategic planning to delay or stagger when large grants or gifts are received and booked in our financials. Those who are savvy to nonprofit finance are familiar with the sometimes dramatic ups and downs that come with the receipt of large multi-year grants. Accounting standards for nonprofits require that a nonprofit book the entire amount of the grant award, even if the cash for years two, three, and after will not be received until a future date. Because there is a promise to give, the revenue is recognized in the current year.

Once recognized, these multi-year grants may be restricted for use on only certain programs or expenses. The portion of the multi-year grant that is promised for future periods is also restricted based on time. The tables below provide a snapshot of the effect a typical multi-year grant could have on nonprofit financials. It takes a sophisticated financial statement user to understand that the negative overall bottom line in years two and three is not a sign of trouble. So not only do we have to manage our restrictions, we have to educate our donors to read the Without Donor Restriction column as the true measure of our organizational activities and performance.

Strategies to manage when grant revenue is booked

One strategy for managing when grant amounts hit our books would be to use the concept of donor-imposed conditions to control the timing. ASU 2018-08 defines the nature of conditional gifts from donors. Donor-imposed conditions are different from restrictions. Conditional gifts are not recognized — meaning they do not show up in our financial statements — until the conditions stipulated by the donor are satisfied.

ASU 2018-08 spells out the circumstances that create a condition. As we learned above, the way we draft our proposal narratives and budgets matters. If we would prefer not to immediately book the second, third, or later installments of a large multi-year grant, we could creatively write a condition into the body of our proposal. We could even go so far as to work with our foundation program officer or grant administrator to insert language into the grant agreement that attaches a condition to the future installments.

One characteristic of a conditional contribution is that a barrier exists that must be met before the condition is satisfied. Common examples of barriers include:

- A matching funds requirements

- A requirement that a certain certification or government approval be secured

- A measurable performance threshold must be met within a certain timeframe

Each of these types of barriers would delay a grant amount from being recognized until the stipulation was met, as long as there was also a right of return provision in the grant agreement. Right of return simply means that the donor retains the right to request the contribution be returned if the grantee does not meet the stipulations. A valid strategy for managing when contributions are booked may require including language describing conditions in our proposals and asking for it to be included in the grant agreement or contribution transmittal letter.

Creative proposal writing and proactive accounting strategies

Understanding new FASB standards can help us be more strategic in how we mold our funding requests. We can even look beyond the standards that deal with grants and contributions to use other revenue recognition standards to guide our proposal writing. How we craft our proposal narratives and budgets will often determine when we recognize revenue and what the actual restrictions are on any grants that we receive. While it may be alarming to discover that we have been inadvertently restricting ourselves more than many of our contributors would have required, it is freeing to realize we can develop alternative fundraising strategies.

To ensure our proposal budgets and narratives complement rather than complicate our efforts to find flexible funding, we can put the latest FASB standards for revenue recognition concerning grants, contributions, and contracts to good use. Using full-cost budgets, deliverable-based budgets, and purposefully building conditions into certain grant requests, we can structure our proposal narratives and budgets purposefully. By skillfully designing how we word our narratives and how we display our budgets, we can control when our revenue is recognized and how any restrictions will be treated when it comes time to report them. By shaping our ask strategically, we can avoid becoming unwitting victims of the accounting requirements before it’s too late.

How we can help

CLA’s extensive experience with nonprofit organizations allows our professionals to go beyond accounting standards and regulations. Our goal is to understand your organization’s goals, and consult with you on financial management, grant compliance, information security, tax compliance, and other strategic issues that enhance your ability to fulfill your mission