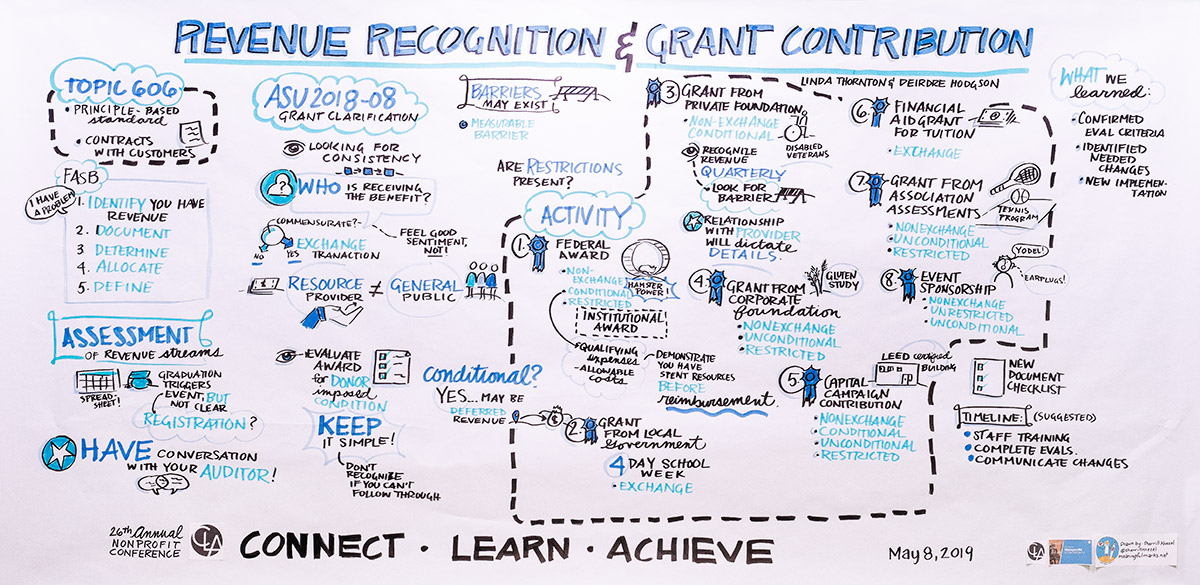

The update uses a flowchart to help remove uncertainty arising from the revenue recognition standard that took effect January 1, 2018, for nonprofit organizations.

On June 21, 2018, the Financial Accounting Standards Board (FASB) released Accounting Standards Update (ASU) 2018-08, Clarifying the Scope of the Accounting Guidance for Contributions Received and Contributions Made.

The update provides clarifying guidance on accounting for the grants and contracts of nonprofit organizations as they relate to the new revenue standard (ASU 2014-09 Revenue from Contracts with Customers), and aims to minimize diversity in the classification of grants and contracts that exists under current guidance.

To help organizations better understand the impact of the standard, the guidance includes illustrative examples and a flowchart to provide a framework to evaluate and properly classify revenue streams.

Reciprocal versus nonreciprocal transactions

Step one in the ASU flowchart asks organizations to distinguish between reciprocal (exchange) and nonreciprocal (contribution) transactions. Under current practice, many nonprofits treat governmental entity grants and contracts as exchange transactions, regardless of the substance of the grant or contract.

But for many, the current mindset is that the government does not give contributions — that way of thinking equates the benefits received by the general public to the government receiving commensurate value in return for the assets transferred.

ASU 2018-08 makes it clear that the benefit received by the general public is not the same as the resource provider receiving that benefit (i.e., the government receiving commensurate value in return for the transfer). In addition, execution of the resource provider’s mission does not equate to commensurate value. Therefore, under the new guidance, these transactions are considered nonreciprocal.

Deirdre Hodgson and Linda Thornton presented this topic at the 26th Annual Nonprofit Conference, where this session was graphically recorded by Sherrill Knezel.

Determining conditional contributions

Grants and contracts that were previously accounted for as exchange transactions are not necessarily contributions. Step two in the flowchart requires organizations to determine whether a contribution is conditional. Answering this question includes consideration of the following:

- Is there a barrier that must be overcome?

- Does the agreement contain either a right of return of assets transferred or a right of release of the donor or grantor from its obligation to transfer assets?

The updated guidance includes examples of barriers, such as:

- Measurable performance-related requirements (i.e., matching funds, helping a specific number of individuals, etc.)

- Primary purpose agreements (include a specific spending purpose)

- Limited spending discretion

If the contribution is considered unconditional, the final step is to determine if any restrictions exist and to recognize the revenue in the appropriate net asset class.

Implementation of the new standard

Three scenarios are provided to illustrate the possible differences that may affect how the standard impacts your organization include:

- In the past, if you receive funding up front, you may have accounted for the entire grant as a temporarily restricted contribution; the portion that is still subject to the right of return (if a barrier is not met) would now be shown as deferred revenue.

- If you previously accounted for agreements as exchanges, and your policy is to not show restrictions met during the same year as being received as unrestricted support, the revenue would be shown initially as restricted and then as a release from restrictions.

- If you were accounting for grants and contracts using a cost-based reimbursement model, the revenue recognition is likely the same. In the past, you recognized revenue as you met the barrier (i.e., performed the required service). This approach would remain the same in the future, as the condition and the restriction are likely met simultaneously.

The effective dates for ASU 2018-08 depend on whether an entity is receiving contributions or making contributions:

- Resource recipient — If the entity is either a public business or a nonprofit that has issued, or is a conduit bond obligor for, securities that are traded, listed, or quoted on an exchange or an over-the-counter market, and that serves as a resource recipient, the entity should apply ASU 2018-08 amendments on contributions received to annual periods beginning after June 15, 2018, including interim periods. All other entities should apply the amendments for transactions in which the entity serves as the resource recipient, to annual periods beginning after December 15, 2018, and interim periods within annual periods beginning after December 15, 2019.

- Resource provider — If the entity is either a public business entity or a nonprofit that has issued, or is a conduit bond obligor for, securities that are traded, listed, or quoted on an exchange or an over-the-counter market, and that serves as a resource provider, the entity should apply ASU 2018-08 amendments on contributions made to annual periods beginning after December 15, 2018, including interim periods within those annual periods. All other entities should apply the amendments for transactions in which the entity serves as the resource provider, to annual periods beginning after December 15, 2019, and interim periods within annual periods beginning after December 15, 2020.

How we can help

ASU 2018-08 in its entirety is now available. CLA’s nonprofit professionals have been following this standard and are familiar with the ways it affects organizations. We can help you understand these clarifications and discuss the possible changes to your accounting processes and procedures.