Chris Dhanraj is joining me. I'm Clayton Bland. We're going to walk you through the CLA Outlook for 2026; we're excited to share with you.

We really take a top-down view of the macroeconomic drivers, consumer finances, business conditions, labor market, Federal Reserve policy, and fiscal policy — and we're going to tie that into what our view is going to be around equity markets, fixed income, and the private market.

So Chris, let's jump in on our outlook for 2026.

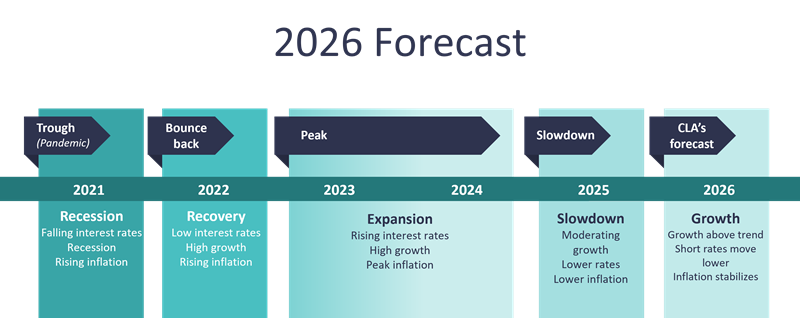

For 2026, Clayton, we think that growth, economic growth in particular, will accelerate. And we think that not only will growth accelerate, but we do think that inflation will stabilize and interest rates will move lower, all of this which will be great for the economy.

And if you look on the screen here, what we are showing is sort of the economic report card, right? What does the current situation look like across the economy, Fed policy, consumer, business conditions, labor, and fiscal policy?

Fast forward to 2026 and beyond, the interest rate picture gets much, much better, Clayton. Right?

We have gone from interest rates of about 5% and we are now at 3.25% to 4% and expecting to go even lower for the next one year.

And so with interest rates coming down, with the Fed becoming a bit more dovish, and adding more balance to the balance sheet, we think it's actually a good setup for the economy.

Let's take Federal Reserve policy, as you just highlighted. Where do you think this ends up stabilizing over the next 12 months in 2026?

You know, I think over the next 12 to 24 months, we're going to head back down to three, maybe even slightly below.

And the answer is why? And the reason is, well, when the Fed talks about its neutral rate, they're basically trying to keep interest rates just above the level of inflation. Inflation has come back down to that 3%, even bit lower if you look at core PCE.

So we think that the interest rate picture goes down probably another, you know, 75 to 100 basis points over the next year.

Let's look at the implications for fixed income.

When you look at what happens during a recession, nobody wants junky assets, right? Nobody wants to take any risk at all. They just sell their investment grade bonds or your high yield bonds and they buy, you know, treasuries or they go to cash.

You are not seeing this. It's a huge appetite for issuance in the high yield market and the investment grade market. From this perspective, there's no signs of recession.

As we move over time and you look at a five-year rolling period, a 10-year rolling period — this again goes back nearly 75 years — you're looking at, why do people say time invested in the market is way more important than timing the market.

We believe that this will continue to be a trend worth holding to. That over a 10-year period, your downside volatility is reduced and stocks still offer attractive returns and a 60/40 portfolio still offers fairly attractive returns, when you look at these averages.

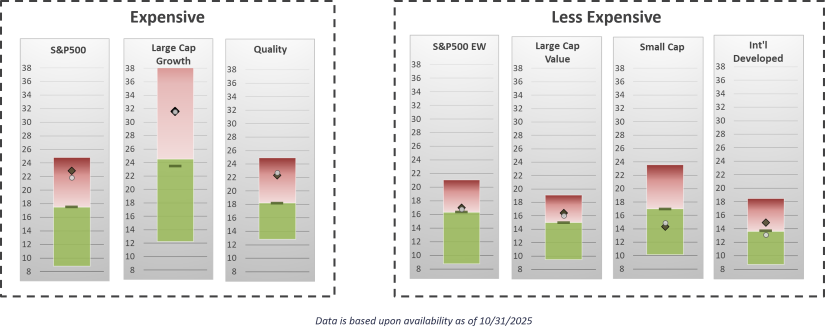

When you think about, you know, the stock market, what is what is your initial thought? Oh, it's expensive.

And so when you think about what's expensive in the stock market, it's your growth stocks. So think about your Mag 7, right? Even, you know, the S&P 500 has gotten pretty expensive because 40% almost are these Mag 7 stocks.

And so there's been a lot of, you know, hand-wringing about, well, stocks are too expensive. If you drill down Clayton, there's actually some areas of the market that we're tilting our portfolios towards in 2026 and beyond because they're actually kind of cheap.

There's an element of how do you value one versus the other? How do you balance one versus the other?

I think our approach that we're using in 2026 and beyond is, rather than taking a deep value bent, we can buy small caps and international companies, which are also cheaply valued, but also benefit from lower interest rates. So you get two for the price of one.

As we talked about alternatives, I think one of the interesting thing is you're seeing an explosion of alternative products coming out. And the reason why that is, is you're seeing a lot of structures that give retail investors a lot more accessibility to these alternative markets, so-called interval funds that kind of act like mutual funds.

Maybe lastly, Chris, we'll just jump in and highlight the capital markets assumptions. And I think again, this is how do you invest for growth, but in a very diversified way. One thing maybe to mention, Clayton is that private markets are exactly that. They're private and they're illiquid, right?

What is the opportunity cost of locking up your money for 10 or 11 years and you're paying fees every single year versus a very liquid ETF? And again, all of these should be at least part of your discussion with your advisor.

But there's no one magic bullet. This is about putting together the right portfolio that's diversified, that allows you to kind of weather the storm of any drawdowns, but helps you reach your goals.

Yeah, this is fantastic. Chris, thanks so much for the time. Appreciate everybody.

Key insights

- 2026 should be a year of strong economic growth, which should be a tailwind for investment portfolios.

- Investors face new opportunities to reposition portfolios for stronger returns — but selectivity and timing will be key.

- Looking across equities, fixed income, and alternatives presents some attractive opportunities for growth and yield while avoiding areas that sport expensive valuations.

Navigate 2026 with confidence. Ready to review your strategy?

As we enter 2026, many business owners and investors are still feeling the weight of uncertainty. Headlines have been dominated by volatility, inflation, and geopolitical tension — and sentiment surveys reflect a cautious, even pessimistic, outlook. But the data tells a different story.

Markets are at or near all-time highs. Inflation is stabilizing. Interest rates are falling. And economic growth is showing signs of acceleration. This disconnect between perception and reality is the most important dynamic to understand.

Explore CLA’s 2026 economic outlook, market forecast, and capital market assumptions to help you make informed decisions. From fixed income and equities to alternative investments, here’s what you need to know — and why it matters.

- Economic outlook

- Fiscal policy: Long-term risks to watch

- Fixed income outlook

- Bond strategy spotlight

- Equity market trends and strategy

- Growth vs. value: a closer look

- Alternative investment strategies

- What to ask before you invest

- Capital market assumptions

Economic outlook for 2026

CLA anticipates the U.S. economy could grow at or slightly above its long-term trend of 2% in 2026, assuming the Federal Reserve continues cutting interest rates in a timely manner.

This marks a shift from the restrictive monetary environment of the past three years, as the Fed pivots toward rate cuts and ends quantitative tightening. Inflation is stabilizing, and credit conditions remain solid — creating a more favorable environment for business investment and consumer activity.

While consumer spending may be moderate due to cooling wage growth and employment, household balance sheets remain strong, small business confidence is holding steady, and corporate earnings continue to show resilience.

These factors support a cautiously optimistic view: recession risks appear low, and the economy is positioned for continued expansion.

Why this matters

Despite widespread uncertainty and negative sentiment, the data tells a different story. Economic fundamentals suggest cautious optimism — conditions are in place for expansion, not contraction.

Understanding this disconnect can help you avoid reactive decisions and instead focus on the underlying fundamentals that point to continued growth.

What to watch in 2026

- Fed decisions around rate cuts and inflation data

- Labor market trends and wage growth

- Consumer sentiment and spending patterns

- Small business optimism and capital investment

Fiscal policy: Long-term risks to watch

Fed policy plays a crucial role in shaping the economic landscape. The Fed is set to become more dovish as it lowers interest rates and prepares to end its quantitative tightening policy. This in turn should support business and consumer confidence in interest rate sensitive areas, such as capital markets and real estate.

However, federal debt and interest expenses are rising — and will likely remain a key concern in 2026 and beyond.

Without significant spending cuts, the Congressional Budget Office (CBO) projects federal debt will exceed GDP within the next five years, with interest payments consuming a growing share of national income. This dynamic could limit the government’s flexibility to respond to f uture downturns, a nd potentially “crowding out” the private sector from the credit markets.

The CBO is forecasting U.S. federal debt to increase beyond the level of GDP over the next 10 years, with interest expense consuming an ever-larger portion of GDP. Increasing federal debt runs the risk of “crowding out” the private sector.

Why this matters

Rising debt and interest costs can quietly erode growth potential. For business owners and investors, this means future policy flexibility may be limited — and long-term planning must account for the fiscal drag that’s already in motion.

Key highlights

- The monetary policy of the Fed remains a key lever for economic stability.

- The Fed is expected to continue cutting interest rates over the next year, which could lower the marginal cost of doing business and boost growth of the money supply, adding much needed liquidity to our economy.

- The One Big Beautiful Bill Act makes tax cuts permanent and encourages more business investment.

- Tariffs are a possible headwind, but they haven’t had much of an impact since the first quarter of 2025.

Want to explore more about the impact on your portfolio or business? Watch the video and stay ahead with weekly insights. Start with CLA Outlook.

Fixed income outlook for 2026

After a challenging stretch for bonds, fixed income is back in focus. Lower interest rates are anticipated to be a tailwind for bond prices, and real yields — adjusted for inflation — are at their most attractive levels in nearly two decades.

Our year-end forecast for the yield curve shows short-term rates should fall while intermediate and long-term rates remain volatile within a narrow band that ends up not too far from current levels .

The yield curve is projected to steepen, with short-term rates falling and long-term rates stabilizing. Credit conditions remain favorable, but tight spreads suggest limited upside in lower-quality bonds. When investing, consider locking in higher yields by extending duration modestly (e.g., 5 – 7 years) and focusing on quality credit.

Short-term rates have room to fall. Intermediate rates are near the low-end of our range while long-term rates are near the high end.

High nominal interest rates and falling inflation means that “real” interest rates remain attractive.

When seeking income, the most attractive sectors include private credit, preferred stocks, and investment grade bonds.

Bond strategy spotlight

- U.S. Treasury markets could remain a safe haven amid global uncertainties.

- Lower rates and a steepening yield curve support bond recovery and positive total returns.

- Retirees may benefit from intermediate-term investment-grade bonds for income and stability.

- Business owners could consider using fixed income to offset equity volatility and preserve liquidity.

- Tax-sensitive investors may want to evaluate municipal bonds carefully — yields are tight, but tax advantages may still apply.

- Focus on high-quality bonds and intermediate duration to lock in attractive yields.

Our fixed income outlook is shaped by anticipated interest rate cuts, which are expected to influence the yield curve and investor sentiment. Despite all the debt piling up from federal deficits, the long-end of the yield curve appears to be quite contained.

CLA perspective

“We’ve already had three rate cuts this year … and the long end of the yield curve is actually quite contained. Despite the level of debt and interest expense, people still see the U.S. Treasury market as the least risky.”

“We haven’t seen 30-year treasuries blow out … and the government continues to issue short-term debt to operate.”

Why this matters

Fixed income is regaining its role as a stabilizer. For investors, this is a chance to lock in attractive yields and rebalance portfolios after a volatile rate environment. Understanding where the Fed has influence — and where the market is signaling confidence — helps guide smarter bond strategies.

Equity market trends and strategy

The equities market presents both opportunities and challenges as valuations remain high, but certain sectors offer potential for growth.

Equities are anticipated to continue higher in 2026, driven by strong earnings growth and a supportive macroeconomic backdrop. However, elevated valuations — especially among mega-cap tech stocks — call for a more selective approach.

Bear market frequency and recovery patterns reinforce the importance of long-term perspective.

Stocks that are “expensive” suggests a lot of good news has already been priced in, so they may be at risk from any downside surprises.

“Cheap” stocks are currently “out of favor” but should benefit from any upside surprises while offering downside protection.

Diversification is key. International and small-cap stocks offer compelling value, with earnings growth forecasts comparable to U.S. large caps but at significantly lower valuations. Value stocks, which have lagged in recent years, may benefit from falling interest rates and improving economic conditions.

Growth stocks vs. value sectors: a closer look

- Growth stocks (e.g., tech, AI leaders) remain strong but face slowing earnings growth momentum.

- Value sectors (e.g., energy, financials, industrials) may benefit from rate cuts and cyclical recovery.

- AI-driven productivity gains could support both growth and value companies — especially those investing in efficiency.

Why this matters

Equity markets are evolving — and volatility is part of the journey. History shows intra-year drawdowns are common, even in strong market years. Long-term trends like AI adoption and earnings growth are driving opportunity, but selectivity and resilience are essential.

Investors who understand the cycle and stay invested are better positioned to benefit. Diversify across regions, styles, and market caps to capture upside and manage risk.

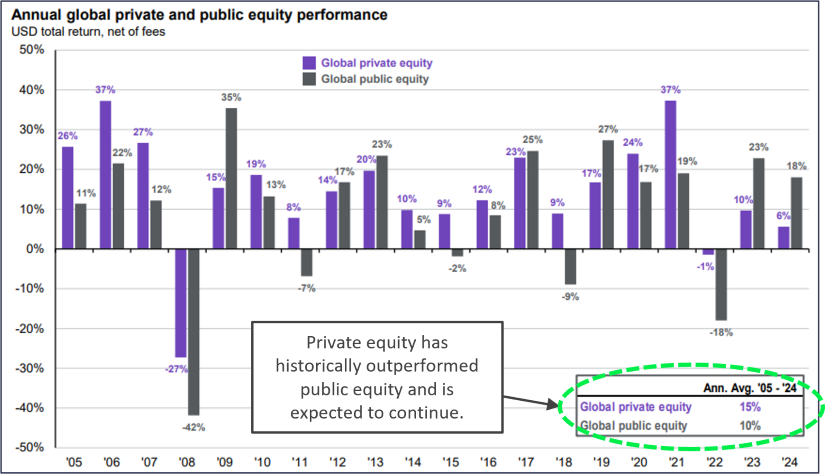

Alternative investment strategies

Alternatives play an important role in portfolio diversification, and the alternatives market is witnessing a surge in innovative investment products with the creation of new retail-friendly structures to access alternatives.

However, be wary as many of these products have high expenses, too much leverage, or returns that have lagged public market returns.

Alternative investments — including private equity and real estate — are well-positioned for 2026. Lower interest rates tend to boost asset valuations and deal activity, especially in private markets.

There are approximately 18,000 companies in the private sector while there are only about 3,000 companies in the public sector. Private equity has a strong history of outperforming public equities over the long run.

CLA perspective

“You’re seeing an explosion of alternative products … but fund manager selection is critical. Who you pick will actually determine your outcome.”

“Even within the same firm, different vintages can have significant dispersion.”

Why this matters

Alternatives offer diversification and potential upside — but they’re not one-size-fits-all. With more products entering the market, investors need to be discerning. The right manager can make all the difference, and due diligence is non-negotiable.

What to ask before you invest

- What is the manager’s track record and experience?

- What are the fees, liquidity terms, and risk profile?

- How does the strategy fit into your overall portfolio?

- Are you comfortable with the time horizon and capital lock-up?

- Are tax and wealth planning considered simultaneously?

Manager selection is critical. The dispersion of returns in alternatives is wide, and new retail-friendly products often come with high fees or complexity. Prioritize quality and transparency when allocating funds to alternative investments.

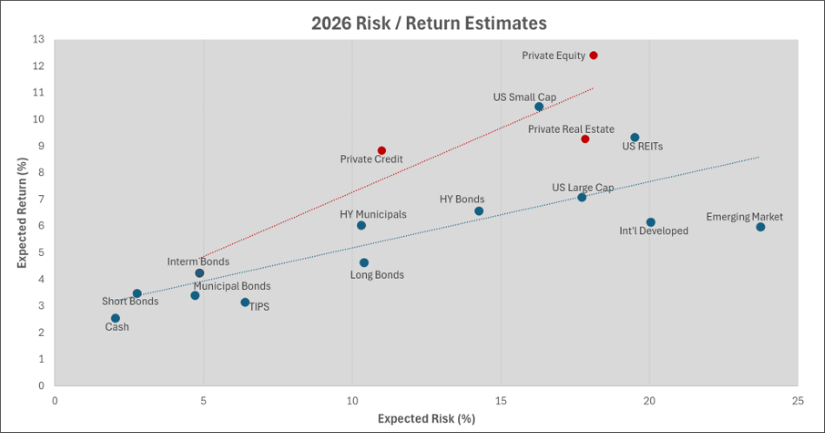

Capital market assumptions for 2026

CLA's capital market assumptions highlight strategic investment areas poised for growth, focusing on small-cap stocks and private equity.

While private markets have higher expected returns, investors should also consider the illiquidity that accompany these investments.

Capital market assumptions help guide strategic portfolio decisions. For 2026, models may favor private equity, private credit, and small-cap stocks for their strong risk-adjusted return potential. Real estate and select income-generating assets also rank well.

Private equity, private credit, and small caps are the most attractive asset classes, followed closely by public and private real estate.

Looking ahead at evolving market conditions

CLA’s capital market assumptions are updated annually to reflect evolving market conditions. They serve as a foundation for long-term investment strategy, helping investors align to their portfolios with goals, risk tolerance, and time horizon.

Key highlights

- Small-cap stocks and private equity may deliver higher returns in the coming years.

- Strategic asset allocation and diversification remain key to navigating market uncertainties.

- Diversified portfolios with strategic tilts can enhance returns and reduce volatility.

How CLA can help with financial planning

While uncertainty remains high, the data points to opportunity — and those who can look past the noise may be well positioned to reassess their financial strategies. With economic growth projected to continue, interest rates falling, and markets offering new value pockets, now is the time to act with purpose.

Conditions change often. Staying informed helps you make better decisions. Whether you're building a portfolio, planning for a business transition, or seeking tax-efficient investment strategies, CLA Wealth Advisors can help you move forward with clarity.