Key insights

- For the period beginning after June 15, 2025, Governmental Accounting Standards Board (GASB) Statement Nos. 103 and 104 will introduce changes to financial disclosures, presentation formats, and note disclosures to improve clarity and transparency in financial statements.

- GASB 103 requires Management’s Discussion and Analysis (MD&A) to focus on five specific areas including an overview, financial summary, detailed analyses of financial position and operations, descriptions of capital assets and long-term financing, and forward-looking information impacting net position.

- Under GASB 104, institutions are now required to separately disclose lease assets, intangible right-to-use assets related to public-private partnerships, subscription assets, and other intangible assets in their capital asset notes.

Enable accurate and transparent financial reporting.

In 2024, the Governmental Accounting Standards Board (GASB) issued two updates that will impact financial statements of public colleges and universities.

GASB Statement No. 103, Financial Reporting Model Improvements (GASB 103), requires changes to management’s discussion and analysis (MD&A), treatment of unusual or infrequent items, presentation of the proprietary fund statement of revenues, expenses, and changes in fund net position (SRECNP), presentation of major component units, and budgetary comparison information.

GASB Statement No. 104, Disclosure of Certain Capital Assets (GASB 104), requires certain types of capital assets to be disclosed separately in the capital asset note disclosures.

Both GASB 103 and 104 are effective for fiscal years beginning after June 15, 2025.

How GASB Statement 103 changes affect higher education

Management’s Discussion and Analysis

GASB 103 requires the MD&A be confined to five topics; information not related to the required topics should not be included in the MD&A:

1. Overview of the financial statements, including relationships of the statements to each other.

2. A financial summary in a prescribed condensed format comparing the current year to the prior year (refer to detailed format in GASB 103, paragraph 8b).

3. Detailed analyses of financial position and results of operations summarizing significant changes. If applicable, refer to the analysis of significant capital assets and long-term financing activity required under topic four below. This information should not be duplicated.

In addition to reporting the changes in terms of dollars or percentages, the analysis should explain why those changes occurred and indicate the magnitude and facts, decisions, or conditions a user of the financial statements may not know.

Significant policy changes and important economic factors impacting results should also be discussed. For example, if tuition and fee revenue significantly increased because of the institution approving increases in tuition and fees charged to students.

4. Description of significant capital assets and long-term financing activity:

- Capital asset activity includes additions and disposals of assets, changes to commitments for purchasing capital assets, and should include certain intangible assets (for example, leases and subscription-based information technology arrangements (SBITAs)). The description should also address any significant policy changes and economic factors relevant to the capital asset activity.

- Long-term financing includes debt, leases, public-private partnerships (PPPs), and SBITAs. The description should include new arrangements, changes in credit ratings, and changes in debt limitations. It should also include any significant policy changes and economic factors.

5. Currently known (at the date the financial statements are issued) facts, decisions, or conditions should be described if expected to have a significant effect on the net position of an institution or that are expected to produce significant differences from the results of operations of the current year. GASB 103 gives five examples (not all inclusive):

- Trends in relevant economic or demographic data (for example enrollment)

- Factors used to develop next year’s budget

- Expected changes in budgetary net position

- Actions taken related to postemployment benefit plan liabilities, capital asset improvement plans, lease liabilities, operator liabilities in a PPP, SBITA liabilities, and other long-term financing

- Actions other parties have taken, such as new legislation or regulations

While writing your institution’s MD&A, GASB 103 has other requirements, such as emphasizing the current year when discussing fluctuations from the prior year (this analysis should be fact based and include both significant positive and negative impacts), avoiding duplication, distinguishing between the primary government and discretely presented component units, and providing an objective and easily readable analysis.

Implementation suggestions:

- Organize your prior MD&A into the five required sections and consider removing sections not required.

- Read your prior MD&A and remove any duplicative sections.

- When explaining significant fluctuations, the descriptions should not only point out the differences, but explain the reasons why. For example, it wouldn’t be appropriate to only state tuition revenues increased by $X and X% in undergraduate activity. The reasons should be discussed — such as enrollment increased X% due to higher demand in a poor economy and the board of trustees approved an X% rate increase on July 1.

- Avoid copying and pasting your capital assets and long-term debt footnotes into the MD&A. The roll-forwards disclosed in the notes are a good starting point to identify significant activity. Once identified, write up the reasons why these events occurred.

- Are the forward-looking sections of prior MD&As limited to circumstances that are thought to have a significant effect on net position or cause significant differences in the results of operations?

- Read the example MD&A contained within GASB 103, appendix C.

Unusual or infrequent items

There is no change in the definitions of unusual or infrequent items as defined in GASB Statement No. 62, Codification of Accounting and Financial Reporting Guidance Contained in Pre-November 30, 1989, FASB and AICPA Pronouncements.

What has changed is the presentation of these items. Inflows and outflows related to unusual or infrequent items need to be presented individually as the last presented flow of resources prior to the increase (decrease) in net position on the SRECNP.

Presentation of the proprietary fund statement of revenues, expenses, and changes in net position

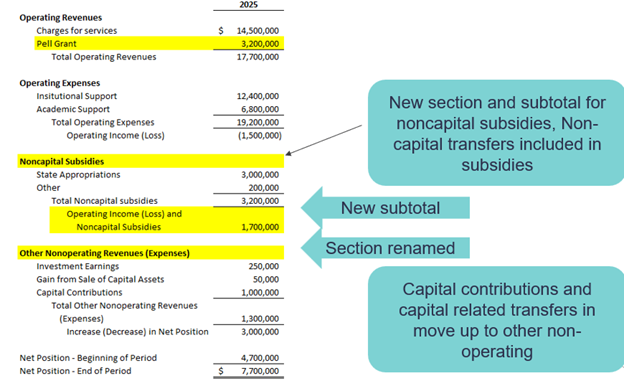

The SRECNP is required to present the following information in the order shown:

- Operating revenues (detailed)

- Total operating revenues

- Operating expenses (detailed)

- Total operating expenses

- Operating income (loss)

- Noncapital subsidies (detailed)

- Total noncapital subsidies

- Operating income (loss) and noncapital subsidies

- Other nonoperating revenues and expenses (detailed)

- Total other nonoperating revenues and expenses

- Income (loss) before unusual or infrequent items

- Unusual or infrequent items (detailed)

- Increase (decrease in net position)

- Fund net position beginning of period

- Fund net position end of period

- Nonoperating revenues and expenses are defined as:

- Subsidies received or provided

- Contributions to permanent and term endowments

- Revenues and expenses related to financing

- Resources from the disposal of capital assets and inventory

- Investment income or expenses

Operating revenues and expenses would be those other than defined above as nonoperating.

Subsidies are defined as resources received (or paid) from/to another party:

a) For which the institution does not provide (other party does not provide) goods and services, and

b) That directly or indirectly keep the institution’s current or future fees lower than they would be otherwise (are recoverable through the institution’s current or future pricing model)

An example of an institution’s SRECNP after the adoption of GASB 103 follows:

Implementation recommendations:

- Update your current SRECNP template to conform with the new presentation standards.

- Certain accounts mapped to prior lines and sections of the SRECNP may need to be updated within your reporting software to conform with GASB 103.

- Read your notes to the financial statements and update the sections related to what type of activities are operating and non-operating. Include the new noncapital subsidies definition.

- Educate upper management and governance about the changes and what the SRECNP will look like going forward.

- If you issue comparative financial statements, the changes are required to be reported retroactively; therefore, update your prior year financial statement to conform with GASB 103.

- When the primary government adopts GASB 103, the component units included in their report will also need to adopt GASB 103. Communicate with management of your component units regarding reporting changes.

Major component units in basic financial statements

In the basic financial statements, each major component unit is to be presented separately in the statements of net position and SRECNP, if it doesn’t impact the readability of the statements. If readability is impacted, a combining statement of major component units needs to be added after the institution’s basic financial statements. It would not be acceptable to include this combining schedule in the notes to the financial statements or as supplementary information.

The definition of a major component unit has not changed with the issuance of GASB 103 (defined in GASB Statement No. 14, The Financial Reporting Entity, as amended by GASB Statement No. 61, The Financial Reporting Entity: Omnibus).

To identify major component units, consideration should be given to a component unit’s nature and significance in comparison to the primary government based on any of the following three factors:

- The component unit provides services to the citizenry that make separate reporting a major component unit essential to the financial statement users.

- The component unit has significant transactions with the primary government.

- The component unit has a significant financial benefit or burden relationship with the primary government.

Implementation suggestions:

- If you have more than one major discretely presented component unit, check your current presentation — a change may be required.

- If prior notes to the financial statements contained combining schedules of major component units, they can be removed as this information is now in the new combining statement of major component units.

- When the primary government adopts GASB 103, the component units included in their report will also need to adopt GASB 103. Communicate with management of your component units regarding reporting changes.

Budgetary comparison information

Many institutions of higher education do not present budgetary comparison information. For institutions that do prepare this information, it’s required to be presented as required supplementary information (RSI) and must include:

- Variances between original and final budget amounts, and

- Variances between final budget and actual amounts

An explanation of significant variances is required to be presented in the notes to the RSI.

What are the changes to GASB Statement 104?

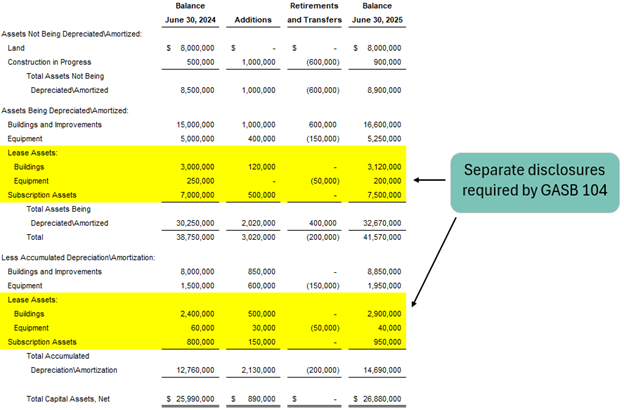

This standard requires certain information be included in the capital asset disclosures already required by GASB Statement No. 34, Basic Financial Statements – and Management’s Discussion and Analysis – for State and Local Governments.

The disclosure your institution is already making regarding the “roll-forward” of capital assets is now required to disclose the following capital assets and related amortization separately:

- Lease assets (by major class of underlying asset)

- Intangible right-to-use assets recognized by an operator in accordance with GASB Statement No. 94, Public-Private and Public-Public Partnerships and Availability Payment Arrangements (by major class of underlying PPP assets)

- Subscription assets

- Intangible assets other than those noted above (by major class of asset)

Retroactive application is required, therefore, any reclassifications required would need to be made to the beginning of the earliest period presented. An example disclosure after the adoption of GASB 104 follows:

GASB 104 defines a capital asset held for sale if:

- The government has decided to pursue the sale of the asset, and

- It is probable the sale will be finalized within one year of the financial statement date.

It also gives four factors to consider when evaluating if a sale is probable:

- Is the asset available for immediate sale in its current condition?

- Is there an active program to locate a buyer that has been initiated?

- What are the market conditions for selling that type of asset?

- Are regulatory approvals needed to sell the assets?

Should an asset meet the above definition, it will continue to be reported within the appropriate major class of capital assets. An institution will need to disclose capital assets held for sale in the notes to the financial statements that include historical cost and accumulated depreciation/amortization, by major class of asset.

Implementation suggestions:

- Review any capital assets the institution is in the process of selling to see if they meet the definition of held for sale.

- Update footnotes of the prior year to conform with GASB 104.

How CLA can help with the adoption of GASBs 103 and 104

CLA’s higher education professionals have discussed these changes in detail with various institutions of public higher education. Whether you need to better understand a specific provision in these standards or need direct assistance with adoption, CLA can help.

Contact us

Enable accurate and transparent financial reporting for your institution. Complete the form below to connect with CLA.