Key insights

- Rural hospitals face financial challenges due to demographic and economic factors but can improve margins through strategic financial modeling and operational adjustments.

- Agile, scenario-based financial models tailored to rural hospitals help anticipate market changes and assess the impact of various strategies on margins and cash flow.

- Combining strategies like increasing swing bed days, improving labor performance, reducing accounts receivable days, and improving chargemaster revenue can turn a negative margin into a positive one.

- Deploying artificial intelligence and automating repetitive revenue cycle tasks can uncover operational efficiencies and streamline hospital functions.

Get strategies to improve your rural hospital’s economic health.

Rural hospitals play an important role in their communities — providing access to essential health care services and serving as an economic lynchpin.

Yet, rural residents tend to have a higher reliance on Medicaid, higher rates of uninsured, lower incomes, and smaller volumes — creating financial pressures that impact margins.

Whether you're a critical access hospital, rural prospective payment system hospital, or rural health clinic, consider these actionable strategies for enhanced financial stability.

Strategies for improving margins in rural hospitals

Prepare with agile financial modeling and scenario planning

For financial leaders navigating the complexities of rural health care, the most impactful action is using a dynamic, scenario-based financial model adapted to your organization’s specific realities and evolving market conditions.

Take our hypothetical example below using our CLA Intuition model.

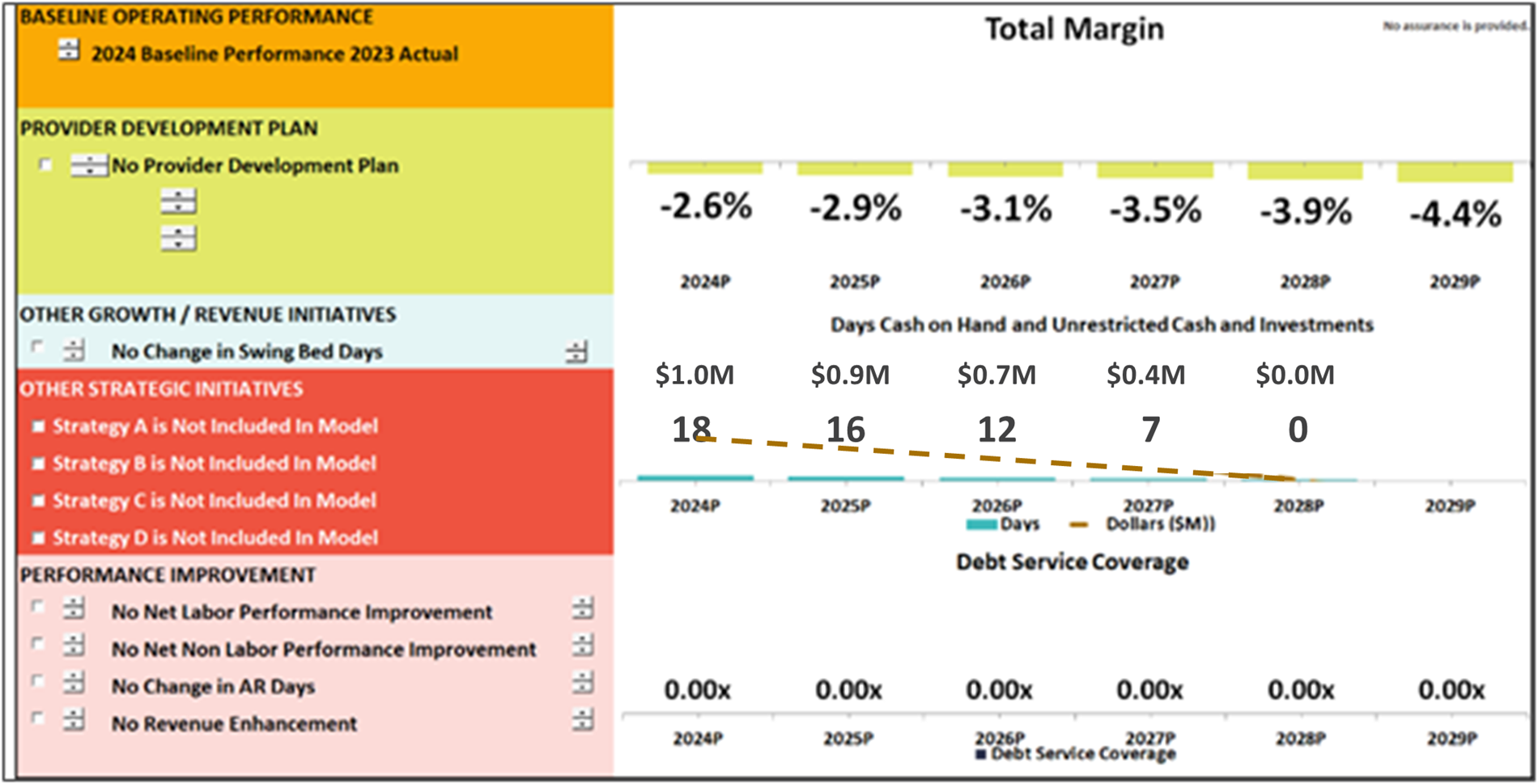

A rural hospital has a negative 2.6% total margin. Assuming the hospital makes no changes, within five years, its margin would fall to a negative 4.4% (Figure 1).

However, using strategic planning and financial modeling, the hospital can assess how different strategies — such as increasing swing bed days, labor performance improvements, reducing days in accounts receivable, and chargemaster revenue improvements — could improve the hospital’s margin.

If our sample rural hospital successfully implements all strategies, its margin improves to a positive 6.6% (Figure 2). The hospital could toggle between different scenarios to see how success on some strategies but not others would impact margins, days cash on hand, or other metrics.

Figure 1: Rural hospital status quo

Figure 2: Rural hospital with multiple strategies implemented

What else can the CLA Intuition® model equip rural health care to do?

- Simulate financial outcomes of strategic decisions by modeling multiple scenarios and projecting long-term impacts

- Assess the viability of service lines, reimbursement strategies, and resource allocations

- Identify key performance drivers — such as patient volume, payer mix, staffing, and capital investments — and model their influence on financial outcomes

- Stress test assumptions before implementation to reduce exposure and improve confidence in decision-making

- Align financial planning with both short-term operational needs and long-term strategic goals

- Mitigate financial risk by enabling proactive, data-informed decisions

- Enhance alignment and communication across leadership, boards, and management through clear, visual financial insights

Connect with us to discuss a CLA Intuition financial model specific to your rural hospital.

This is the power of financial modeling. It empowers rural hospitals to navigate uncertainty — whether from policy shifts, demographic changes, or economic pressures — with more clarity and control. It positions financial leaders to not only safeguard sustainability, but also to identify and pursue growth opportunities with more confidence.

Leverage new rural health clinic (RHC) opportunities

Policy changes over the past several years have created new opportunities for RHCs. To help position your organization for financial improvement:

- Analyze how removing the “primarily engaged” requirement allows for a flexible mix of specialty and primary care services — and expanded options for reimbursements and care delivery

- Revisit past decisions against establishing an RHC at a provider-based location; inflationary updates to federal limits may now make this financially advantageous

- Understand how removing the productivity standard could positively impact payments

- Take advantage of G0511 billing and coding changes now that CMS has unbundled these care management codes

Scour cost reports for improvements

Cost reports are the foundation for many reimbursements. Regular review can help you find more opportunities for margin.

- Review cost alignment and reporting to help isolate cost inefficiencies and appropriately categorize costs for reimbursement

- Analyze overhead cost centers and accuracy of statistical basis to uncover over/under allocation to cost centers

- Align provider and statistical reimbursement system correctly to accurately report Medicare utilization to receive proper reimbursement

- Analyze your wage index, specifically labor-related data, to understand its impact on reimbursements

- Scrub disproportionate share hospital (DSH) data for missing days, which helps improve DSH payments

Assess your revenue cycle for missed opportunities

Effective and efficient revenue cycle management is a go-to strategy for margin improvement. Key areas of focus are the chargemaster, charge capture, revenue integrity, pricing, coding, and billing.

- Review all elements of your chargemaster annually to prevent revenue losses and to look for new opportunities where codes or services could be reported

- Review your pricing structure annually and consider conducting comparative analysis with competitive markets in your region

- Watch for changes in claim edits and/or increases in denials to find areas that need attention

- Evaluate whether revenue trends are consistent with departmental cost or if charges for an episode of care are missing

Review CLA’s 340B article on recent happenings in the program and learn how we can help your hospital with the annual audit requirement or compliance work.

Begin 340B program or reduce program inefficiencies

The 340B program is complex, but it can be a lifeline for hospitals serving rural populations in need.

- Consider starting a 340B program to assist both your patients and your hospital with drug expenses

- Review your 340B program annually for compliance and to uncover inefficiencies

Strategically use artificial intelligence, automation

- Initiate a digital readiness assessment and roadmap to define pain points and map out solutions

- Deploy AI tools to streamline revenue cycle functions

- Automate manual, repetitive revenue cycle tasks