Key insights

- Health care transaction activity in the U.S. during early 2025 has been influenced by political, financial, and technological factors, resulting in a mixed environment with some sectors experiencing growth while others slow down.

- A changing tariff regime and federal actions may have led to some market uncertainty, impacting deal value.

- More than half of all physician practice group transactions in early 2025 involved dental practices, marking a significant spike.

- Hospitals are facing margin pressures but might see growth in outpatient settings, senior living is growing due to demographics, and behavioral health is maintaining high deal volume due to market demand.

Learn the implications of industry trends for your business.

Health care transaction activity in the U.S. during early 2025 has been shaped by political, financial, and technological influences, resulting in a mixed market with some sectors growing while others slow down.

The reasons for varied transactions may reflect four key drivers of activities this year:

- How the new president and Congress drive change

- How the ongoing need for strategic growth drives transactions

- How the necessity of improving financial position drives activity, including transactions

- How the roles of artificial intelligence and technology drive efficiencies

To help you stay informed and make strategic investment decisions, explore recent trends and developments in health care transactions.

Health care deals muted in early 2025

The first quarter saw a boost in volume and value of deals, with deal values rapidly declining in quarter two. The threat of and imposition of tariffs plus ongoing federal changes likely created uncertainty in the market, causing a pullback.

When compared to the first six months of 2024, the total deal value was relatively the same even though deal volume increased in the second quarter.

NOTE: All data in this article is sourced from publicly announced U.S. deals by LevinPro HC, Levin Associates 2025, levinassociates.com

NOTE: All data in this article is sourced from publicly announced U.S. deals by LevinPro HC, Levin Associates 2025, levinassociates.com

Buried in these numbers are several patterns — a significant increase in dental transactions, diminished hospital transaction activity, and spikes in key sub-segments like e-health and behavioral health.

Dental practice transaction activity spikes

When looking at physician practice groups, over half of all transactions in the first six months of 2025 were dental practices.

No other specialties were even close. When compared to the same period in 2024, there were 38 fewer announced deals — declining from 270 to 232 in 2025.

E-health, behavioral health become new deal niches

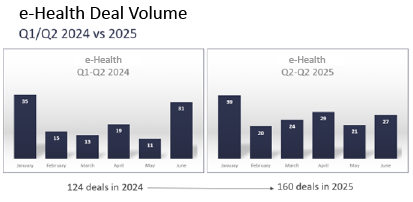

With the growing focus on artificial intelligence and technology advancements, there was an uptick in e-health related transactions, increasing from 124 deals in 2024 to 160 deals in the first six months of 2025.

Further, the current administration has focused specifically on the role digital health and technology can play in health care, including chronic disease management.

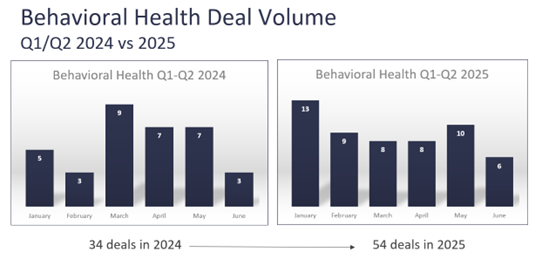

For behavioral health, the demand for autism services, substance use disorder, and other psychiatric needs propelled transactions in 2025, growing from 34 deals in 2024 to 54 this year during the same time period.

Hospital deals cool

Hospital transactions were elevated in 2024 overall but have significantly cooled off in the first half of 2025. Perhaps not surprising with the economic, labor, and federal environment facing the industry.

Private equity (PE) activity stable, non-PE private investment robust

Private equity activity remains stable over the past 18 months with funds raised aging. This means PE may want to deploy those funds to meet investment cycle timelines.

The real growth in early 2025 in buyer type has been non-PE private investment — which topped 200 deals in the second quarter of 2025 for the first time in the past 18 months.

| Physician medical group (386) |

| E-health (128) |

| Other services (123) |

| Home health and hospice (57) |

| Behavioral health (44) |

With respect to PE activity between January 2024 through June 2025, there were 861 deals with 86% in these five areas (see chart). There were 30 fewer deals in the first six months of 2025 compared to 2024 and those were largely in the physician medical group space.

That said, activity was still relatively robust — with the focus on dental transactions as well as e-health and behavioral health.

Even though home health garnered interest early on this year, it may cool a bit until after the Centers of Medicare & Medicaid Services announces the final home health Medicare payment rates for 2026. As currently proposed, Medicare rates will be cut over $1 billion next year with the final payment update due out on or around November 1, 2025.

Watch CLA’s transaction and specialty tax strategy webinar as we discuss key health care trends driving transactions in interesting ways.

Key health care trends to consider

Key trends potentially impacting the deal environment through the rest of 2025 include:

Hospitals

The industry faces ongoing margin pressures near-term and long-term with the impending Medicaid cuts (varied by state) under the budget reconciliation bill (the One Big Beautiful Bill Act). Growth potential is in outpatient settings, including ambulatory surgery centers.

Physicians, dentists

Continued transactions in this space, especially dental practice acquisition driven by PE consolidations.

E-health

Active acquisitions and roll-ups related to artificial intelligence applications, platforms, patient engagement tools, and revenue cycle.

Senior living and care

Demographics will likely continue to push growth in assisted living and independent living — especially focused on wellness and active lifestyles. Skilled nursing facility transactions will likely increase now as the industry anticipates future Medicaid funding reductions (varied by state) under the One Big Beautiful Bill Act in coming years.

Behavioral health

High deal volume suggests significant market demand will continue.

How CLA can help with health care transactions

Are you considering a transaction? CLA can help:

- Deal services — Get help with the nuances of buy- and sell-side due diligence, IT, tax and HR due diligence, tax structuring, and post-merger integration.

- Investment banking — Selling a business is complicated. Our investment banking team supports marketing your business and has access to a large buyer ecosystem to drive enterprise value.

- Tax and credit opportunities — Consider tax and credit strategies when involved with an acquisition, e.g., the Work Opportunity Tax Credit and many state-specific credits and incentives.

- Private equity — Our private equity team is specifically focused on supporting private equity funds through the life cycle of their business, from fundraising through exit.

- Industry outlook — We are constantly monitoring activities across all of health care and life sciences, including market analysis and related information.

Contact us

Learn the implications of industry trends for your business. Complete the form below to connect with CLA.