Key insights

- The aging population will shape demand across every part of HCLS. More older adults, more chronic conditions, and rising care needs will put steady pressure on staffing, capacity, and budgets.

- Health care costs are projected to rise faster than the broader economy. Demographics, chronic disease, and high‑cost therapies will strain margins and push organizations to rethink how they deliver and fund care.

- Policy changes — especially OBBBA — will influence financing, coverage, and state programs for years. Leaders will need to track how these shifts affect reimbursement, workforce needs, and long‑term planning.

- Rapid tech and AI growth will reshape both clinical and business operations. New tools can lighten workloads, support chronic care, and expand access — offering real paths to better performance.

Discover where HCLS can gain momentum in the years ahead.

As health care and life sciences (HCLS) look toward 2035, the sector stands at the intersection of profound demographic, economic, and technological changes.

The coming decade will be marked by challenges — an aging population, workforce shortages, rising costs, and macroeconomic pressures — while simultaneously presenting opportunities for innovation and value creation.

Together, these shifts highlight where fresh approaches can ease pressure on teams, support rising care needs, and spark new momentum across HCLS. Explore these insights to help your organization find a clear starting point for shaping its next moves.

The start of the 2025–2035 decade

In 2025, a newly inaugurated Republican president and Congress were met with an economic environment with elevated inflationary and economic pressures.

Within the first six months, sweeping tax and policy reforms were rapidly enacted under the One Big Beautiful Bill Act (OBBBA), along with significant government restructuring and tariff policies. The remaining six months saw consumer sentiment dip, interest rates remain elevated, tariff concerns moderate, and HCLS mergers and acquisitions subdued.

Against this backdrop HCLS moves into a decade buffeted by four macro issues, which can bring both challenges and opportunities for the industry.

Four major trends driving change in HCLS

1. An aging population

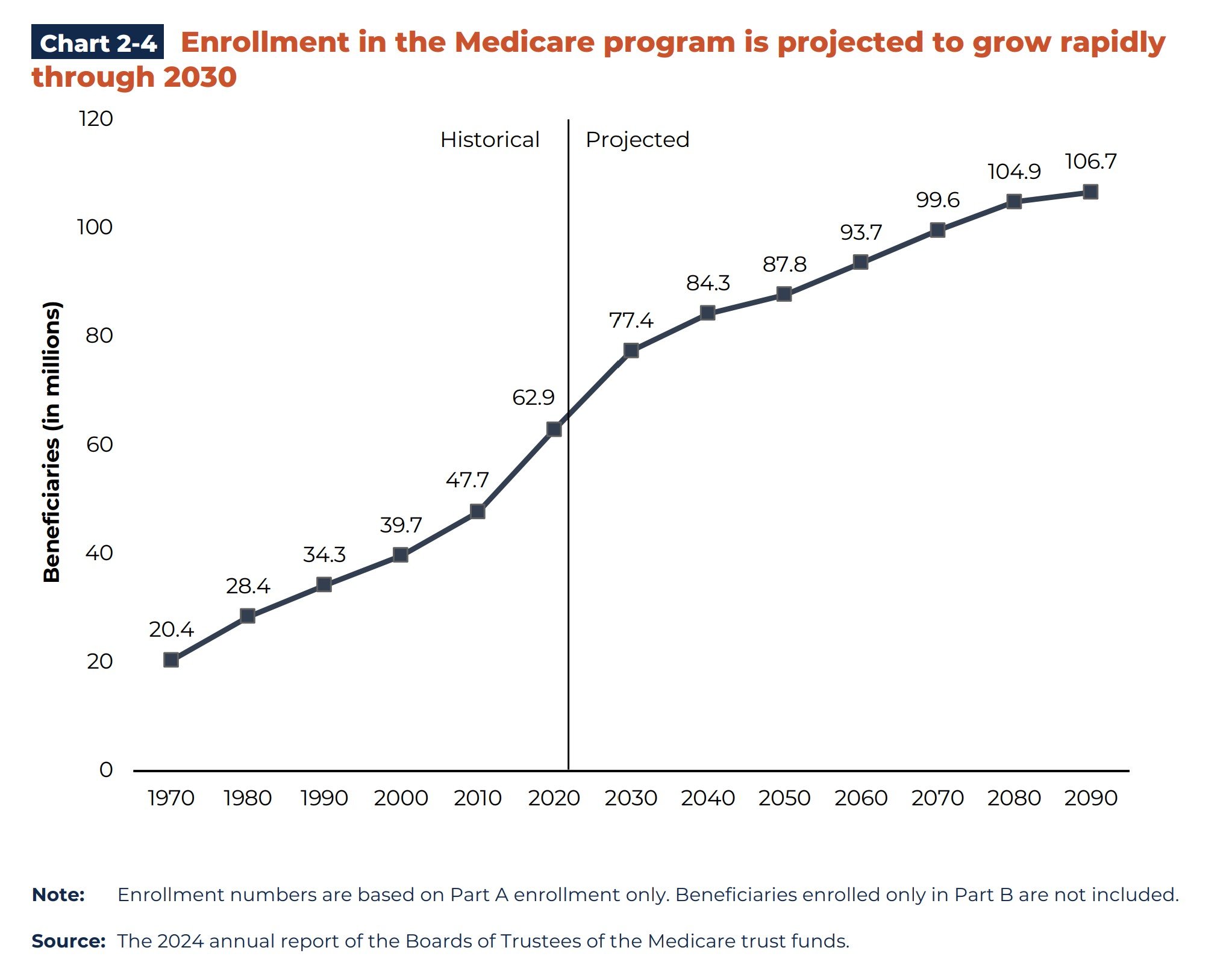

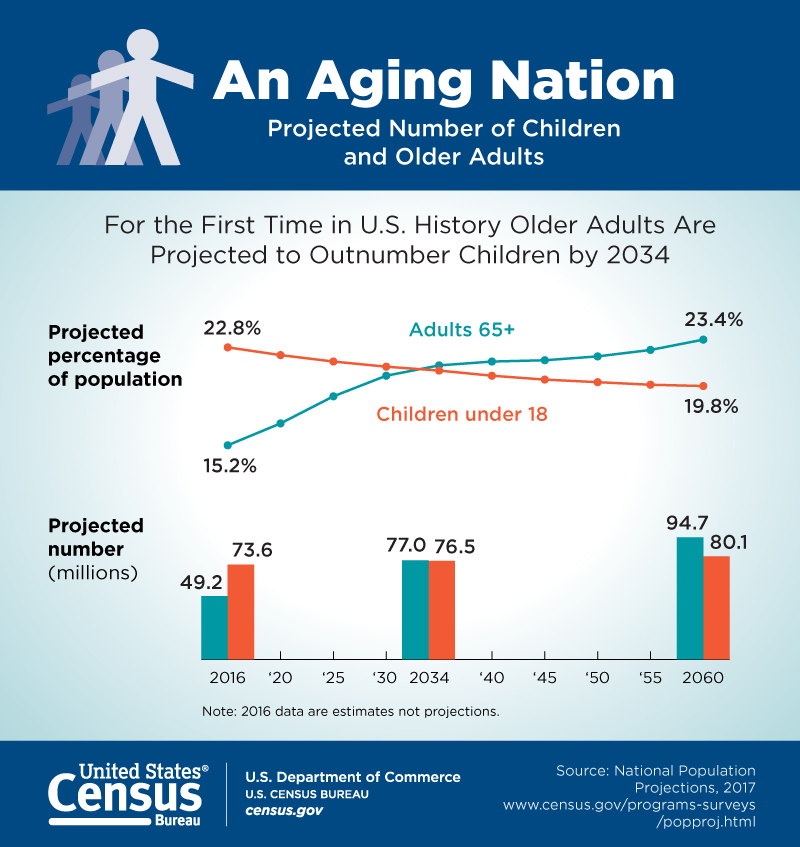

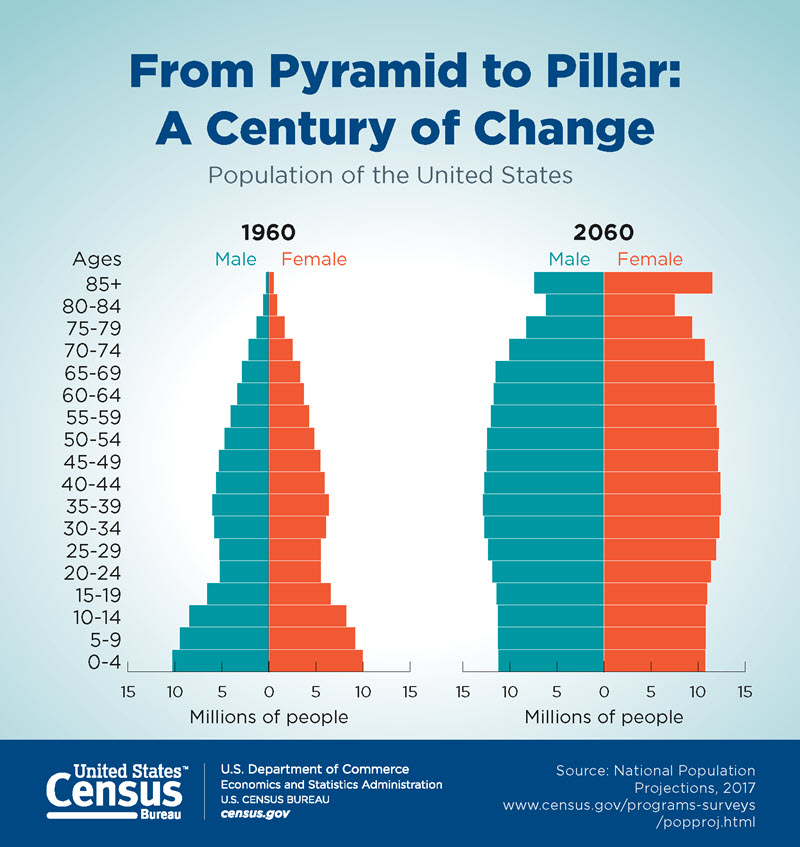

A defining force of the next decade will be an aging demographic. The Baby Boomer generation is estimated at approximately 73 million people. By 2030, all Baby Boomers will have reached Medicare-eligibility and the proportion of Americans aged 65 and older will be at record highs.

Compounding the issue is the prevalence of chronic conditions which rise as individuals age. For context, roughly 90% of the nation’s $4.9 trillion in annual health care expenditures is to treat chronic conditions. This dynamic will likely strain the financing and delivery system and intensify the need for chronic and long-term care services while exacerbating workforce shortages across clinical and support roles.

The focus on wellness and aging in place will intensify and embed into aging services and living options for seniors. Significant demand for senior living and care services will likely remain elevated, portending a decade of growth opportunities.

2. Economics of HCLS, rising expenditures

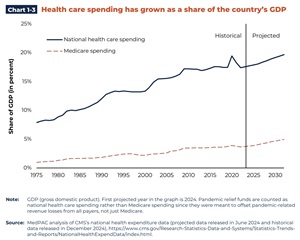

The economics of HCLS will likely continue to deteriorate without intervention. Demographics, the economy, and medical advances will compound the cost of health care over the decade.

National health care expenditures across all payers are projected to rise in the coming decade at an average annual rate of 5.8%. This outpaces the projected average Gross Domestic Product (GDP) growth of 4.3%, resulting in an increasing share of GDP spent on health care, rising from 17.6% of GDP to more than 20% (20.3%) for the first time in 2033 (Office of the Actuary).

Key drivers of rising expenditures include:

- Higher use among older adults

- Chronic conditions

- Advances in high-cost therapies and drugs

- Labor and technology costs

- Administrative complexity

Macroeconomic trends, including tariff policies and geopolitical conditions, for example, also impact the cost of goods and supplies. As a result, key areas like medical devices and surgical instruments as well as pharmaceutical manufacturing and supplies, largely imported today, may see more onshore or nearshore production and new supply chains evolve as economic policies shift.

The federal debt level compounds the problem. In 2025, it cost the federal government $355 billion to maintain the debt, which is 19% of annual federal spending.

Within two decades, federal spending on four items — Medicare, Medicaid, Social Security, and federal debt payments — is projected to exceed all federal revenues coming in. As debt and federal health care expenditures increase, policymakers and industry will likely face mounting pressures for reforms.

The largest federal health care expenditure is Medicare. An aging population stresses its financing in the coming decade on two fronts:

- Increased expenditures

- Fewer employees paying Medicare payroll taxes

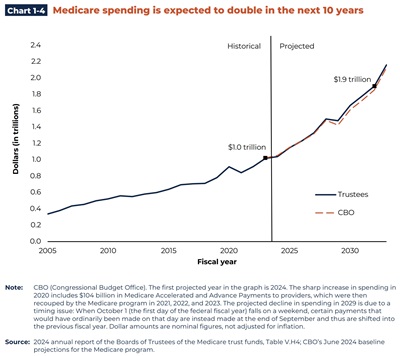

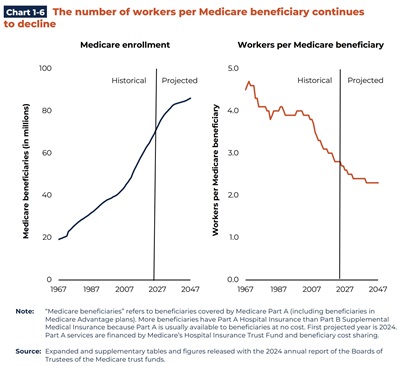

Spending is expected to double over the next 10 years (see Chart 1-4) while the number of workers paying into Medicare (via payroll taxes) will likely continue to decline (see Chart 1-6). This inverse relationship is troubling, as employee Medicare payroll taxes account for 99% of Medicare Part A financing — funding inpatient hospital, skilled nursing facility, home health, hospice, and inpatient psych benefits. Projections are that Medicare Part A will be insolvent by 2033, meaning payroll taxes coming in will be less than the amount of Medicare expenditures needed.

However, this landscape also presents tremendous opportunities for new models and innovations accelerating preventive, lower-cost, and outcomes-based approaches. A few examples include:

- Heightened activity in value-based payments, including mandatory models

- Medicare Advantage enrollment rises, including Special Needs Plans

- Increased interest in PACE programs

- New services offered in new settings (outpatient, home), facilitated by technology

- Upstream prevention efforts, intensive chronic care management work

- Increased interest in alternative insurance coverage options (outcomes-based models, direct contracting, individual health reimbursement arrangements, association health plans)

- Alternative employer-sponsored offerings (onsite clinics, musculoskeletal, mental health, drugs, ortho options)

- Rapid technology and AI-enabled development, uptake

- Robust mergers and acquisitions to reflect market growth, ongoing economics

- Unique collaborations, alliances, partnerships to maintain viability, compete, grow

3. Coming decade of OBBBA impacts

OBBBA is poised to play a pivotal — though somewhat controversial — role in the coming decade, particularly for certain parts of HCLS.

OBBBA will catalyze changes in Medicaid financing nationally felt especially at the state level. By 2034, the Congressional Budget Office estimates OBBBA health care policies will remove roughly $1.2 trillion in federal health care financing from the system with $900 billion removed from state Medicaid programs.

A wild card: Elections

There are always wild cards. Who could have imagined the beginning of this decade would turn into a multi-year pandemic? From 2026–2035, a known wild card will be the 2026 and 2028 elections.

The 2026 mid-term election is the first potential pivot. A majority-party control shift in Congress could create a more difficult legislative environment through 2028. If control shifts further in the 2028 presidential elections, economic and health care policy would likely be heavily impacted through 2032.

The extent of OBBBA’s impact over the decade is heavily dependent on state-level budget decisions. These could lead to reduced reimbursements, loss of coverage and impact on non-health care budget priorities.

On the flip side, OBBBA provides $50 billion to states over five years via the Rural Health Transformation Fund (RHTF). All states applied for and received approval on December 29, 2025. Annual funding begins 2026 and runs through 2030.

HCLS may also be able to take advantage of OBBBA’s tax policies, such as the research and experiential expenditure change, particularly impactful for life sciences, and the business interest expense deduction relevant for many HCLS entities.

4. Promise of AI, technology advances

Technology and AI will be central to the HCLS’s reinvention in the coming decade, offering new discoveries, products, and software across the care continuum.

Rapidly increasing use of technology and AI-powered tools will fuel productivity improvements for providers and businesses. Offloading non-productive work enables clinicians to work at top-of-scope. Tools will also be increasingly used to analyze all areas of operations, and heavily leveraged in chronic care management, preventive medicine and wellness offerings.

Bluestem Health’s month-end closes, patient refunds, patient payments, and bank reconciliations are all far easier and significantly quicker. Read how CLA helped make it happen.

Medical technology firms will innovate in diagnostics, minimally invasive procedures, and robotics while biotech companies will use AI and technology to accelerate targeted therapies and personalized medicine. While these “bespoke” therapies could create new opportunities, they crash head-first into health care economics due to their high costs. In these instances, new types of coverage options or outcomes-based payments will need to take shape.

Smart technologies in hospitals, assisted living, nursing homes and more will become a foundational need when building or renovating existing facilities.

Collectively, these transformations will define the HCLS ecosystem by 2035. The opportunities here are boundless but successful implementation must be rooted in a strong enterprise-wide strategy, robust data governance, cybersecurity, clinical appropriateness, and workforce upskilling.

How CLA can help HCLS prepare for the coming decade

The call for HCLS is to understand these sweeping changs, create plans now, execute, and iterate. Here are a few recommendations for how to begin preparing today for the years ahead:

- Use strategic advisors to stay abreast of disruptions, anticipate risks, and capitalize on emerging opportunities.

- Recalibrate your strategic plan to reflect evolving realities. Align your plan to both short-term pressures and long-term growth goals.

- Drive decisions with data, using financial modeling, scenario, and facilities planning for better-informed decision making.

- Accelerate digital transformation to enhance operation efficiency and create new value streams as the industry evolves.

- Fortify data governance and cybersecurity.

- Analyze opportunities for new partnerships, mergers, acquisitions, or affiliations to expand capabilities, drive scale and position for sustained competitiveness.

- Plan for leadership and ownership transitions now.

For each of these options and many others, CLA’s deep industry knowledge and services can help. Reach out today to have a complimentary discussion on where you and your organization want to go.

Contact us

Discover where HCLS can gain momentum in the years ahead. Complete the form below to connect with CLA.