Do you find yourself daydreaming about the day you no longer need spreadsheets to track your revenue? Are you finding it more difficult to trust the data due to t...

This content was created by CLA’s Denise McLeod, Business Software Director

Do you find yourself daydreaming about the day you no longer need spreadsheets to track your revenue? Are you finding it more difficult to trust the data due to the massive amounts of revenue you are tracking in a single workbook? Is revenue recognition delaying your monthly close process? Revenue Recognition in Order Entry may be the right solution for you.

In Order Entry, you get access to the following functionality with Revenue Management:

- Amortization

- Event-based recognition

- Renewals

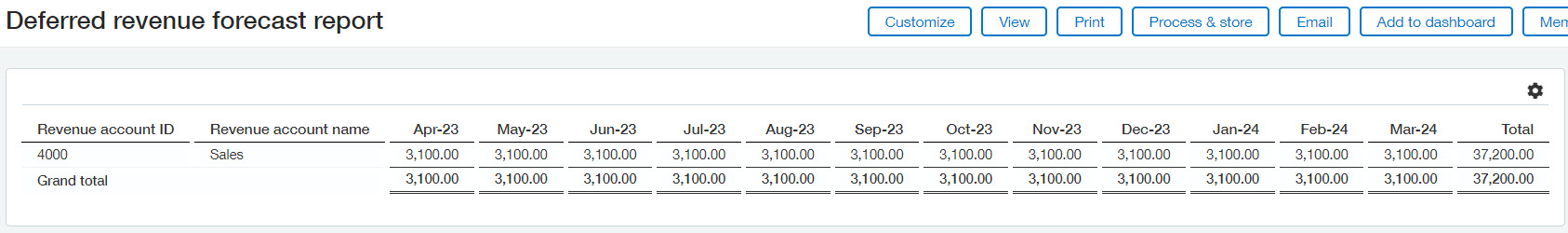

- Deferred revenue forecast report

- Separation of billing and revenue (for example, quarterly billing with monthly rev recognition)

What are additional benefits of Revenue Recognition in Order Entry?

- Create multiple revenue recognition templates, which enables you to track multiple revenue streams within the same transaction.

- Option to manually post the revenue each month or automate the posting.

- Decrease your days to close.

- Improve reporting accuracy and timeliness.

- Provide read-only access to your auditors and reduce the amount of time you and your team spends on revenue related requests.

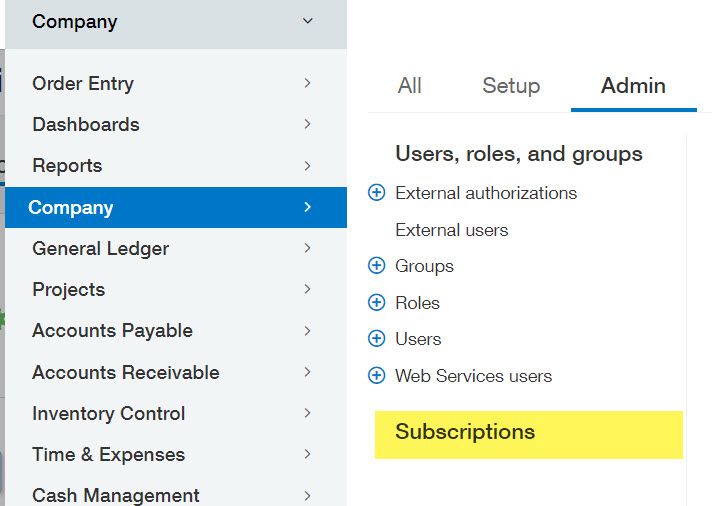

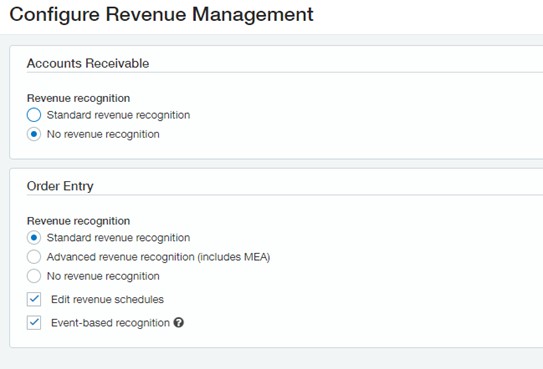

Enabling Standard Revenue Recognition in Order Entry (Assuming you already use Order Entry)

Note: You will need to review your Order Entry Items to ensure they are setup properly for revenue recognition.

After you have enabled standard revenue recognition and reviewed all items, you’ll setup your revenue recognition templates. Order Entry > Setup > Revenue Recognition > Templates

Template ID: You can create the ID structure in a way that works for you. Best practice is to create an ID that correlates with the recognition method, # of months, etc (example of an ID for manual posting with 12-month straight-line amortization: Manual-12Month SL).

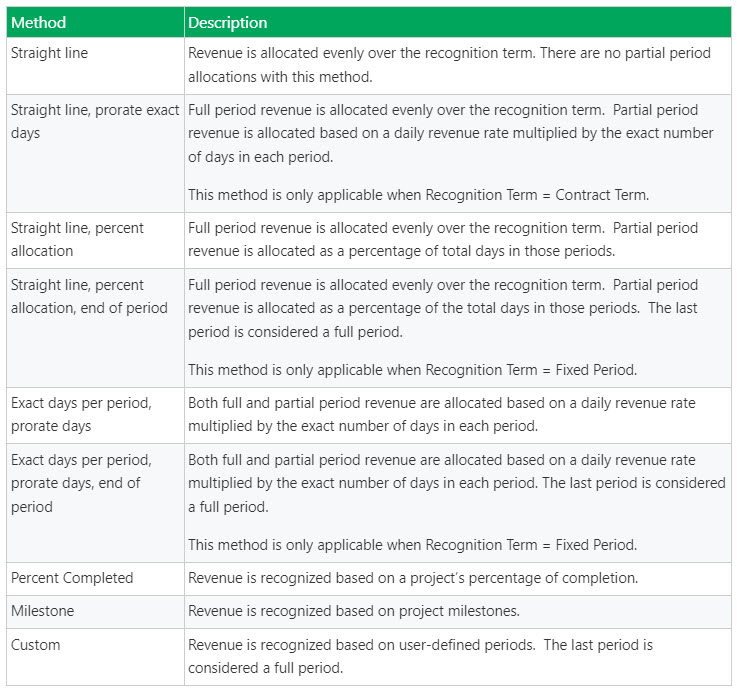

Recognition Methods:

From Intacct’s help guide.

Recognition Schedule Period (when you want the revenue to post):

- Monthly

- Quarterly

- Semi-Annually

- Annually

Posting Day:

This is the exact day you want the revenue to post (1st of the month, end of the month, etc).

Recognition Term:

- Fixed Period – this gives you the option to choose the number of periods.

- Contract term – this uses the transaction start and end dates to calculate the revenue.

Recognition Start Date:

This allows you to choose the transaction date or a user specified date.

Posting Method:

- Automatic – automatically posts on the date in the revenue schedule. We recommend turning on automatic posting only after you’ve confirmed that all revenue schedules are correct.

- Manual – allows you to manually post after you’ve done your revenue review.

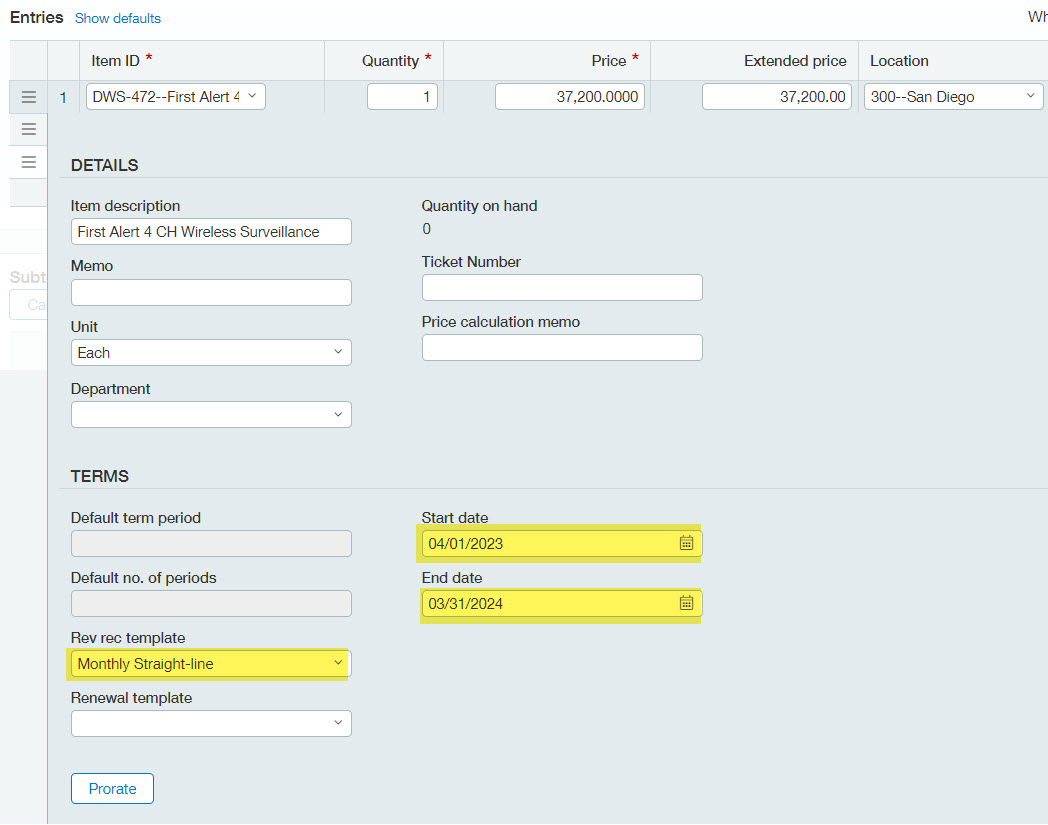

Now for the fun part, selecting one of your revenue templates in the transaction and watching the magic happen:

Here’s a screenshot of an Order Entry transaction. This shows the revenue template and dimensions selected. Once I click post, the revenue schedule will be created.

Note: You can edit the revenue schedule if you have not posted any revenue.

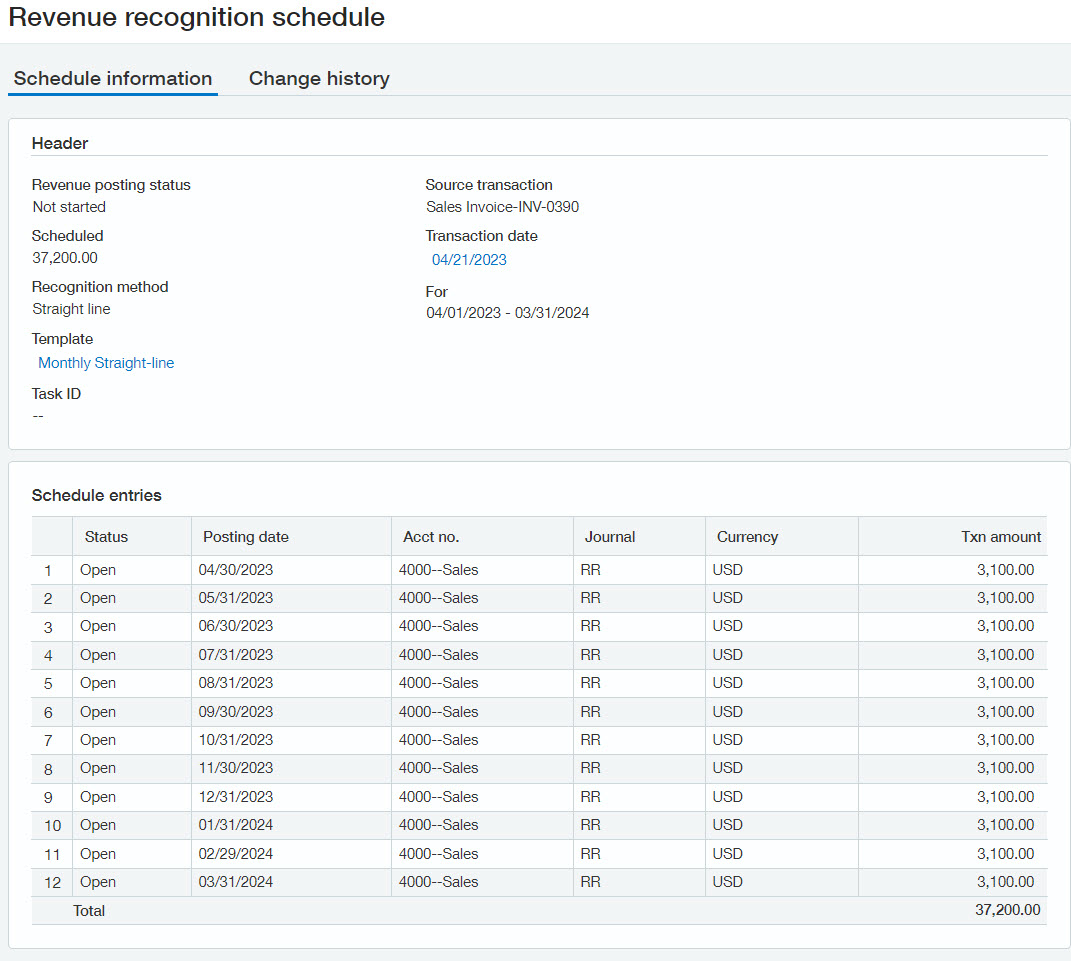

Here’s the revenue schedule for the above transaction:

Reporting:

You can run a deferred revenue report to see forecasted revenue for future periods (see example of deferred revenue forecast report below).

What’s next?

For more on Order Entry, view this blog by Ashley Klapperick. If this solution seems right for you and you are interested in learning more about Revenue Recognition in Order Entry, register for our webinar on April 25, 2023. Click here to register 2023 Sage Intacct Webinar Series – 1589595 (webcasts.com).

The post Revenue Recognition in Order Entry appeared first on Sage Blog.