Discover how work not intuitively thought of as R&D...may qualify.

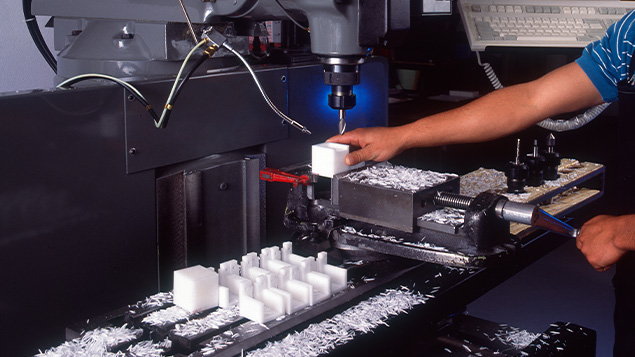

Even if you’re not in the business of experimenting, work you do could qualify for R&D tax credits. Process improvements, manufacturing engineering, and efficiency increases — could all be eligible.

That was the case for a manufacturer of automotive fixtures. Find out how they discovered the opportunity and the economic upside for their business in this case study.

This blog contains general information and does not constitute the rendering of legal, accounting, investment, tax, or other professional services. Consult with your advisors regarding the applicability of this content to your specific circumstances.