Curious if you could qualify for R&D tax credits?

| Organization: Automotive custom fixtures manufacturer | Need: Tax credit opportunities to help fund operations | Outcome: Obtained $130,000 R&D tax credit |

Understanding the situation

A lot of manufacturers don’t think they’re eligible for research and development (R&D) tax credits because they aren’t in the business of experimenting.

That was the case for this automotive custom fixtures manufacturer. They didn’t realize their work qualified for R&D credits — but process improvements, manufacturing engineering, and efficiency increases can all be eligible.

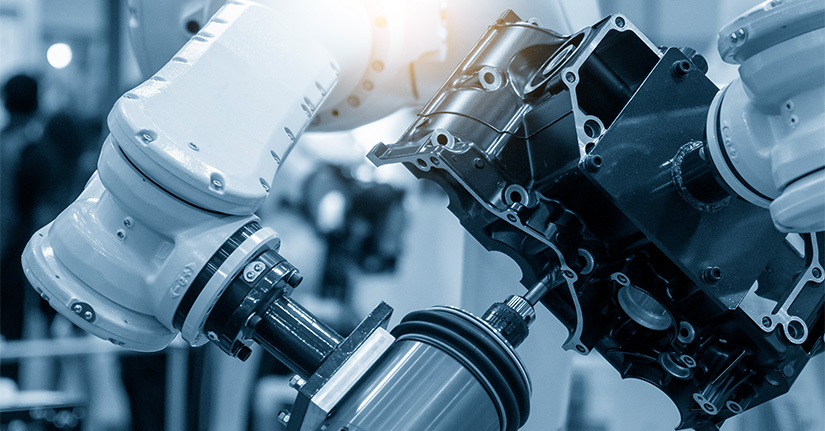

In the case of this manufacturer, it creates custom solutions through complex engineering, advanced robotics, and precision systems with technical calibration routines. CLA suspected these processes would be eligible for R&D tax credits.

We didn’t know we were eligible, and we hesitated because we didn’t have the resources for what we thought would be an intrusive process. CLA helped us through the entire process quickly for a great financial outcome.— Owner, automotive custom fixtures manufacturer

Exploring the challenge

CLA helped the manufacturer apply for an R&D credit — with a quick turnaround on a very tight schedule. CLA performed an operational analysis that assisted with input into the R&D credit calculation.

Also, for compliance, the R&D application required a change in accounting method, which CLA helped the company accomplish.

Achieving results

The manufacturer received $130,000 in R&D tax credits across two facilities in two states.