Authored by Perry McGowan : Professionals : CLA (CliftonLarsonAllen) (claconnect.com) The last year has been awash with rising prices and supply bottlenecks though s...

Authored by Perry McGowan : Professionals : CLA (CliftonLarsonAllen) (claconnect.com)

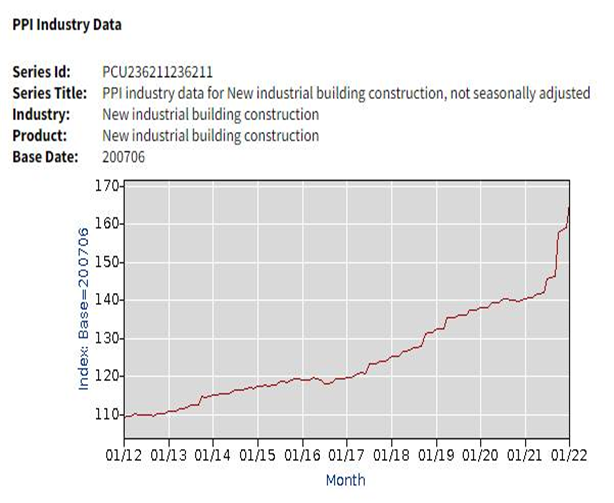

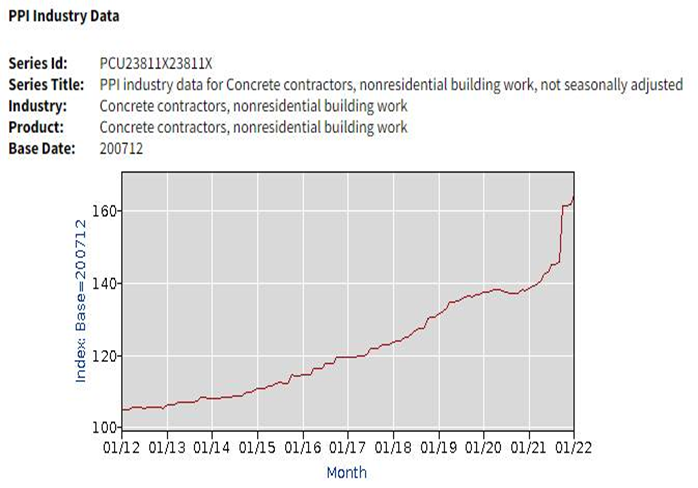

The last year has been awash with rising prices and supply bottlenecks though some construction areas have been hit harder than others. An obvious example is diesel fuel and gasoline. Prices for these highly visible and easily tracked commodities have risen by one third over the 12 months ending February 28, with average diesel prices now at $4.10 per gallon and gas at $3.61. While fuels are a small component across the construction expense spectrum, other costs are rising too as are, not surprisingly, the costs of completed jobs to customers. The Bureau of Labor Statistics (BLS) reported this week that prices for industrial buildings and nonresidential concrete projects rose 18.1% and 18.8%, respectively, for the 12 months ended January 31, 2022. Input costs to construction industries increased 28.1% through January according to St. Louis’s Federal Reserve Economic Data.

It has now been about two weeks since the Russian invasion of Ukraine brought us further economic uncertainty. While Russia and Ukraine, combined, represent perhaps 2% of the global economy, they represent a larger presence in certain component and commodity markets, especially to the European marketplace. While the impact to the US is more indirect, price shocks may ripple across the Atlantic, sometimes quickly as in the case of fuels, sometimes more gradually as supply constraints work their way up the manufacturing ladder. Recent news reports have highlighted the logistical complexities that may interrupt these supply chains and especially in certain commodity markets where Russia or Ukraine are large contributors. This includes some construction materials such as palladium (used in steel production), copper, and iron. The secondary effects of these disruptions may have further inflationary effects, but the war also seems poised to create other governmental policy shifts that could increase domestic defense-type spending. Some of these revised priorities may likely turn into construction projects but all of them seem likely to have additional inflationary effects.

As costs of construction rises, sticker-shock may dampen customer enthusiasm for new projects. Recent BLS data suggests a softening of project starts in some construction areas, but rising strength in others, with no overall trend evident. While the project pipeline seems adequate for the time being, contractor attention to material costs will be a strategic issue for some time to come. When it comes to bidding on future jobs, we should not presume inflation is going away anytime soon.