Key insights

- There's no one reason why health care is moving into the home. Factors such as demographics, value-based care, and the desire to age in place all play a role.

- Many different types of care can be delivered at home, but they are not all the same, nor are they all paid the same.

- Rapid innovations in technology and increasing private investment in health care indicate strong growth potential across industry segments.

Home health care is evolving — don’t be left behind.

There has been a growing movement toward delivering health care at home. Value-based models, like the Bundled Payments for Care Improvement, have resulted in more hospital discharges directly to the home rather than to skilled nursing facilities (SNFs). Health insurers, like United Health’s forthcoming purchase of LHC Group, are positioning themselves for the future of wellness and care at home. And new entrants are providing primary care either in-person or virtually at home. What is driving this movement, and how should organizations be thinking it?

In a series of articles, we take an environmental scan of trends propelling health care into the home — and key into home health care and home care considerations along with potential approaches and considerations for the future.

Home as health care’s evolving site of care

When we’re talking about care in the home, it is important to remember there are many different types of care that can be delivered in this setting — home health care, home care (daily living supports), or a variety of general health care services, like primary care. These terms and services are frequently lumped together, but they are not the same in care delivery coverage or payment.

If discussing home health care, this is a specifically defined service under Medicare. According to Medicare.gov, “home health care is a wide range of health care services that can be given in your home for an illness or injury. Home health care is usually less expensive, more convenient, and just as effective as care you get in a hospital or skilled nursing facility (SNF).”

Examples of home health care can include certain wound care, monitoring serious illness, and intravenous injections. An eligible individual must be under the care of a doctor or allowed practitioner, receive services under a plan of care, be homebound, and be certified that at least one of the following is necessary: intermittent skilled nursing care, physical therapy, speech-language therapy, or continued occupational therapy services. Home health aide services and medical social services may be covered under the plan of care if they meet certain criteria based on specific facts and circumstances. The Centers for Medicare & Medicaid Services (CMS) has opened up more ability for Medicare Advantage plans to provide some of these services (like meals or home health aides) as additional benefits under Medicare.

A more nebulous term frequently used is “home care.” This tends to be focused on helping individuals with daily supports and services in the home, such as personal care, household care, shopping, transportation, and cooking. It may include private-duty nursing, and it may or may not include home health care. Home care as a standalone is not reimbursed by Medicare, though there has been some movement in Medicare Advantage to cover several hours under supplemental benefits. It is also generally not reimbursed by health insurance. It is typically paid for out-of-pocket. For example, senior living operators may provide various home care services as part of their offerings along with primary-care services.

Another complexity is whether an individual is on Medicaid, dually eligible, and/or under long-term services and supports (LTSS) or home and community-based supports (HCBS), which can provide coverage for a broader set of home care services. Medicaid varies by state, so these considerations will all be state-specific.

Finally, many health care services, such as primary care or behavioral health, can now be provided in the home either in-person or virtually. Depending, these may be covered by employers, insurers, Medicare, Medicaid, or out-of-pocket by consumers.

Environmental scan of trends driving care to the home

There’s no one reason why health care is moving into the home. We see the trends called out in the graphic below, oftentimes interrelated, helping to propel this movement:

Demographics

An aging demographic cannot be ignored. Millions of baby boomers will age into Medicare every year and place stress on our current reimbursement system, meaning more cost-effective care, such as care in the home, is needed. For example, the 2022 Medicare Trustees Report estimates that by 2028 the Medicare Trust Fund Hospital Insurance (Part A) will be insolvent. That means appropriate care at home could be used to redirect individuals from higher-cost institutional settings like hospitals and nursing facilities to the home.

Shifting sites of care

For years we have seen a steady movement of health care from higher-cost to lower-cost settings. Hip and knee replacements moved from hospital inpatient to outpatient procedures. Nursing homes have been bypassed or stays shortened. Basic primary care services are provided at local pharmacies or at home. CMS has been a leader in pushing this trend, but so, too, have new entrants. The home is one of those growing, potentially lower cost, sites of service.

Consumer preference, convenience

There is a new era of consumer expectation arising. Access to care is no longer solely limited by geography. Individuals and families have busy lives, which makes convenience an important consideration. Loyalty to providers tends to vary by generational cohort. And overall, there are far more options to receive care, shifting health care’s front door.

Desire to age in place

Aging in place appears to be a growing preference for many individuals. For example, CLA’s senior living trends report shows 79% of survey respondents said it is critical to support aging in place — and home health was the top option for the middle market. Fifty-six percent of senior living organizations said they were in the process of operating their own home care agency in their life plan community. Another 24% were planning to pursue that approach. Home care and home health care can also allow those in the sandwich generation (caring for their own families and their parents) to provide the care necessary to aging parents without having to look at other costly or institutional settings.

Care management, care coordination

A majority of adults have at least one chronic condition with many having multiple. Medicare recognizes the importance of care management and continues to make improvements in reimbursing for it. Keep in mind care management isn’t only for the aging. Many adults under the age of 65 have conditions — including physical, behavioral, and substance use disorders — that need ongoing care coordination. Providing care coordination and support at home can bridge gaps caused by social determinants of health.

Value-based care, capitated payments

The movement from fee-for-service payments to other types of financing is an ongoing trend. The underlying driver for value models is high-quality care combined with cost efficiency. When set reimbursements or set budgets are used (think Accountable Care Organizations, bundled payments, or capitation) then care management, technology, and lower-cost settings can come into play. Receiving care at home, including virtual care, is in that mix.

Emergence of technology

Speaking of technology, telehealth and other virtual care delivery (think remote patient monitoring or virtual visits) have rapidly come to the forefront, especially during the pandemic. They are also reimbursable by Medicare and many insurers. Monitoring weight, oxygen, and other data via technology and bringing health care providers virtually into the home allow for more access and care delivery. There have also been plenty of investments by providers, operators, and private investors within the technology space.

Private investment

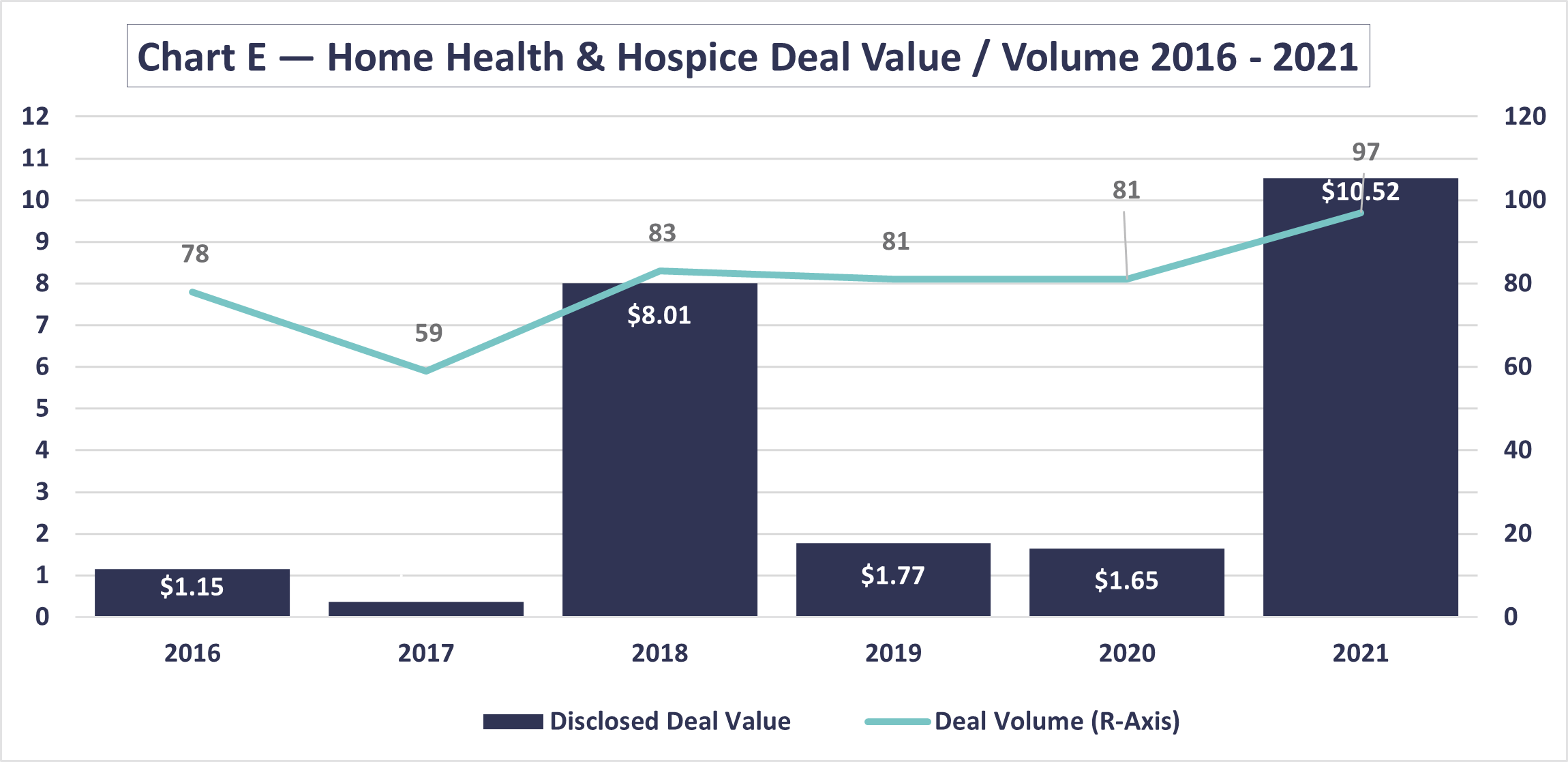

In his recent article, CLA’s Jed Cheney highlighted that health care’s deal volume increased almost universally across segments in 2021 compared to 2020, including home health and hospice. Home health and hospice transaction trends were significantly higher coming out of 2020. Whether the transactions are funded by private equity, venture capital, family offices, or others, ongoing trends are making a case for strong growth potential. There also continues to be significant investment into all types of technology and innovations.

Source: Deal Search Online, www.healthcaremanda.com

*represents those where purchase price has been disclosed

Experience during COVID-19

With all its difficulties, the pandemic did allow health care to rapidly innovate, including moving more types of health care to the home. From CMS allowing the hospital at home waiver to skyrocketing use of telehealth and virtual care delivery, the result has been demonstrated success with treating illnesses or conditions at home without a negative impact on quality or outcomes.

How we can help

Even as trends coalesce and investments increase, there are still barriers to success and key points to remember when considering home-based care. It is important to understand your market and the population you are looking to serve (near- and long-term). Those answers will define which options are viable for you. We’ll dive into a few of these issues in our next article with a specific focus on home health and home care.

If you are interested in learning more or need insight, CLA can assist with:

- Analyzing your market and potential

- Providing buy- or sell-side deal analysis and insights

- Reviewing or developing a strategic or master plan

- Understanding telehealth and virtual care delivery

- Assessing technology and cybersecurity