Credit unions are becoming more complex — more services, products, branches, and delivery systems. That means more risk. To mitigate the increased risk, you may have an internal audit program or you are considering starting one. Reliable, effective, and efficient internal controls provide a solid foundation from which you can provide years of sound financial service.

Our approach to internal audit services combines the strengths of your credit union with our internal audit capabilities, derived from our investment in personnel, technology, methodology, and resource knowledge.

The following is an outline of our technical approach to service delivery, which includes working with your management team to develop protocols for the relationship and the engagement. We are with you every step of the way to align the objectives, needs, and expectations of your management team, board of directors, supervisory or audit committee, and regulators.

Role of internal audit

Your credit union is a complicated business. Thousands of transactions occur every day and nearly all of them affect your inventory — cash. Because of the growing need for faster transaction processing, traditional controls are often difficult to implement. The role of internal audit has evolved from a compliance-based function, focusing primarily on detection, to a strategy valued by executives and board members. Acting on the growing importance of this strategic tool, we help you create a competitive advantage through the internal audit function.

We believe an internal audit should focus on organizational improvement in three key areas:

- Risk management

- Control systems

- Governance processes

Our internal audit approach is designed with a continuous improvement process in mind.

Internal auditor already in-place

This is great news because you're already committed to the process. We don't want to replace your internal auditor, but we can assist the audit team in developing or reviewing your internal audit program or provide audit training or special project assistance in complex areas.

Creating an internal auditor position

We can help get you started by developing your internal audit charter, helping you find the right person for the position, training your new auditor, and developing or assisting in the development of your audit program.

Co-sourcing internal audit function

We perform internal co-source services for credit unions of all sizes — some on a weekly, monthly, or quarterly basis. Our staff of experienced internal auditors can get right to work on your high risk areas and give you tremendous value for a reasonable cost.

Our auditors will work with your supervisory or audit committee and management team to develop a flexible internal audit schedule that suits your credit union's needs. You control the process, our independent auditors deliver the results.

Why co-source internal audit?

Having an in-house internal auditor can give you the best, most in-depth audit coverage. Yet because of increasing complexity, even highly qualified, in-house professionals may find that there are areas that are beyond their technical capabilities, or are so time consuming that they cannot get it all done. In that case, we can provide temporary staffing on a short-term basis.

On the other hand, your credit union may be smaller or not complicated enough to need a full-time internal auditor. Maybe your internal auditor departed for a new position and you’re having difficulty finding a satisfactory replacement. Or maybe you are just embarking on the concept of internal audit and you don’t want to hire a full-time employee yet. If this is the case, we can help.

Our internal audit approach

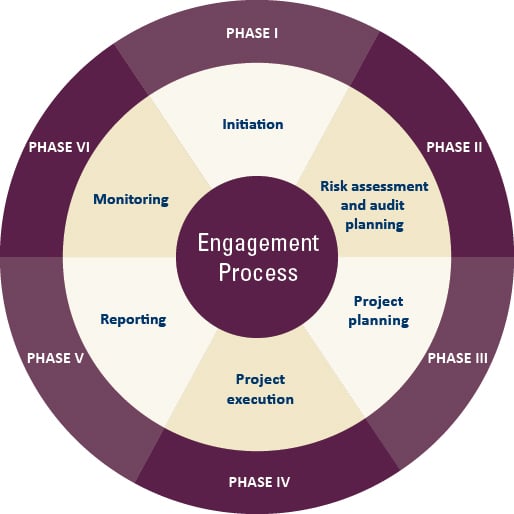

This diagram illustrates the six phases of our efficient, effective internal audit engagement methodology and demonstrates our belief that the internal audit process is a fluid, on-going process.

Phase I: Initiation

First, we work to understand and define expectations for your organization’s internal audit function and the parameters of the internal audit charter. In addition, we will establish communication protocols to use throughout the engagement to determine the most respectful and efficient working relationship is created at the very beginning of the process.

Phase II: Risk assessment and audit planning

The risk assessment phase establishes the foundation for developing an annual internal audit plan and related project programs. This process is critical to a successful, cost-effective, and efficient audit function, as it provides the information needed to develop the audit programs through identifying key risks and targeted processes.

To facilitate the risk assessment process, we employ an internal, proprietary risk assessment tool to identify and evaluate the financial, operational, and environmental risks of your organization. Information gained through interviews with executive management and key business process owners, our understanding of your current financial operation, and our general industry knowledge of credit unions form the inputs to our risk assessment tool.

We will also consider the risk impact of any new regulations/legislation aimed at credit unions, and any significant endeavors of the organization. Ultimately, the consulting internal audit plan will encompass audits that will meet risk priorities and budgetary constraints for the given audit period. We will work with you to develop an overall schedule to complete the required audits throughout the year in an efficient and effective manner, with the least disruption to your business operations.

Phase III: Project planning

In this phase of the project, we will meet with accounting and operations personnel responsible for the area to be audited. The objective is to gain an understanding of the processes, controls, audit objectives and personnel related to the area. We may also flowchart the processes to improve our understanding of your operations.

Phase IV: Project execution

During this phase, we will schedule and complete the specific operational, financial, or compliance internal audits. These audits will be completed during the least disruptive times for process owners to improve efficiency and effectiveness. We will use a consistent internal audit service team, supplemented with resources as needed.

Phase V: Reporting

Our internal audit reports are issued promptly after the completion of fieldwork — our communication framework is set up to foster value-driven results. We require our auditors to prioritize their findings and discuss drafts of internal audit reports with the appropriate management and staff prior to issuance.

We believe this approach:

- Confirms the information contained in the report

- Minimizes reaction to significant findings

- Encourages buy-in from the process owners

- Increases the likelihood of implementing recommendations

Final reports are issued to management. In addition, we will meet as requested and prepare a formal presentation to address any questions. During the presentation, we will summarize the findings in the reports, discuss the status of the internal audit plan, and provide assistance as requested.

Phase VI: Monitoring

The internal audit process does not end with the communication of audit results. Using follow-up status reports and open issues reports, we will monitor the implementation of the audit findings to determine that our findings and recommendations are addressed.

We believe that an internal audit is successful if the results of the work help achieve and support your strategic objectives. We will work with you to understand your business and assist you in improving your internal controls and risk management processes. We can also assist you in improving your bottom line with suggestions for cost reductions, streamlining of business processes, and/or revenue opportunities.

Internal audit services for credit unions

CLA can provide these internal audit services:

- Information system reviews

- Asset/liability system reviews

- Cash management

- CECL modeling and accounting

- Consumer lending controls

- Risk-based leading controls

- Indirect lending controls

- Mortgage lending controls

- Commercial lending controls

- Collections controls

- Regulatory compliance

- Risk management

- Branch controls

- Investment controls

- Fixed asset controls

We also provide these share control services:

- IRAs

- Certificates

- Dormant accounts

- Dividend testing

- Closed accounts

- Income and expense controls

- Electronic/remote member service controls

- Review of credit union policies

- Review of operational procedures

- Bank Secrecy Act and Anti-Money Laundering (BSA/AML) compliance