Find out the advantages and disadvantages of portability when compared to a credit shelter trust, so you choose the most fitting estate plan for your family’s situat...

Estate planning for married couples used to generally mean sheltering wealth into a trust. But the simplicity of portability is changing this equation for some pairs. However, as with most tax law changes, there are advantages and disadvantages to relying on portability compared to the tried and true method of using a credit shelter trust. So, which is better for you? Let's take a look.

Explore our collection of trust and estate planning articles to help you build the financial future you envision.

The federal estate tax exclusion in 2014 is now $5.34 million. This means you can give your loved ones, either via gifts during your lifetime or at your death, $5.34 million without incurring federal gift or estate tax. The $5.34 million is per individual, so a married couple with a combined net worth of $10.68 million will not be subject to federal gift or estate tax. In addition, the $5.34 is indexed for inflation, so the exclusion amount will continue to increase in coming years.

Portability is now a permanent part of the federal estate tax system, which means each spouse’s estate tax exclusion that is unused at death is “portable” and can be carried over to the surviving spouse. Portability was enacted as a temporary provision in 2011, but Congress has made this important provision permanent. Portability can simplify estate planning significantly.

Before portability, married couples had to divide and re-title ownership of their assets between them so that each had about the same level of net worth. Their will (or revocable trust document) also had to establish a trust on the death of the first spouse in the amount of the estate tax exclusion.

This path fully used the couples' estate tax exclusions, and effectively “sheltered” the assets by funding what is termed a “credit shelter trust.” This trust is sometimes called the “bypass trust” because it bypasses the taxable estate of the surviving spouse. It’s also called the “B Trust” in A/B trust planning or simply the “family trust” because in addition to estate tax savings, it provided for the family of the decedent after death, including the surviving spouse, children, and potentially even the grandchildren.

Compared to a credit shelter trust, portability is simple. A husband and wife can put together a basic will that leaves all of their assets to each other, without the complication of a trust. A long-married couple often prefers the ease of having their assets in joint tenancy. Portability works well with jointly held assets as well.

| Advantages | Disadvantages | |

|---|---|---|

| Portability |

|

|

| Credit Shelter Trusts |

|

|

Comparing portability and credit shelter trusts with a married couple

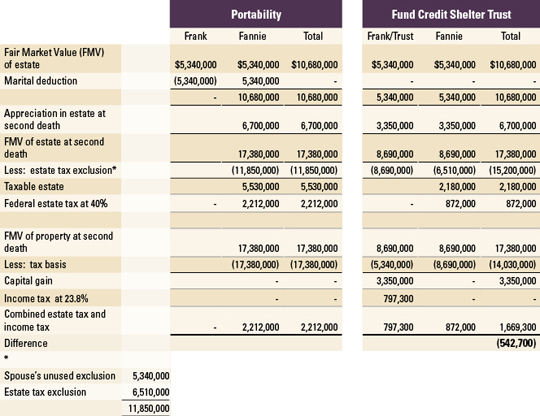

Let’s compare portability with a credit shelter trust for a married couple, Frank and Fannie, with the following assumptions:

Frank and Fanny have a combined net worth of $10.68 million and live in a state with no estate or income tax. Frank passes away in 2014, and Fannie in 2024. We will assume the federal estate tax rate will be 40 percent during this 10-year period, and the maximum income tax rates on long-term capital gains will stay at the current levels of 20 percent, plus an additional 3.8 percent net investment income tax.

Let’s also assume their assets have successfully survived the recession and are now increasing in value at an annual rate of 5 percent. We will presume the rate of inflation is 2 percent annually, which means the federal estate tax exclusion increases 2 percent annually.

The couple elects portability

If Frank leaves all of his assets to Fanny and portability is elected, Fanny will have assets valued at $17.38 million when she passes away 10 years later in 2024. Her estate tax exclusion will be Frank’s unused exclusion of $5.34 million plus her own estate tax exclusion, which is projected to be $6.51 million in 2024, for a total of $11.85 million. Accordingly, the amount subject to estate tax is $5.53 million, resulting in federal estate tax of $2.12 million. Because any asset that is part of the decedent’s taxable estate receives a new basis at death equal to the estate tax value, the assets all have a tax basis equal to their value.

Frank and Fanny’s heirs can sell the assets and have no income tax due. The combined estate tax and income tax for portability is $2.12 million.

The couple elects a credit shelter trust

With a credit shelter trust, when Frank dies in 2014, his assets will fund a trust. At Fanny’s passing 10 years later, the appreciated assets, now in the credit shelter trust rather than in Fanny’s taxable estate, will not be subject to estate tax. Fanny’s estate tax exclusion is $6.51 million and the resulting federal estate tax is $872,000. However, the appreciated assets in the trust will not receive a step-up in basis; therefore there will be income tax when the assets are sold in the amount of $797,300. The combined estate tax and income utilizing a credit shelter trust is $1,669,300.

The tax savings of using a credit shelter trust under these assumptions is $542,700 — a significant savings!

How we can help

Estate and financial planning goes beyond the question of portability versus a credit shelter trust. There are nonfinancial choices and issues to consider, and other trust options with unique income tax considerations, such as a grantor and non-grantor, and spousal limited access trusts just to name a few. Planning your estate begins with a retirement vision. CLA can help you break down these scenarios to find the most fitting estate plan for your family's situation.