Though COVID-19 has recently wreaked havoc in the market, we are optimistic about the long-term prospects for the market and the economy.

Key insights

- The COVID-19 crisis serves as a reminder that the stock market and the economy do not move in lockstep with one another.

- The Federal Reserve has intervened massively, but still has plenty of power in its arsenal.

- We feel that a checkmark-shaped recovery could be the most probable outcome.

- We provide long-term investment strategies that are tethered to our clients’ specific financial plans.

Looking for a long-term investment approach?

When reports first emerged in December 2019 of a small cluster of mysterious pneumonia cases in the city of Wuhan, China, no one could have foreseen the dramatic events that would unfold over the coming months. COVID-19 has grown into a global pandemic that has killed thousands and devastated the global economy and capital markets.

This report provides a brief recap of the pandemic’s effects on the market and insights on what an eventual recovery may look like in our opinion.

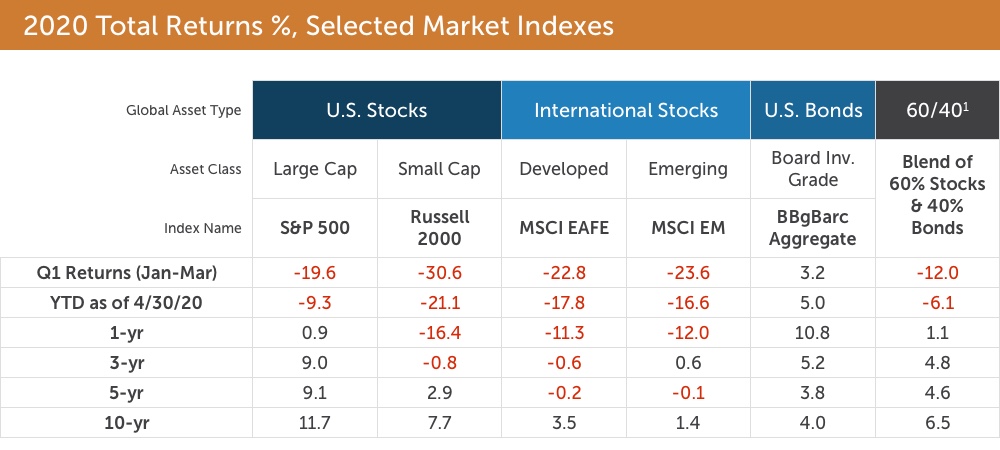

1Hypothetical 60/40 blend comprised of: 40% BBg Barclays U.S. Aggregate, 32% S&P 500, 7% Russell 2000, 16% MSCI EAFE, and 5% MSCI EM.

1Hypothetical 60/40 blend comprised of: 40% BBg Barclays U.S. Aggregate, 32% S&P 500, 7% Russell 2000, 16% MSCI EAFE, and 5% MSCI EM.

An investor cannot invest directly in an index, and the hypothetical portfolio is not intended to reflect any specific portfolio managed by CLA Wealth Advisors. An unmanaged index does not reflect any expenses that may be associated with an actual portfolio.Returns above are total returns %, annualized for periods of longer than 1-yr. Past performance is no guarantee of future results.

Source: Morningstar

How the year started

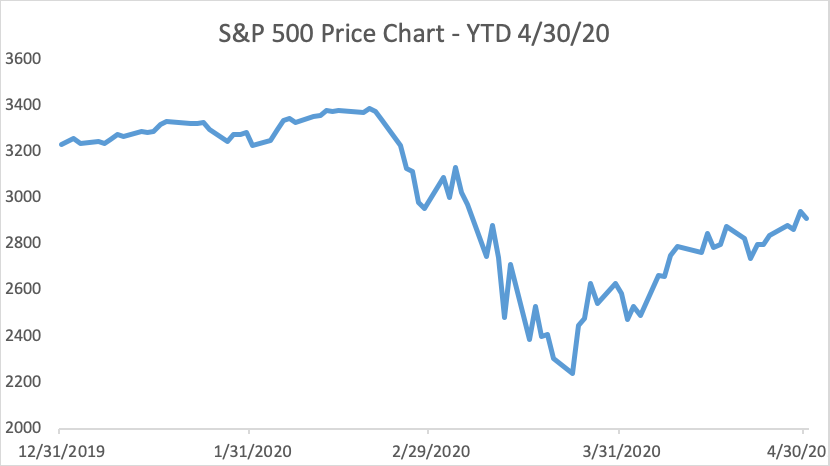

The U.S. economy and financial markets began the year in strong fashion, shrugging off geopolitical tensions with Iran and concerns that stock market valuations were somewhat rich. The S&P 500 peaked on February 19, just as the potential severity of the pandemic was beginning to take its hold on the market. The large cap index fell nearly 34% from the February 19 peak to the March 23 valley, which was one of the swiftest bear markets in history, according to UBS.

The market rallied into quarter-end, and April saw positive returns from U.S. stocks. In fact, the Dow Jones Industrial Average’s April return of 12.8% was the third-highest monthly return since World War II (source: FactSet). The S&P 500’s year-to-date return as of month-end, April 30, 2020, is -9.3%.

Certain sectors of the S&P 500 (see table of Q1 returns below), such as energy and industrials, were especially hard hit by COVID-19, while the top-performing sectors during the downturn were technology, health care, and consumer staples.

Gross returns; source Standard & Poors

Looking at the economy more broadly, COVID-19 has had shocking consequences for the U.S. labor force, with numbing job loss numbers. The official unemployment rate now stands at 14.7%, the highest since the Great Depression era (U.S. Bureau of Labor Statistics, April).

The economy is not the same as the stock market

The COVID-19 economic crisis and recent market action serve as glaring reminders that the stock market and the economy do not move in lockstep with one another. History supports this assertion. For example, we have had bear markets without a simultaneous economic recession (such as the Internet Bubble of the early 2000s, which saw stocks tumble dramatically long before a recession began). We can also observe how bull markets in stocks often begin during a recession, long before the economic reports turn positive.

The Great Financial Crisis of the last decade serves as another example. The stock market bottomed in early March 2009, while economic reports were increasingly dismal throughout the summer of 2009. Historical evidence shows that if one is metaphorically waiting in the station for the economic data to turn unambiguously positive and sound the “All aboard!” before you allocate to stocks, the bull market might have already left the station.

Why is that? The stock market, as it is often said by financial industry professionals, is a “discounting mechanism.” Investors, in aggregate, are always looking forward. Stock prices, therefore, discount what is already known in addition to what general expectations are for future events. This can be a puzzling concept for the general public. For example, some were flummoxed or even angered by the juxtaposition of a huge stock market rally in early April while the job loss reports were shockingly grim. People were missing the fact that the market’s discounting mechanism had already “priced in” those horrific jobs numbers.

The Fed and the federal government bring massive policy relief

We’ve spoken previously about the favorable monetary policy backdrop provided by the Fed. Additionally, in the most recent quarterly report, we mused about how the Fed, although seemingly “low on ammunition” given the already-low policy rate coming into this year, has plenty of power in its arsenal if a severe recession or crisis were to befall us.

The Fed has responded in a massive way to the COVID-19 crisis. Policy actions to-date have included, but are not limited to:

- Lowering the federal funds rate to effectively zero — The fed funds rate is a key policy lever; lowering it aims to reduce mortgage rates, auto loans, and more.

- Issuing forward guidance — This informs the markets that they intend to keep rates low “until it is confident that the economy has weathered recent events and is on track to achieve its maximum employment and price stability goals” (April 29, 2020, press release, federalreserve.gov).

- Backstopping money market funds — During the peak of volatility in March, many investors withdrew money from funds. This created concern that some money market mutual funds could “break the buck” (have its daily price fall below $1 per share, meaning investors would lose some principal). The Fed created a mechanism (Money Market Mutual Fund Liquidity Facility) to increase the likelihood that money funds could meet redemptions without any losses.

- Lending securities to financial institutions — Via a program called the Primary Dealer Credit Facility, the Fed offers low interest rate loans to approximately two dozen large financial firms, called primary dealers. The dealers provide collateral to the Fed in the form of stocks, corporate and municipal bonds, and commercial paper. The goal is to increase market liquidity and foster smooth functioning of trading markets.

- Repo operations — The repo market is a little-known but important cog in the global financial system, whereby financial firms borrow and lend cash and securities on a short-term basis (usually overnight). Even before COVID-19, the Fed injected huge amounts of capital in the repo market, which has since increased.

- Buying bonds in the secondary market via ETF purchases — The New York Fed announced that in May it would begin to purchase shares of exchange-traded funds (ETFs) that hold investment-grade and even high-yield bonds. This direct support of secondary market bond prices is extraordinary and perhaps even controversial; some analysts believe it oversteps the authority granted to the Fed via the 1913 Federal Reserve Act.

Fed Balance Sheet: $6.5 Trillion… and counting

Sources: Bloomberg, Federal Reserve

The Fed’s balance sheet, at the time of writing, stands at $7 trillion. Notably, the Fed’s balance sheet, in response to the Great Financial Crisis, went from less than $1 trillion to more than $4 trillion. A move of similar magnitude in response to COVID-19 implies a balance sheet of approximately $12 trillion. There are legitimate concerns about the long-term implications of this monetary stimulus, but in the meantime, the Fed’s actions undeniably helped the markets remain liquid and likely stemmed further losses during the peak volatility period in March.

The U.S. Congress, for its part, has also been very active in attempting to provide relief to stricken Americans. Some of actions taken by the government include:

- Stimulus payments of up to $1,200 per qualifying person

- IRS filing and payment deadline extension to July 15

- Expanded and extended unemployment benefits

- Loans to distressed businesses, cities, and states

- The Coronavirus Aid, Relief, and Economic Security (CARES) Act

Providing timely and targeted relief is a complex task. Nevertheless, the fiscal actions taken above have buoyed the markets and hopefully provided some relief to those Americans economically impacted by the crisis. Congress appears willing and able to increase the amount of stimulus later this year.

The shape of the recovery

Many market analysts have adopted an “alphabet soup” of shapes as a way to think about what the recession and ultimate recovery from COVID-19 might look like. The shapes serve as an analogy for the path that markets may take in the future. Below is a list of commonly discussed recovery shapes:

- V-shaped — A steep decline followed by an equally fast recovery; the most optimistic scenario

- U-shaped — A recovery that comes only after a prolonged period of muddling along the bottom

- L-shaped — A Japanese-style scenario for stocks (Japan’s Nikkei 225 Index that peaked at nearly 39,000 in 1989, and trades at under 20,000 today); the absolute worst-case scenario

- W-shaped — The markets recover, but only to suffer another downturn

- Checkmark-shaped — After a steep drop, the markets begin a slow — but steady — recovery

Which of these shapes will the recovery most look like? The future remains unknown, but we feel that a checkmark-shaped recovery could be the most probable. The worst-case scenario is extremely unlikely, in our view. The already-discussed fiscal and monetary policy support — combined with the strength and resilience of Americans and the American economy — gives us ample reason to be optimistic about our recovery from this crisis.

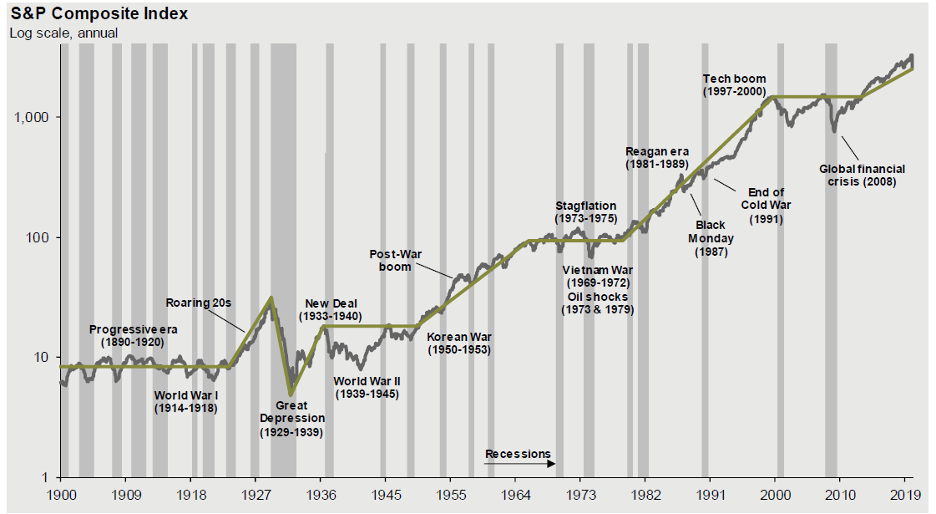

Investing during a bear market

We like to remind investors that bear markets and recessions are not rare events — they are part of the cycle. While the bull market that began in 2009 was going to end, it was impossible to predict when or what the catalyst would be. No matter the catalyst, bear markets remind us of the importance of two tenets of prudent investing: diversification and long-term focus.

During a bull market, especially when U.S. large cap stocks are rocketing upward, diversification can be a source of frustration for investors. During a stock market sell-off, however, diversification shows its value. To wit, from February 19, 2020, to March 23, 2020, the S&P 500 fell 34%, while investment grade bonds remained flat (-0.9%, BBgBarc Aggregate Bond Index; returns via Bloomberg).

Having a long-term focus is relatively easy during bull market periods. During a painful sell-off, however, the focus of many investors turns to the short-term, and there is an urge to “get out” of the market. In the words of Liz Ann Sonders, Chief Investment Strategist, Charles Schwab & Co, “get in” or “get out” are not investment strategies; they are simply speculations on a moment in time.

U.S. Stock Market Since 1900

Source: FactSet, NBER, Robert Shiller, J.P. Morgan Asset Management

Data shown in log scale to best illustrate long-term index patterns. Past performance is not indicative of future returns. Chart is for illustrative purposes only. Guide to the Markets – U.S. Data are as of March 31, 2020.

Final thoughts

At CLA, we are mindful of the challenges that lie ahead. The ultimate “return to normal” depends on the development of reliable COVID-19 therapies and, eventually, a vaccine. How quickly those things happen is unpredictable. But as we stated earlier, we are optimistic about the long-term prospects for the market and the economy. The challenges are enormous, but America’s track record proves that we overcome challenges. Warren Buffett, at the recent Berkshire Hathaway annual shareholder meeting, stated “Never, ever bet against America.” We agree.

How we can help

Our goal is to help you avoid a “get in” or “get out” investment approach. Our team provides long-term investment strategies that are tethered to our clients’ specific financial plans. To learn more about how we can help you in a bull or bear market, reach out to schedule an appointment with one of our financial professionals.

CliftonLarsonAllen Wealth Advisors, LLC

Investment Committee

The purpose of this publication is purely educational and informational. It is not intended to promote any product or service and should not be relied on for accounting, legal, tax, or investment advice. The views expressed are those of CLA Wealth Advisors. They are subject to change at any time. Past performance does not imply or guarantee future results. Investing entails risks, including possible loss of principal. Diversification cannot assure a profit or guarantee against a loss. Investing involves other forms of risk that are not described here. For that reason, you should contact an investment professional before acting on any information in this publication. Financial information is from third party sources. Such information is believed to be reliable but is not verified or guaranteed. Performances from any indices in this report are presented without factoring fees or charges, and are provided for reference and competitive purposes only. Any fees, charges, or holdings different than the indices will effect individual results. Indexes are unmanaged; one cannot invest directly into an index. Investment advisory services are offered through CliftonLarsonAllen Wealth Advisors, LLC, an SEC-registered investment advisor. Prior approval is required for further distribution of this material.