.jpg?rev=932bcf4f102b4c2180eac9514190440f&la=en&h=451&w=700&hash=6D3FE04BE96B037B5B77819E903DB78A)

A total of $175 billion has been designated to the Provider Relief Fund (PRF) to help health care providers during COVID-19. Learn more about PRF distributions, the ...

Key insights

- Billions of dollars have been distributed to health care providers through the Provider Relief Fund via general and targeted distributions.

- While an essential lifeline for many, PRF dollars come with complex and evolving conditions.

- Understand key terms to meet critical compliance, audit, and reporting requirements.

- CLA’s health care, nonprofit, tax, outsourcing, and other practices can assist you with COVID-19 funding, including PRF.

Have questions about the PRF?

In response to the COVID-19 pandemic, Congress and the president passed and signed into law four economic stimulus packages. Two of those laws included funding for health care providers through the Public Health & Social Services Emergency Fund. The Department of Health and Human Services (HHS) calls this fund the Provider Relief Fund (PRF). To date, $175 billion dollars has been allocated to the PRF, with roughly $120 billion distributed or in process of distribution.

Summary of PRF funding

As of August 6, 2020, a total of $175 billion has been designated to the PRF to help health care providers that face a loss of revenue and/or health care related expenses due to COVID-19. One hundred billion dollars was designated under the third COVID-19 stimulus package, the Coronavirus Aid, Relief, and Economic Security Act (CARES Act) enacted as Public Law 116-136 on March 27, 2020. An additional $75 billion was added to the PRF under the Paycheck Protection Program and Health Care Enhancement Act (PPP and HCE Act), which was signed into law on April 24, 2020, as Public Law 116-139.

Key Update

At the time of publication, Congress is still negotiating a fifth COVID-19 stimulus package. The U.S. House and the U.S. Senate are working from different legislative positions, but both include PRF dollars. The House version, referred to as the HEROS Act, includes $100 billion more in PRF dollars, while the Senate version, referred to as the HEALS Act, includes an additional $25 billion.

There is limited statutory text related to these dollars, but keep one key phrase in mind: the statute indicates that the dollars are to be used “to prevent, prepare for, and respond to coronavirus, domestically or internationally, for necessary expenses to reimburse, through grants or other mechanisms, eligible health care providers for health care related expenses or lost revenues that are attributable to coronavirus.” Since statutory language always governs, HHS pulls this language into much of its guidance related to the PRF, including a justification for the amount of dollars received, acceptable uses, and complying with PRF terms and conditions.

While the statute is largely silent on what are considered acceptable uses of PRF dollars, the statutory language does outline several acceptable uses, including “building or construction of temporary structures, leasing of properties, medical supplies and equipment, including personal protective equipment and testing supplies, increased workforce and trainings, emergency operation centers, retrofitting facilities, and surge capacity.”

There are also statutory requirements related to the issue of “double-dipping” of funds, reporting, and transparency.

The PRF is overseen by HHS, with support from the Health Resources & Services Administration (HRSA).

click to enlarge

click to enlarge

Full details for uninsured claims-based reimbursements can be found at hrsa.gov/coviduninsuredclaim

PRF distributions to date

Key Update

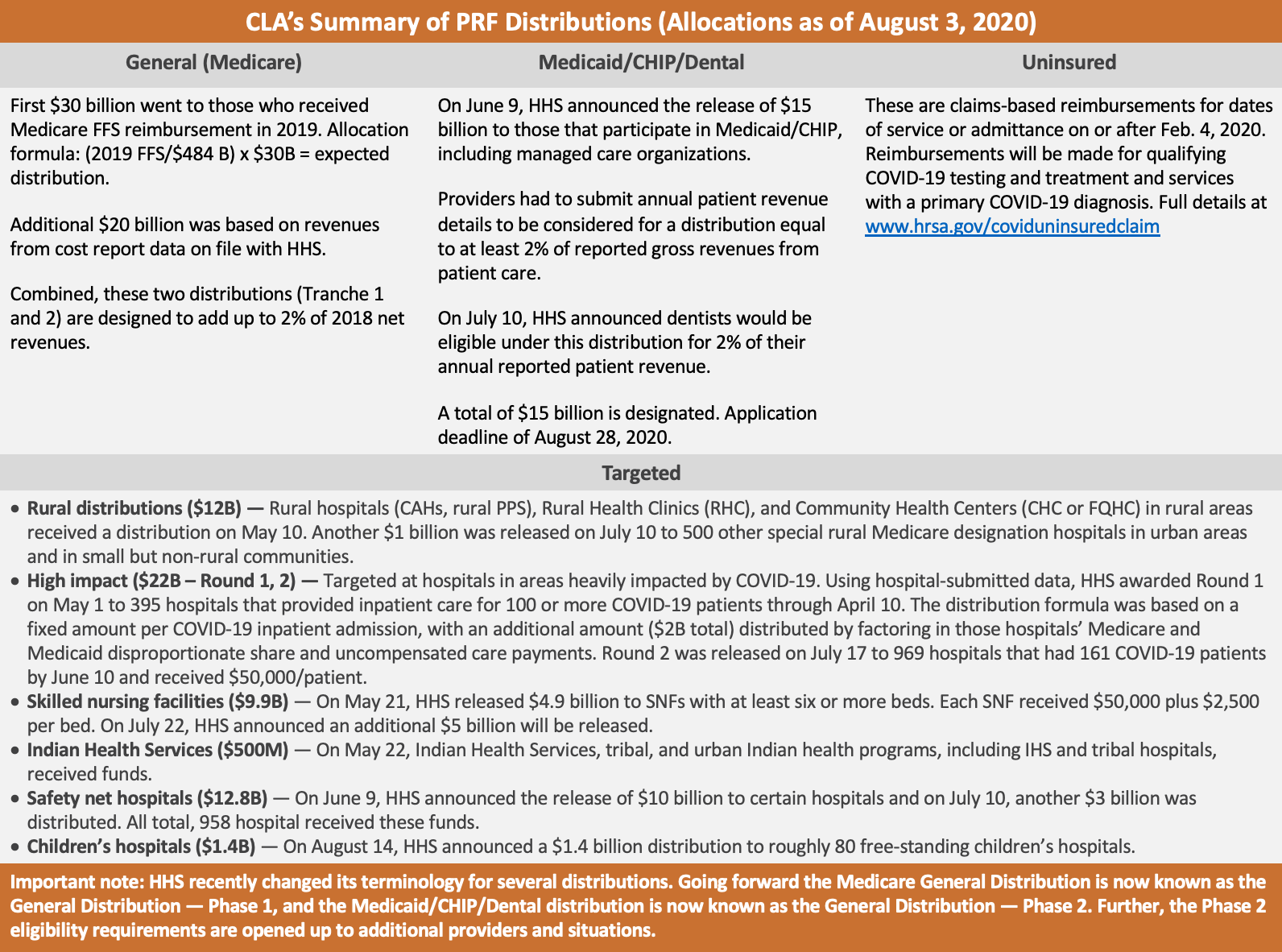

On August 10, 2020, a news release announced a reopened application process for what was originally known as the General Distribution for Medicare providers. HHS indicated that it is looking at the separate Medicare and Medicaid/CHIP/Dental distributions as one major distribution made up of two phases.

In other words, going forward the Medicare General Distribution is now known as the General Distribution – Phase 1, and the Medicaid/CHIP/Dental distribution is now known as the General Distribution – Phase 2. Further, the Phase 2 eligibility requirements are opened up to additional providers and situations.

Review all of these changes at the HHS Provider Relief Fund portal. Applications will be accepted until August 28, 2020.

The first and largest distribution to date was announced on April 10, 2020, and called the “General Distribution” for Medicare providers. Eligibility for this distribution was based on a provider billing Medicaid fee-for-service (FFS) in 2019. The first wave of payments under this distribution was referred to as Tranche 1. Then, on April 22, 2020, HHS announced the ability for those who received Tranche 1 to apply for Tranche 2 of the General Distribution. A total of $50 billion was to be distributed through both of these tranches.

On June 9, 2020, HHS announced a General Distribution for Medicaid/CHIP/Dental providers. This is an application-based distribution available to Medicaid, CHIP or dental providers who did not receive anything under the General Distribution: Medicare (Tranche 1, 2) mentioned above. This distribution is open and eligible providers may apply through August 28, 2020. HHS designated a total of $15 billion for this distribution.

To address specific providers in need, HHS has distributed what they are calling “targeted” distributions. Those include:

- High impact/Hot zones ($22 billion: round 1, 2) — Round 1 of $12 billion was announced on May 1, 2020, for hospitals in COVID-19 hot spots. The distribution formula was based on a fixed amount per COVID-19 inpatient admission, plus $2 billion distributed based on the hospital’s Medicare and Medicaid disproportionate share and uncompensated care payments. Round 2 of $10 billion was announced on July 17, 2020. The distribution formula was based on hospitals with over 161 COVID-19 admissions between January 1 and June 10, 2020, or one admission per day, or that experienced a disproportionate intensity of COVID-19 admissions (exceeding the average ratio of COVID-19 admissions/beds).

- Rural health clinics and rural hospitals ($11+ billion) — On May 1, 2020, HHS released $10 billion targeted at rural health clinics, rural Critical Access Hospitals, and rural prospective payment system hospitals. On July 10, 2020, HHS released another $1 billion to 500 additional special rural Medicare designation hospitals in urban areas and in small but non-rural communities.

- Indian Health Services (IHS) ($500 million) — On May 22, 2020, HHS distributed $500 million to IHS, tribal, and Urban Indian Health Programs. This includes IHS and tribal hospitals.

- Skilled nursing facilities ($4.9 Billion, $5 billion) — On May 21, 2020, HHS announced $4.9 billion in funds to skilled nursing facilities (SNFs) and on July 22, 2020, HHS announced an additional $5 billion will be distributed.

- Safety net hospital distribution ($12.8 billion) — On June 9, 2020, HHS announced the release of $10 billion to safety net hospitals. On July 10, 2020, HHS announced an additional release of $3 billion to additional safety net hospitals.

- Children’s hospitals ($1.4 billion) – On August 14, 2020, HHS announced the release of $1.4 billion to approximately 80 free-standing children’s hospitals.

Finally, the PRF has been used to reimburse providers for COVID-19 testing and treatment for the uninsured. This is a claims-based process for dates of service or admittance on or after February 4, 2020, for qualifying testing and treatment services with a primary COVID-19 diagnosis. Examples of eligible services or testing for reimbursements are:

- Specimen collection, diagnostic and antibody testing

- Testing-related visits in the following settings: office, urgent care or emergency room, or via telehealth

- Treatment: office visit (including via telehealth), emergency room, inpatient, outpatient/observation, SNF, long-term acute care (LTAC), acute inpatient rehab, home health, DME (e.g., oxygen, ventilator), emergency ground ambulance transportation, non-emergent patient transfers via ground ambulance, and FDA-approved drugs as they become available for COVID-19 treatment and administered as part of an inpatient stay

HRSA is facilitating these uninsured claims and has established the COVID-19 uninsured claims website with information on reimbursements.

Terms and conditions

Each PRF distribution comes with its own set of terms and conditions. Recipients have 90 days to attest to these terms and conditions or to reject and return them. While the terms and conditions generally all follow the same requirements, there are some specific requirements for certain distributions. Review and consider the respective terms and conditions closely, as these serve to anchor much of what will be required for reporting, audit, and compliance.

While there are many terms and conditions to highlight, CLA views the following as central for providers to understand: “The Recipient certifies that the Payment will only be used to prevent, prepare for, and respond to coronavirus, and that the Payment shall reimburse the Recipient only for health care related expenses or lost revenues that are attributable to coronavirus.”

Per the statutory language outlined earlier, we can see that HHS is pulling that through into the terms and conditions. Furthermore, these terms are incorporated into some PRF applications and into guidance provided by HHS that will play significantly into reporting and compliance requirements.

Several additional terms and conditions to be mindful of are:

- No double-dipping — “The recipient certifies that it will not use the Payment to reimburse expenses or losses that have been reimbursed from other sources or that other sources are obligated to reimburse.” As referenced earlier, this is a statutory requirement that HHS has pulled into the terms and conditions. In other words, the recipient cannot claim or use PRF dollars for lost revenues or expenses that have already been covered by other funds or obligated reimbursements

- Transparency and public release of data — “The Recipient consents to the Department of Health and Human Services publicly disclosing the Payment that Recipient may receive from the Relief Fund. The Recipient acknowledges that such disclosure may allow some third parties to estimate the Recipient’s gross receipts or sales, program service revenue, or other equivalent information.” This information is already being released via several HHS websites.

- Documentation and record retention — “Shall maintain appropriate records and cost documentation including, as applicable, documentation required by 45 CFR § 75.302 – Financial management and 45 CFR § 75.361 through 75.365 – Record Retention and Access, and other information required by future program instructions to substantiate the reimbursement of costs.”

- Salary cap — “None of the funds appropriated shall be used to pay the salary of an individual, through a grant or other extramural mechanism, at a rate in excess of Executive Level II.” This is a federal pay level, which is set at $197,300 for 2020.

- No balance billing — “For all care for a presumptive or actual case of COVID-19 … certifies that it will not seek to collect from the patient out-of-pocket expenses in an amount greater than what the patient would have otherwise been required to pay if the care had been provided by an in-network Recipient.” If providers treat a presumptive or actual COVID-19 patient who is out-of-network, they can bill the insurer but may not balance bill any outstanding payments.

Key considerations

There are plenty of questions and unresolved issues related to PRF distributions and acceptable uses. Follow these steps as you move forward.

Robust tracking of lost revenues and health care expenses related to COVID-19

Need help tracking PRF funds?

Lost revenues and health care expenses are important for multiple reasons. First, they will be necessary to justify the amount of PRF dollars you receive. If you cannot show enough lost revenues or health care expenses to justify the PRF money you were given, there is the potential for recoupment of the overage.

Second, acceptable uses of PRF dollars also relate back to lost revenues and health care expenses.

Third, robust documentation (which is a term and condition) and tracking of expenses will assist you in reporting and compliance-related matters.

Overall, it is essential to track the funds you received, the revenues you lost, and the expenses you incurred in a detailed, documented, and justified manner.

Acceptable uses of PRF dollars

Hand-in-hand with the previous point, it is necessary to track and document acceptable uses of PRF. While there are some examples provided in statute (as referenced earlier) and by HHS in its Frequently Asked Questions, there are many potential ways to use PRF dollars that may or may not qualify. Without more guidance from HHS, many of these uses still fall in a grey area.

Therefore, the safest route is to use dollars on clearly delineated uses while awaiting additional information and guidance from HHS or to have clearly outlined, justified, and defensible documentation to support your use of PRF dollars, or to consult legal counsel.

Reporting and compliance

Key Timeline

In announcing reporting requirements, HHS also established a deadline to use PRF dollars. That deadline is July 31, 2021. Any unused funds at that time will need to be returned to HHS.

Another reason to have ongoing, detailed accounting of your lost revenues and health care expenses (along with any use of PRF dollars) relates to emerging reporting and compliance requirements. HHS has recently announced that one or two reports will be required from providers who received more than $10,000 in aggregate from the PRF.

The first report will be due by February 15, 2021, and, to the extent there are any unused funds that roll over into 2021, a second “and final” report will be due by July 31, 2021. Yes, this means HHS has set a deadline to use PRF money: July 31, 2021.

Additionally, for those entities or individuals that receive and expend $750,000 in PRF (and/or other federal money) in a fiscal year, HHS has confirmed that single audit or program audits will be required.

Need more insights? Check out our recent webinar:

Demystyifng the Single Audit Requirement for PRFHow we can help

Our health care, nonprofit, tax, outsourcing, and other practices work every single day with our clients on COVID-19 funding, including PRF. We can assist with application eligibility, solutions, and advisory services for tracking PRF (and other COVID-19 funds), lost revenue calculations, acceptable use requirements, and many other provider-specific implications and questions. Our goal is to know you and help you through this ever-changing landscape.