Actuary Jill Urdahl defines OPEBs, compares the new rules with related GASB standards, and discusses implementation strategies for state and local governments.

GASB Standards 74 and 75 require your state or local government to show net liability for your publicly sponsored retiree health care plans — and other post-employment benefits, or OPEBs — on your balance sheet. The accounting treatments for OPEBs mirror those of GASB 67 and 68 for public pensions, but there are some distinct differences you need to be aware of.

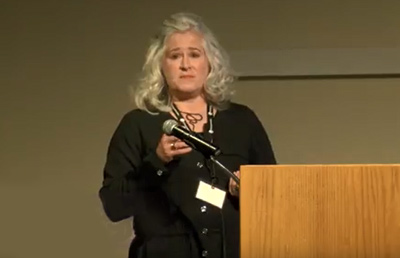

In this series of CLA Talks videos, Jill Urdahl, president and consulting actuary at Hildi, Inc., breaks down the new accounting standards and shares strategies your state or local government can put in place to implement and comply with GASB 74 and 75.

OPEB coverage and new requirements

In this video, Urdahl reviews OPEBs covered under GASB 74 and 75, the new disclosure requirements, and the differences between GASB 73 and GASB 75.

General overview

In this video, Urdahl continues with a general overview of GASB 73, 74, and 75.

Changes from GASB 45 and new terminology

In this video, Urdahl covers the changes from GASB 45, discount rate calculation, and new terminology.

Strategies for implementation

In this video, Urdahl discusses valuations and offers strategies for implementing GASB 75.

View additional installments in the CLA Talks video series.