Key insights

- As prices rise, business owners and investors may be feeling the pinch of inflation.

- Companies across industries are looking for ways to mitigate the impact.

- Investors may need to review their long-term strategies to consider how their decisions could affect their portfolio.

Ready to review your financial strategy in light of market changes?

Rising inflation can feel like an additional burden for many taxpayers — a hidden liability, but without the tax policy behind it. Now that economic data confirms the trend of rising prices is extending into 2022, concerned investors and business owners may be struggling to navigate this inflation “tax.”

Rising inflation has compounding impact

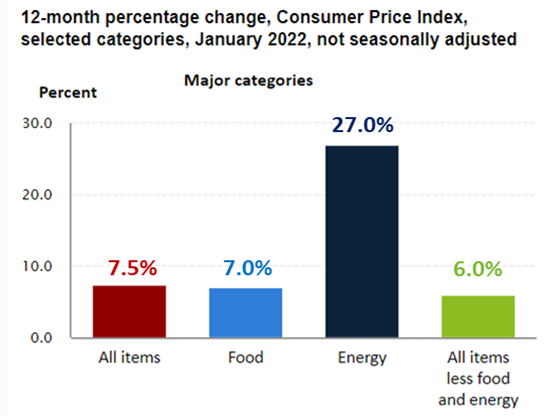

Let’s start by focusing on two January 2022 data points from the U.S. Bureau of Labor Statistics, as seen in the chart below: 9.7% and 7.5%. The first is the rate of rising prices among producers of goods, while the second is the pace at which consumer prices are rising. These two points represent the increase of prices since only last year, showing that the trend of rising prices has a compounding impact on the economy, businesses, and investors.

Interestingly, this inflation threat is now being taken seriously by policymakers. The Federal Reserve has made it clear that it intends to raise interest rates at least four times by a quarter point this year, starting with the March 2022 meeting, as a first step in tempering higher prices. The reduction in asset purchases under so-called “quantitative easing” or QE programs put in place post the Great Financial Crisis represents the second step.

Note that the number of rate hikes this year could potentially be higher, with markets predicting as many as seven 25-basis-point rate hikes at each scheduled Fed meeting in 2022.

Industries feel the impact

Inflation is not simply an academic or policy discussion. For business owners, rising prices is a trend across industries, ranging from agriculture to manufacturing to construction.

Focusing on the construction industry, while construction companies are seeing overall strengths in revenues and backlog given the post-COVID economic recovery, inflation impacts are also noticeably increasing. Price increases for materials, equipment, vehicles, and wage pressures around the tight construction labor market are all weighing on operating margins. Non-labor inputs are seen as the largest challenge to operations, including rising material costs due to supply chain pressures — nearly 85% of firms feeling the most stress are the largest firms in the industry.

However, given the threat of inflation, construction firms are taking proactive measures. Contracting terms and supply cost management are taking into account inflation effects on long-term commitments. Even firms with short contracting cycles must pay closer attention to the condition of key suppliers and the inflationary pressures moving up the supply chain. And all firms are looking at ways to improve operational efficiency to protect margins should rising prices prove to be sticky.

Investors eyeing inflation trends

For investors, inflation is also a “tax” that needs to be managed closely as it can be the deciding factor whether one can achieve their goals. Rising inflation and interest rates is a serious headwind to fixed income assets.

In the first six weeks of 2022, U.S. Treasuries have seen their biggest fall in over four decades while municipal bonds through February 8, 2022, have logged their worst year-to-date start ever with the Bloomberg Municipal Bond benchmark index falling 2.5%.

At CLA, we stress-test portfolios to show the impact of higher inflation on total returns — and take measures to mitigate the impact of higher prices, including using active management strategies rather than passive strategies as we build the portfolio core.

We also look at complementing portfolios with strategies that typically rise — rather than fall — with rising interest rates. These include accessing companies with floating rate debt payments in the fixed income markets or that continue to pay rising dividends in the equity markets.

Real estate can also provide portfolio diversification and can benefit from rising prices given landlords’ ability to raise tenant rents and pass that on to end investors. Finally, in our financial planning discussions, we are advising clients to take note of the use of excessive leverage or borrowing in a rising rate environment.

How we can help

As we look forward, it is too early to tell when the impact of inflation will ease. However, CLA’s tax and wealth advisory professionals can help you develop strategies to navigate rising prices and mitigate the burden of what can feel like a hidden “tax.”