Financial institutions must comply with the lender responsibilities under the Paycheck Protection Program and other loan programs.

CLA (CliftonLarsonAllen LLP) announced today that it has new solutions to help financial institutions navigate the intricacies of loan forgiveness under the Paycheck Protection Program.

Lenders must be prepared to handle complex calculations, navigate evolving forgiveness guidance, and establish adequate monitoring and controls over the loan forgiveness process. They also need people with proper training to review borrower loan forgiveness requests and the sufficiency of supporting documentation prior to making approval decisions.

In addition to offering outsourced solutions to manage and review borrowers’ loan forgiveness applications, CLA brings deep industry experience to help financial institutions develop reports on expected forgiveness amounts in order to accelerate purchases by the Small Business Administration. By facilitating the early repurchase of forgivable loan amounts, lenders could have the opportuity to convert funds to higher-yielding earning assets and further accelerate the timing of recognition of SBA processing fees.

“During these unusual market conditions, lenders should be able to focus on customer relationships, rather than loan forgiveness applications,” said Charlie Cameron, who leads CLA’s financial institutions practice. “The loan forgiveness process will be time consuming and complicated. We have the tools to automate and bring strong project management practices to the process.”

Technology resources

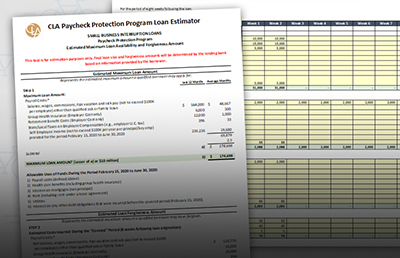

CLA’s technology-driven tools help increase efficiency throughout the loan forgiveness process. Automated payroll cost calculations, specifically designed to apply the PPP forgiveness rules, can improve consistency and accuracy over manual processes.

Using these tools, CLA professionals help facilitate review of the borrowers’ own calculations of the forgivable loan amounts. Throughout the process, an executive dashboard is available to lenders to track and measure work flow, to provide insight into liquidity estimates, and to enhance management oversight over the institution’s PPP loan forgiveness processes.

CLA offers financial tools to help lenders and borrowers navigate PPP loan forgiveness. To learn more, visit claconnect.com. CLA also publishes thought leadership about top issues affecting banks and credit unions in their financial institutions blog.

About CLA

CLA exists to create opportunities for our clients, our people, and our communities through industry-focused wealth advisory, digital, audit, tax, consulting, and outsourcing services. With nearly 9,000 people, more than 130 U.S. locations, and a global vision, we promise to know you and help you. CLA (CliftonLarsonAllen LLP) is an independent network member of CLA Global. See CLAglobal.com/disclaimer. Investment advisory services are offered through CliftonLarsonAllen Wealth Advisors, LLC, an SEC-registered investment advisor.