Consumer confidence and manufacturing optimism are rising; find out what it might mean for interest rates, global stocks, and real estate investment.

American consumers are finally beginning to feel the effects of the recovering economy through higher expected income and a brighter employment outlook. Based on gross domestic product (GDP) from the last three quarters of 2014, the U.S. economy is growing at an average rate of 3.9 percent, its fastest pace since March 2004. All signs point to the Federal Reserve moving soon to raise short-term interest rates.

While economic growth overseas is decidedly less robust than here at home (think Greece and the Eurozone), there are reasons for investor optimism in Europe, and the European Central Bank (ECB) has initiated its own version of stimulus (quantitative easing). International equity markets have significantly lagged U.S. equity markets over the past two years, but we have been cautioning clients that this will most likely change and that they should stay patient with a diversified portfolio of U.S. and international equities. This message has come home to roost in the first quarter of 2015 as the European, Asia, and Far East (EAFE) index of international stocks has significantly outperformed the S&P 500 (+4.88 percent versus +.95 percent). We believe the trend is likely to continue due to the ECB bond-buying program and recovering economies in Europe and Asia. In addition, valuations are much more attractive than in the United States.

Some positives and negatives in the economic and investment background include:

| Positives | Negatives |

|---|---|

|

|

The American consumer is back, higher interest rates may follow

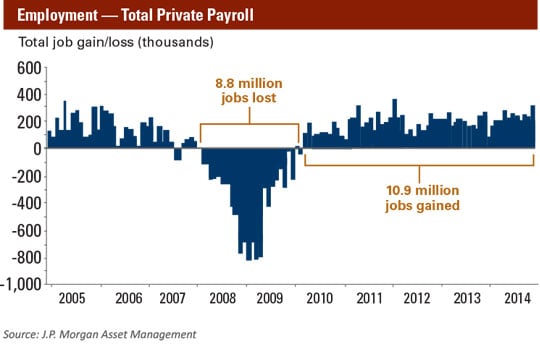

By and large, the American consumer is in great shape and growing more optimistic. As illustrated by the charts that follow, the economy has more than recovered the jobs lost during the Great Recession. In addition, increasing expectations for income growth are supporting new housing starts, automobile sales, manufacturing, and other cyclical areas of the economy.

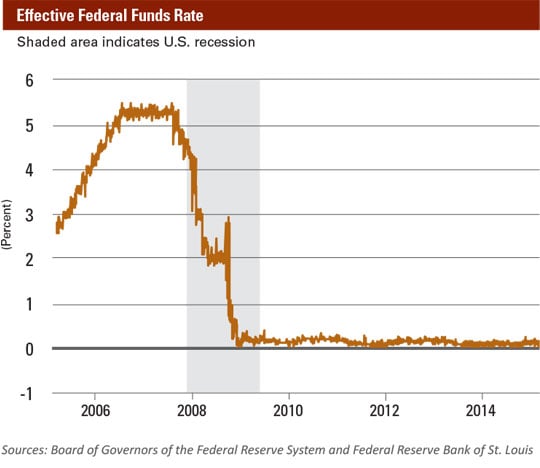

Through January 2015, U.S. employment growth had a 12-month average of 264,000 jobs created per month. The last time the monthly job creation average was this high, the federal funds rate was 7 percent versus 0 percent today. While we don’t expect the Fed to hike rates back to 7 percent anytime soon, there is ample positive economic data for the central bank to move off the 0 percent interest policy that has been in place since 2008.

Industry spotlight: growth in manufacturing and distribution

Following the Great Recession, the U.S. manufacturing and distributing industries have been some of the most resilient in our economy.

Download a copy of the fourth annual Manufacturing and Distribution Outlook report, a composite of opinions from more than 350 privately owned manufacturing and distribution companies.Get the Report

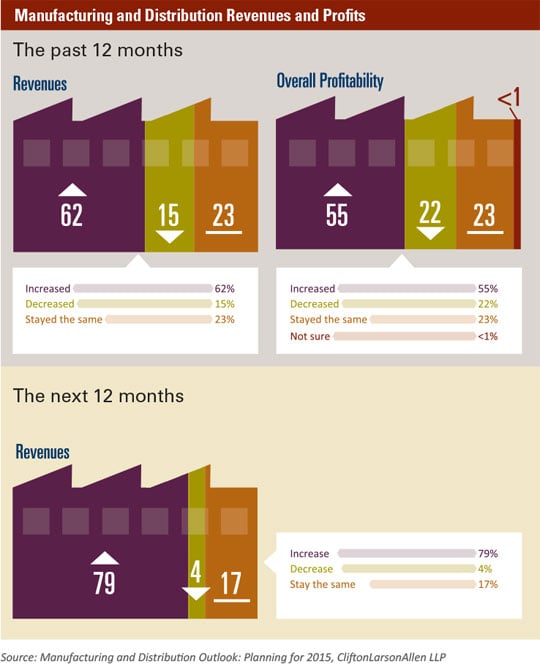

While these businesses continue to face numerous regulatory and competitive challenges, CliftonLarsonAllen’s annual industry survey found that 62 percent of respondents increased their revenues over the past 12 months and 55 percent increased profitability.

As shown in the following chart, nearly a quarter of survey respondents reported flat revenues in the past year, but the group is expecting even greater growth in 2015.

Erik Skie, CPA

Managing Principal

That’s all positive news to Erik Skie, managing principal for the manufacturing and distribution industry with CLA. “We expect the growth in the industry to continue,” Skie says. “It is also encouraging to see the industry adapting to the prevailing uncertainty in our domestic and global economy.”

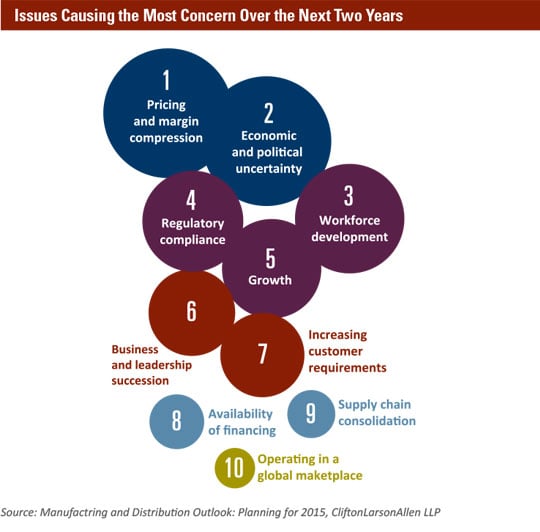

CLA’s annual survey had “economic and political uncertainty” topping its list of concerns for 51 percent of respondents in 2012, and 46 percent in 2013. In 2014, it slipped to 36 percent and has been replaced by “pricing and margin compression” as the number one concern. Skie says the survey results affirm that manufacturers have become more accepting of some uncertainty despite the significant competitive challenges that persist.

“In either case, it says that manufacturers and distributors are more focused today on the business issues they can control and less on forces that are out of their hands,” Skie adds. Not surprisingly, owners and executives also indicated that their positive outlook will continue to be tested by rising health care and regulatory costs and the shortage of skilled labor. Respondents indicated they are focusing their continuous improvement efforts to offset these challenges.

While the skilled labor shortage has dominated headlines, Skie sees the impending ownership and leadership transition in manufacturing as a significant issue for the industry. An estimated 9 million of America’s 15 million business owners were born on or before 1964 and are quickly approaching retirement age. As a result, there is an estimated $11 trillion of business wealth that will soon be transferred from one generation to the next. Forty-five percent of survey respondents expect that transition to take place in one to five years, so the immediacy of the issue seems to be getting much more attention.

We believe that leadership transition is a risk factor for those who have not planned or prepared for succession, and a significant acquisition growth opportunity for those with strong leadership and management teams.

International stocks are worth keeping

With U.S. stocks handily outperforming overseas stocks (including emerging markets) over the last three years, we are seeing more client interest in reducing foreign stocks and adding to their U.S. stock exposure. This is commonly known as selling low and buying high and is not a recommended wealth creation strategy.

At this time, valuations in non-U.S. stocks, especially emerging market stocks, look more compelling than the United States. This does not mean that non-U.S. stocks will immediately start to outperform domestic issues; however, valuation advantages tend to work out in favor of the patient investor.

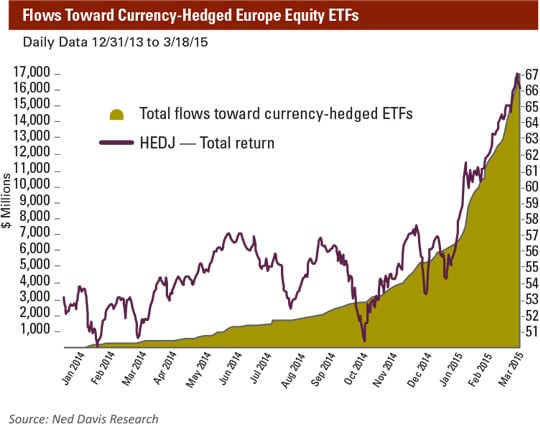

In addition to valuations, central bank policy may also favor overseas equities. The ECB recently started its own stimulus program by purchasing bonds in the open market. A similar program in the U.S. helped instill investor confidence and investment in U.S. stocks. When you consider the cash flows into European stock exchange traded funds (ETFs) that are illustrated below, you see that a similar theme may also be occurring in Europe.

Keep in mind that the Fed ended its bond-buying program at the end of 2014 and is poised to raise interest rates. Stimulus is being reduced in the United States and increased significantly in Europe and Japan. History suggests superior equity returns from those countries with accommodative monetary policies and more attractive valuations.

Consider real estate for safety, income, and growth

Commercial real estate investments represented by the National Council of Real Estate Investment Fiduciaries (NCREIF) property index have been a mainstay of institutional investors for decades. Individual investors have been able to participate in real estate investing through publicly traded real estate investment trusts (REITs). While REITs have provided liquidity and access to the real estate sector, they have tended to move up and down with the stock market, muting their appeal. The NCREIF property index has not correlated as closely with traditional stocks and bonds when compared to REITs.

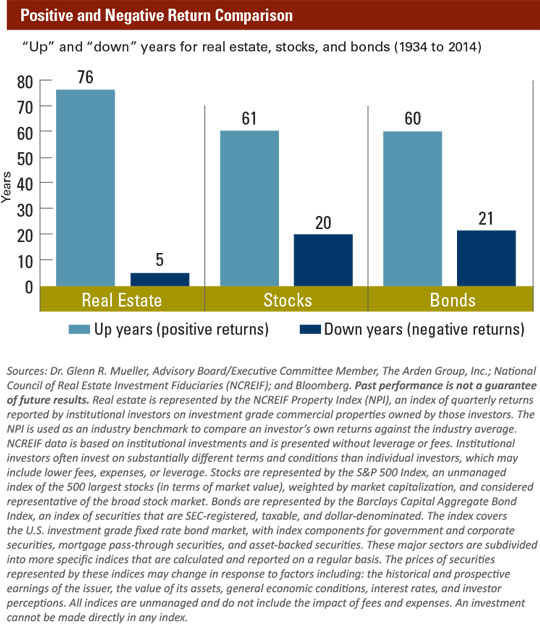

Real estate ultimately grows with the economy and employment, while also providing excellent inflation protection. Consistent income, coupled with attractive appreciation potential and fewer down years than stocks and bonds, also adds to the appeal of this asset class.

Expect the unexpected

With the U.S. stock market entering its seventh year of positive returns, it is natural to wonder how long this bull market will continue. Historically, the up market has lasted longer than average in both duration and magnitude. However, cycles can last longer than anyone expects. With the Federal Reserve still accommodative and central banks in Japan and Europe following suit, there is a tail wind for stocks in this country. While valuations in the U.S. stock market are certainly not cheap, we do see more compelling valuations in overseas markets. With interest rates at generational lows, it will be difficult to achieve inflation-beating returns in bonds.

While we don’t anticipate that stocks will replicate their performance of the last several years, we do think they will outperform bonds, but not necessarily every year. We are using private real estate to diversify portfolios, where appropriate, for our clients who can lock up a portion of their risk capital for a number of years. The income generated from professionally managed rental real estate can exceed what is available in the stock and bond markets, while providing appreciation and an inflation hedge should inflation become an issue in the next few years. This includes industrial properties, apartments, offices, hotels, and retail commercial real estate. Income-producing real estate can serve as a great diversifier, while reducing risk and enhancing returns in combination with a traditional stock and bond portfolio.

The above chart, compiled by Dr. Glenn R. Mueller, a member of the advisory board and executive committee member of The Arden Group, Inc., indicates that stocks and bonds have produced four times the number of negative return years versus real estate over the past 81 years. Mueller, a professor at Denver University, visiting professor at Harvard University, real estate investment strategist for Dividend Capital Research, and co-editor of the Journal of Real Estate Portfolio Management, brings more than 39 years of real estate experience to his analysis.

We do believe volatility in the stock and bond market will accelerate as the Fed gets closer to its first interest rate increase in nearly eight years. Long-term investors should ignore this volatility. Of course, that’s easier said than done.

Quoting Benjamin Graham, the father of value investing, Warren Buffett said, "In the short term, the market is a voting machine. In the long term, the market is a weighing machine." We think Buffet is saying that the stock market moves in the short term for many different and hard-to-predict reasons, but in the long run, the market weighs corporate earnings and prices increase as the economy and corporate earnings grow.