Key insights

- The COVID-19 public health emergency (PHE) declaration provided many temporary flexibilities for the delivery and reimbursement of technology-enabled health care.

- Congress is working on legislation to extend certain flexibilities.

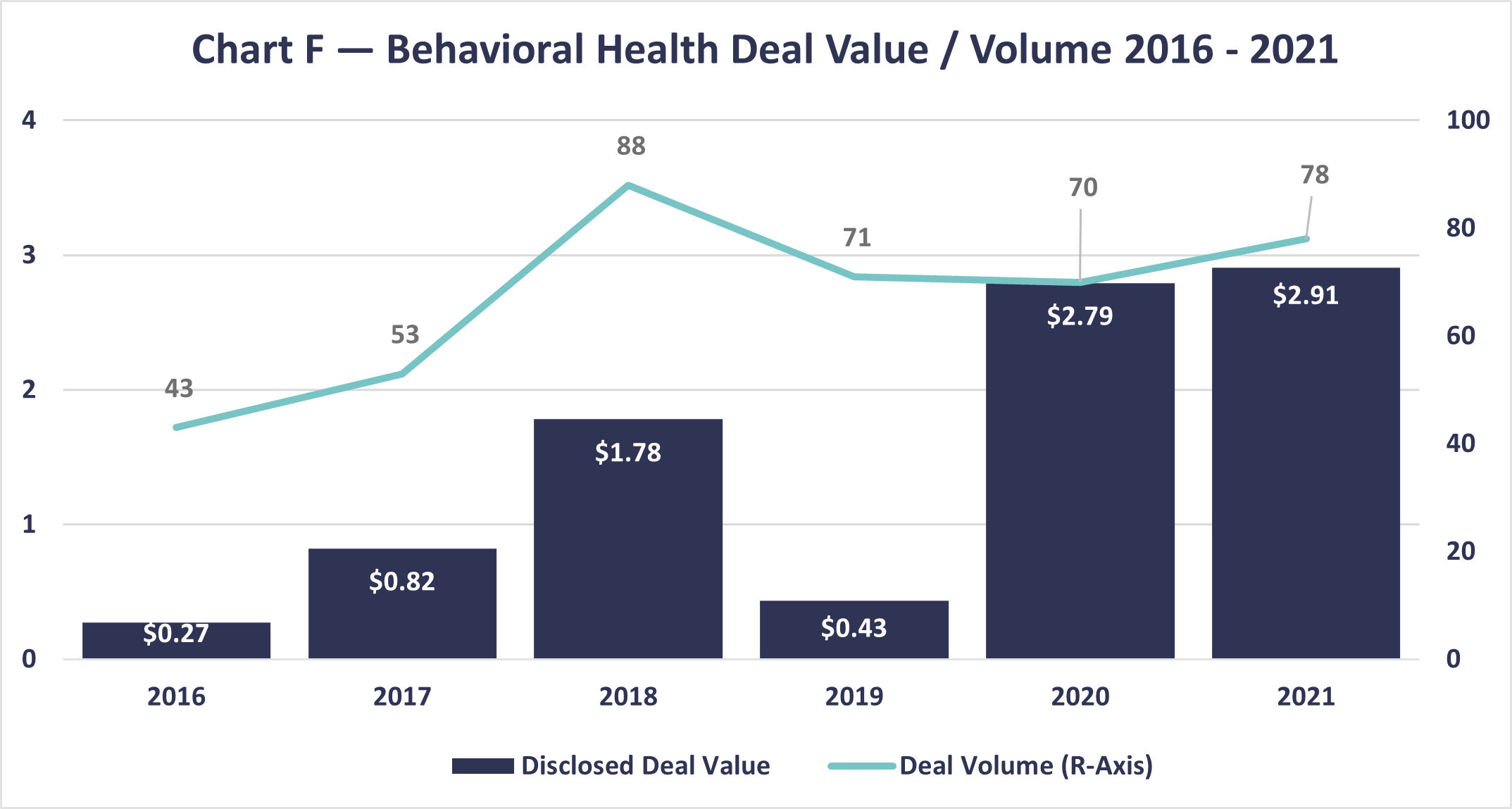

- Deal volume and value in health, especially behavioral health, has been high.

- Consider key questions as you analyze and strategically plan for the post-PHE future.

Need help planning your post-PHE future?

The COVID-19 pandemic provided a real-life, intensive use case for the role of technology throughout health care. This included moving acute care from the hospital to the home and significantly leveraging remote monitoring, telehealth, and audio-only interactions for care delivery. The experience provides a wealth of data to be analyzed for advancing technology-enabled care across all health care settings.

Use case for telehealth and Medicare

One of the most robust examples from the pandemic was in telehealth, the most mature tech-enabled care modality to date. The public health emergency (PHE) declaration allowed the Centers for Medicare and Medicaid Services (CMS) to make myriad changes to statutory or regulatory requirements. Key telehealth flexibilities authorized include:

- Removing geographic limitations for providing telehealth. Previously, telehealth could only be provided if the patient was in a rural location.

- Allowing patients to be at home when receiving telehealth services. The home was not an allowable setting (for reimbursement) prior to the pandemic.

- Adding nearly 150 new health care services to the “telehealth services list” to allow for reimbursement.

- Permitting rural health clinics (RHCs) and federally qualified health centers (FQHCs) to be distant site providers — which had not been a previously allowed setting.

- Allowing and reimbursing for audio-only communication as opposed to the audio-video (synchronous) format normally required with telehealth.

In a December 2021 report, the Department of Health and Human Services found Medicare fee-for-service telehealth visits shot up from 840,000 in 2019 to nearly 52.7 million in 2020. Roughly 92% of these patients received care via telehealth in their homes.

For RHCs and FQHCs, which were allowed to serve as “distant site” providers for telehealth services, the 9,000 total telehealth visits in 2019 skyrocketed to more than 830,000 in 2020. Telehealth increased significantly in urban settings after restrictions to rural locales were lifted, with the Northeast and West demonstrating the largest increased usage.

The report shows roughly 1 million primary care telehealth visits per week in April 2020 receded to less than half that by October 2020. However, that was not the case with behavioral health specialists, which saw the largest increase in telehealth overall and comprised roughly one-third of all visits. These visits jumped from 8,000 in January 2020 to 280,000 visits per week by May. That number averaged about 250,000 visits per week throughout 2020.

A second report analyzed results of the Census Bureau’s Household Pulse Survey, which included a far broader population beyond Medicare, such as children and the uninsured. That report found consistently higher use of telehealth (and audio-only communication) in 2021 — 23% of survey respondents reported having received telehealth within the past four weeks. However, telehealth use did vary significantly by certain factors such as income, education, race and ethnicity, and health insurance status. This second report provides additional insights into future considerations.

Congress may make permanent changes

During the pandemic, patients used telehealth at significantly higher levels — and providers rapidly implemented telehealth capabilities to great effect. However, once the PHE ends, the Medicare flexibilities will also end. Congress recognized this and extended several flexibilities an additional 151 days post-PHE (Consolidated Appropriations Act of 2022).

Based on pandemic experience and utility of telehealth, some in Congress would like to do even more to move telehealth forward. One of the bills that seems to hold promise for potential action this fall is H.R. 4040, the Advancing Telehealth Beyond COVID-19 Act of 2022.

HR 4040 would extend the following policies through 2024:

- Remove geographic requirement that telehealth services be delivered only in rural areas

- Remove originating site restrictions so individuals could be seen at home

- Allow an expanded list of practitioners to provide telehealth, such as physical therapists

- Allow RHCs and FQHCs to provide telehealth as distant site providers

- Allow for audio-only (i.e., non-synchronous) telehealth

- Allow face-to-face hospice recertification requirement to be done using telehealth (versus in-person)

- Delay through January 1, 2025, the requirement for in-person visits for mental health

While HR 4040 does not provide permanent extensions to these policies, enactment of the legislation would allow for additional time to study how they impact care delivery and cost. Also, the additional time would provide Congress an opportunity to pass permanent changes.

Post-PHE implications — and what’s next

The pandemic provided a look into how well telehealth and other technology-enabled care can be used, though use varied by population, location, provider, and other important factors. Those variations should be analyzed by all stakeholders — health care providers, investors, legislators and regulators, and consumers — to broaden access while concurrently providing high quality care.

On the Congressional/regulatory side, CMS has released multiple Medicare rules that include policies on technology-enabled care (see our HI2 blog for more details). While the agency continues to adjust and advance various telehealth and technology-enabled care, CMS’s regulatory authority is limited by statute. To make any larger changes, Congress will need to act.

Regulators, providers, the market, and consumers are coalescing around behavioral health access. Telehealth flexibilities — particularly allowing for audio-only communication — greatly expanded access to care in this area, including substance use and opioid use disorders support.

At the same time the need continues to grow, we have seen significant investment into behavioral health. CLA’s article on transaction trends indicates private equity and strategic buyer value rose to almost $3 billion in 2021.

The health care space, particularly telehealth and prescription drugs, is filled with complicated requirements — as evidenced by recent investigations into the prescribing patterns of certain behavioral health companies. Seek legal and advisory assistance to help stay in compliance with changing regulations.

We anticipate seeing continued activity in technology-enabled care like remote patient monitoring and its derivative, remote therapeutic monitoring (RTM). RTM only recently received the green light from CMS as a covered, reimbursable service. Though CMS is still somewhat limiting its use, digital therapeutics have potential to complement telehealth via ongoing therapy adherence and therapy response.

Because of the pandemic, the types of providers who can deliver and be paid for telehealth were expanded to include physical, occupational, and speech language therapists and others. Additionally, physicians were allowed to provide synchronous supervision.

As we look out several years post-PHE, think strategically about your PHE experience and what your post-PHE approach could include for technology-enabled care. Consider some questions to get you started:

- Which CMS waiver flexibilities did you use during the PHE?

- When will those waivers sunset?

- Which codes did you bill for and will those be reimbursable post-PHE? For how long?

- What was the revenue associated with these services by payer type?

- How will you continue (or replace) this revenue if no longer reimbursable?

- What were your patient outcomes?

- How was your consumer experience?

- Based on your experience, which practice areas, conditions, and settings will you strategically focus on in the future?

- How will you get there?

How we can help

It is not too early to start thinking about unwinding any pandemic flexibilities — and what doing so could mean for your organization. CLA’s health care professionals can help you analyze these flexibilities and their financial impact for actionable insights you can use to strategically chart your course forward.