On July 31, 2020, the Centers for Medicare & Medicaid Services (CMS) released both the 2021 final skilled nursing facility (SNF) and hospice payment rules. We’ve provided a high-level overview of key provisions in the rules below.

Key insights

- The SNF final rule provides a 2.2% market basket update and the hospice final rule provides a 2.4% update. CMS applied no multifactor productivity adjustment to either.

- CMS finalized using the revised wage index delineations for both the SNF and hospice wage index values. Since providers may experience fluctuations in their area wage index values as a result, CMS finalized a 5% cap on any decrease for 2021.

Looking for additional clarity or guidance on the finalized payment rules by CMS?

On July 31, 2020, the Centers for Medicare & Medicaid Services (CMS) released both the 2021 final skilled nursing facility (SNF) and hospice payment rules. We’ve provided a high-level overview of key provisions in the rules. To review the complete rule, download the final SNF rule (CMS-1737-F) and final hospice rule (CMS-1733-F) from the Federal Register.

Table of Contents

I. SNF prospective payment system (PPS) final rule

a. Payment update

b. Patient-Driven Payment Model (PDPM)

c. Wage index changes

d. Quality Reporting Program (QRP)

e. Nursing Home Compare

f. Value-Based Purchasing Program

II. Hospice final rule

a. Payment update

b. Wage index

c. Election statement content modifications and addendum

d. Quality Reporting Program (QRP)

SNF prospective payment system (PPS) final rule

CMS indicated the final fiscal year (FY) 2021 SNF PPS rule would increase payments rates to SNFs in the aggregate by $784 million and decrease payments to SNFs under the Value-Based Payment program by $199.5 million.

Payment update

The market basket update for FY 2021 is 2.2%. Given the impact of COVID-19 on the economy, CMS finalized no multifactor productivity adjustment.

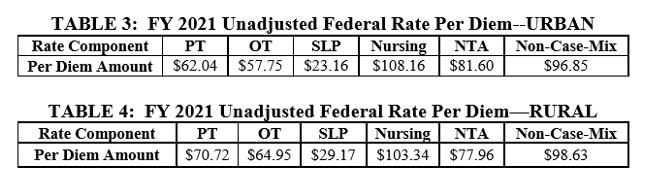

The federal unadjusted rate per diems are listed in Tables 3 and 4.

Source: CMS

Patient-Driven Payment Model (PDPM)

Use CLA's 2021 SNF PDPM Reimbursement Calculator to see your facility's payment rates.

To reflect PDPM and the case-mix adjusted federal rates associated with indexes for urban and rural facilities, in the final rule CMS provided two update tables (see Tables 5 and 6) and a full description of the columns within the table, which can be seen in the Federal Register.

Also for PDPM, CMS finalized technical ICD-10 code mappings and list changes, including several modifications as recommended by commenters.

Wage index changes

Since the inception of the SNF PPS, hospital inpatient wage data has been used in developing a wage index applied to SNFs. CMS used the hospital wage index as a basis to develop the SNF wage index.

For FY 2021, CMS finalized using the revised federal Office of Management & Budget (OMB) delineations (September 2018) for the wage index.

Because there are various implications of using these revisions (movement from rural to urban and urban to rural classifications, among others), CMS finalized without modifications a one-year transition policy. Under this transition, CMS would cap any decrease in the SNF’s wage index at 5% in FY 2021 compared to its wage index for the prior fiscal year (FY 2020). The changes would go into full effect in FY 2022.

The wage index applicable to FY 2021 is set forth in Tables A and B and is available on the CMS website. Table A provides a crosswalk between the FY 2021 wage index for a provider using the current OMB delineations in effect in FY 2020 and the FY 2021 wage index using the revised OMB delineations, as well as the final transition wage index values that would be in effect in FY 2021.

Due to budget neutrality requirements, CMS applied a budget neutrality factor. The finalized factor is 0.9982.

CMS stated these changes also apply to all non-Critical Access Hospital swing-bed rural hospitals.

SNF Quality Reporting Program (QRP)

CMS made no changes to this program.

Nursing Home Compare

CMS finalized codification of the previous data suppression policy for low-volume SNFs and their phase one review and correction deadline policy.

SNF Value-Based Purchasing Program

CMS finalized no real changes to this program, continuing the policy where performance and baseline periods will automatically roll forward by one year from the previous year. As such, the FY 2023 performance period will be FY 2021, and the baseline period will be FY 2019.

Hospice final rule

Payment update

The market basket update for FY 2021 is 2.4% with no multifactor productivity adjustment.

The labor portion of the hospice payment rates is as follows:

- Routine Home Care (RHC) — 68.71%

- Continuous Home Care (CHC) — 68.71%

- General Inpatient Care (GIP) — 64.01%

- Inpatient Respite Care (IRC) — 54.13%

The non-labor portion is equal to 100% minus the labor portion for each level of care. Therefore, the non-labor portion of the payment rates is as follows:

- RHC — 31.29%

- CHC — 31.29%

- GIP — 35.99%

- IRC — 45.87%

Wage Index

CMS applied revised OMB delineations for FY 2021 to the hospital wage index values. CMS recognized that some hospices would experience fluctuations in their area wage index values as a result and proposed a 5% cap on any decrease in the wage index value for this year compared to the prior year. The final hospital wage index for FY 2021 is effective October 1, 2020 through September 30, 2021.

When receiving RHC or CHC, the appropriate wage index value is applied to the labor portion of the hospice payment rate based on the geographic area in which the beneficiary resides. However, the appropriate wage index value is applied to the labor portion of the payment rate based on the geographic location of the facility for beneficiaries receiving GIP or IRC. CMS also applied a wage index standardization factor. See Tables 5 and 6 for rates and standardization factors.

Election statement content modifications and addendum

CMS reminded hospices about its previously finalized policies on election statements and addendums. Those will take effect October 1, 2020. CMS provided several illustrative examples of the statement and addendum on the Hospice Center web page.

Hospice Quality Reporting Program (QRP)

CMS proposes no changes to this program.

How we can help

Connect with CLA for further clarification on these final rules and how they might impact skilled nursing facilities or hospice care providers.