Key insights

- Simple agreements for future equity, or SAFEs, have grown in popularity and are often used between investors and start-up companies.

- SAFEs are a more streamlined approach to infuse capital into a business compared to convertible debt.

- Even though SAFEs are a simpler way for companies to receive financing, be cautious of the dilutive impact SAFEs can have on the capital structure.

- SAFEs are an important consideration in a 409A valuation as they can cause further dilution to the company’s common stock, thereby reducing the strike price on stock options issued to employees.

Privately held companies seeking funding may want to consider alternatives to traditional financing rounds. Certain options can be simpler and bring flexibility for both the company and the investor, but be aware of their impact on the capital structure of the business.

Might SAFE financing be a good option for your company?

What are SAFEs?

A simple agreement for future equity (SAFE) is a legally binding document between a company and an investor. SAFEs were introduced in 2013 as an alternative to convertible debt agreements and have grown in popularity. Unlike a convertible debt agreement, a SAFE is not a loan or debt; however, both are considered convertible securities.

SAFEs are often used between investors and start-up companies prior to the more structured priced rounds of financing. When issued, SAFEs do not represent equity in the company. Rather, SAFEs give the investor the right to receive equity in the company at an agreed upon price at a future date.

SAFE agreement structures and key terms

Key terms in SAFE agreements include:

- Valuation cap — The max valuation at which an investor’s investment converts into equity, or a pre-negotiated amount that serves to “cap” the conversion price once shares are issued.

- Discount — Percentage reduction to the price per share of the triggering event at which the investor converts into equity.

- Most favored nation — Provision that protects the investor by giving them the ability to receive the same rights and preferences received by later investors, if more favorable.

SAFEs can be structured as:

- Valuation cap and discount

- Valuation cap, no discount

- Discount, no valuation cap

- Most favored nation, no valuation cap or discount

Advantages of SAFE agreements

Company perspective

SAFEs are a more streamlined approach to infuse capital into a business using much shorter agreements (typically 5 – 10 pages long) compared to lengthy convertible debt agreements. Additionally, SAFEs are not debt instruments with set maturity dates and interest rates.

The company and its investor can close on the investment as soon as both parties are ready and able instead of trying to coordinate a round of financing with multiple investors simultaneously, making the SAFE fundraising process smoother and more efficient.

Investor perspective

SAFEs provide investors the opportunity to convert their investment into equity upon a triggering event. Triggering events can include a priced equity financing round, winding up or dissolution of the company, or a liquidation event. The conversion features may vary based on the triggering event type, so the company and investor must be aligned on the defined terms in the agreement.

Potential downsides of SAFE financing

Company perspective

Even though SAFEs are a simpler way for companies to receive financing, companies need to be cautious of the dilutive impact SAFEs can have on the capital structure. SAFEs convert into equity at the next round of financing and these shares will have the same rights and preferences as the new investors. It’s critical to consider the additional dilutive impact the SAFE holders could have when negotiating the terms of the financing round.

Although SAFE investments don’t imply a value indication of the company, key terms such as valuation caps and discounts are often included in the agreements. Setting the valuation cap too low or discount too high can cause further dilution upon a triggering event.

Investor perspective

SAFEs can be risky for several reasons, the most obvious being losing your investment as SAFE holders don’t have an equity stake in the business until a future triggering event. SAFEs also have no interest rate or maturity date and are not debt instruments. Therefore, investors should fully understand the risks of investing in a SAFE and verify the agreement has proper protections in place prior to execution.

How does a SAFE convert into equity?

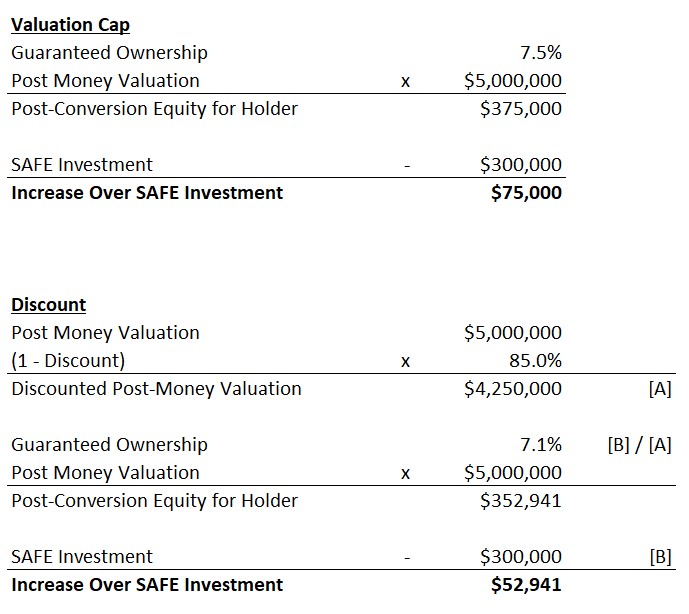

Assume a company issued a SAFE to an investor for $300,000 with a post money valuation cap of $4 million and a discount of 15%. Although the investor doesn’t own equity in the company when the SAFE is issued, the valuation cap does guarantee at least 7.5% of the company, even if the company ends up raising at a valuation above $4 million in the next priced round.

Further assume that one year later, the company raises a priced round at a $5 million post money valuation. The priced round was determined to be a triggering event, so the SAFE holder converts their SAFE investment into equity utilizing the valuation cap or the discount.

Below are the calculations based on the $4 million valuation cap and a 15% discount.

As seen in the example, it may be most beneficial for the SAFE holder to convert into equity using the valuation cap versus the discount.

How do SAFEs factor into 409A valuations?

A Section 409A valuation is an appraisal of the fair market value of a privately held company’s common stock. If a company plans to issue stock options to its employees, a 409A valuation is required to determine the strike price at which the options are granted.

409A valuations have a safe harbor of 12 months after the valuation’s effective date for the company to grant stock options at the indicated strike price, unless there is a material event that requires another 409A valuation. Material events are anything that could impact your company’s value, such as a new priced equity round, acquisitions, or business model changes, among others.

When conducting a 409A valuation, SAFEs are considered outstanding equity instruments that may have an impact on the company's common stock valuation. How the SAFEs are considered within the 409A valuation depends on facts and circumstances.

For instance, if the SAFEs are likely to convert into equity soon, they may be included in the company's fully diluted cap table and valued accordingly. Conversely, if the SAFEs were issued close to the valuation date and a triggering event such as a priced equity financing round is not imminent, the company’s equity value may be reduced by the face value of the SAFE investment.

Overall, SAFEs are an important consideration in a 409A valuation as they can cause further dilution to the company’s common stock, thereby reducing the strike price on stock options issued to employees.

How we can help

It's important to understand the terms of SAFEs and their potential impact on your company's future capitalization structure. CLA’s complex securities professionals within our valuation, forensics, litigation, and investigations group can shed light on a SAFE’s impact to your company’s 409A valuation. Contact us for assistance.