Key insights

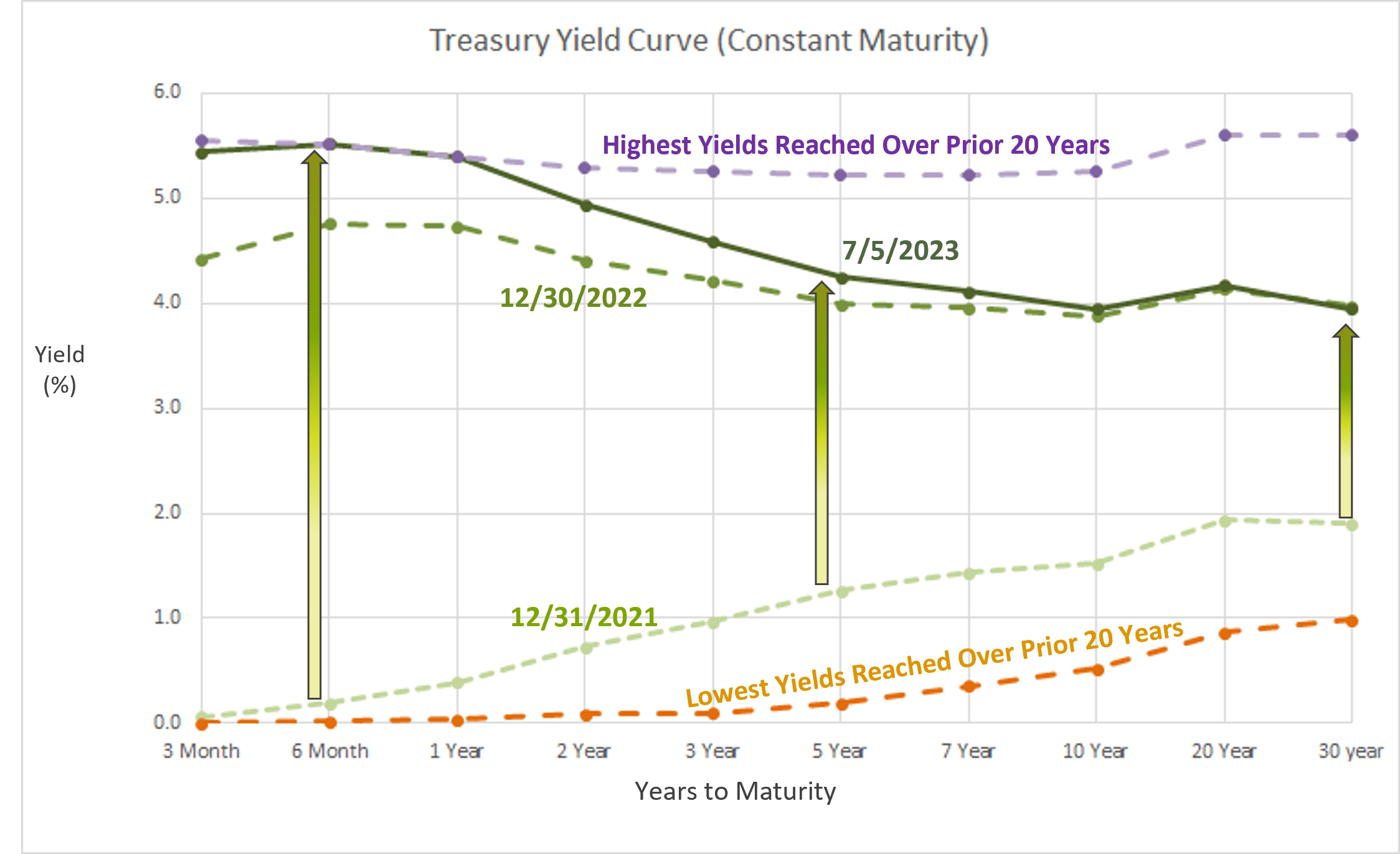

- Short-term yields have moved close to their highest levels of the last 20 years, with short-term rates exceeding intermediate and long-term rates by a significant margin.

- CLA’s interpretation of this inverted yield curve is that the market is behaving in an efficient manner, which can make it difficult for an investor to beat the market.

- Given the relatively high yields of 90-day Treasury bills, it may be a good time to review your bank deposits and other short-term investments to determine if they are earning market rates.

Is your money earning the yields it should?

If you haven’t paid much attention to the recent rise in interest rates, you may be surprised to learn that 90-day Treasury bills and other short-term debt instruments are yielding over 5%. This is a far cry from December 2021 when yields were at historic lows of around 0.05%.

Given this significant and rapid rise, it may be a good time to review your bank deposits and other short-term investments to determine if they are earning market rates. Analyzing investment opportunities can be complex, so you may want to consider working with an advisor to help navigate your cash management needs.

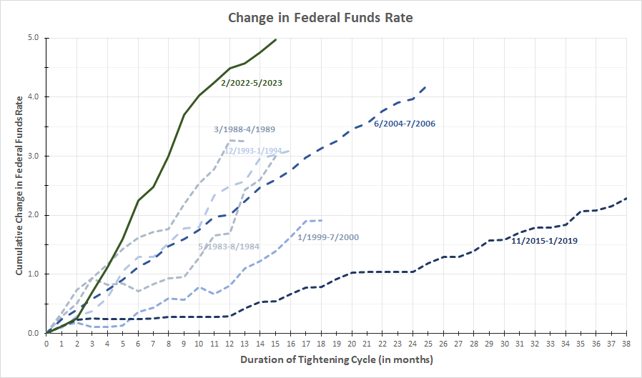

Fed reacts quickly in adjusting federal funds rate

The Federal Reserve increased the federal funds rate — a key benchmark — at a historically fast pace to combat rising inflation. As shown in the chart below, they increased the federal funds rate by 500 basis points (5 percentage points) over 15 months, which is the most aggressive tightening cycle in the last 40 years. This is causing many investors to take a second look at their investment allocations.

Source: Board of Governors of the Federal Reserve System, St Louis Federal Reserve, CLA Wealth Advisors

Short-term yields could bring time-sensitive investment opportunities

Short-term yields (one month to two years) have moved close to their highest levels of the last 20 years, while intermediate (three to seven years) and long-term yields (10+ years) haven’t changed much since December 2022. As shown in the chart below, short-term rates now exceed intermediate and long-term rates by a significant margin, which is called an “inverted yield curve.”

Source: Board of Governors of the Federal Reserve System, St Louis Federal Reserve, CLA Wealth Advisors

An inverted yield curve can be interpreted in several ways

One way assumes demand for short-term loans exceeds the supply of loanable funds.

Another interpretation is that markets are predicting interest rates have peaked and will begin to move lower. Put another way, long-term investments may currently offer lower yields, but they will be locked-in for a longer time, whereas short-term investments will mature and need to be reinvested at potentially lower and lower interest rates.

CLA’s interpretation of an inverted yield curve is that the market is behaving in an efficient manner. That means current prices reflect all available information, making it difficult for an investor to beat the market. Also, an inverted yield curve generally occurs toward the end of a Fed tightening cycle once sufficient liquidity has been withdrawn from the economy to thwart the risk of future inflation.

Consider investment opportunities with this shift

These short-term yields are notable, but things can change. With a potential end to the interest rate hike, investors may find opportunities to adjust their portfolio mix. Now may be a good time to investigate your investment options with your wealth advisor, especially if you have excess cash in bank accounts earning very little interest.

How we can help

With the current interest rate environment, it’s an important time to evaluate your short- and long-term cash management needs. Work with an advisor to determine if Treasury bills, money market funds, sweep accounts, or other investment options might work for you.

Watch our third quarter CLA Outlook to learn more about how interest rates may affect your investment decisions.CLA Wealth Advisors can help with the treasury management of your organization by offering a broad range of strategies. Please contact us to get started.