The new law moves us to a territorial tax regime and eliminates foreign dividends from federal corporate income tax. Does your company qualify for this generous exemption?

The new tax reform law offers many potential benefits for businesses, one of which is the new U.S. territorial tax regime — meaning that domestic corporations are no longer required to report and pay tax on both domestic and foreign income.

The so-called “toll charge” for the transition from a worldwide to quasi-territorial tax system is a federal income tax on the deemed repatriation of offshore earnings held by foreign corporations. Once this transition is complete, domestic Subchapter C corporations will be subject to a participation exemption system, which ultimately allows them to exempt foreign profits from domestic tax.

Participation exemption system allows 100 percent DRD for certain foreign dividends

The Tax Cuts and Jobs Act (TCJA) included new IRC Section 245A, Deduction for Foreign Source-Portion of Dividends Received by Domestic Corporations from Specified 10 Percent-Owned Foreign Corporations.

In general, a domestic corporate taxpayer is permitted to take a 100 percent dividends received deduction (DRD) for foreign-source dividends received from a specified 10 percent-owned foreign corporation (SFC) after December 31, 2017. This 100 percent DRD has the effect of eliminating foreign dividends from federal corporate income taxation.

IRC Section 245A contains many exceptions and qualifications:

- The 100 percent DRD is only available to domestic C corporations and not to Subchapter S corporations. Moreover, the 100 percent DRD is not available to domestic C corporations that are regulated investment companies or real estate investment trusts.

- Domestic C corporations must own 10 percent or more of the vote or value in an SFC’s stock for a period of at least 366 days during the 731-day period surrounding the ex-dividend date (i.e., the day on which all shares bought and sold no longer come attached with the right to receive the most recently declared dividend).

- The SFC cannot be a passive foreign investment company (PFIC) as defined under IRC Section 1297.

- The foreign-source portion of an SFC’s dividend is expressed in this formula:

Total dividends X (SFC’s foreign undistributed earnings / SFC’s total undistributed earnings) - An SFC’s foreign undistributed earnings equal total earnings and profits (as determined under IRC Sections 964 and 986) less the sum of:

- Income that is effectively connected with the conduct of a U.S. trade or business, and

- Dividends from U.S. C corporations in which the foreign corporation owns 80 percent of the stock by vote and value

- Foreign taxes, including withholding taxes, paid with respect to a foreign-source dividend for which a 100 percent DRD is allowed cannot be taken as a foreign tax credit or deduction by the domestic C corporate shareholder.

- The 100 percent DRD does not apply to a domestic C corporation’s Subpart F income inclusions, even if the controlled foreign corporation distributes an amount equal to the inclusion within the same tax year.

- The 100 percent DRD is not available for dividends received by a domestic C corporation that fall within the definition of a “hybrid dividend.” Simply stated, a hybrid dividend is a dividend paid by a controlled foreign corporation for which it receives a tax deduction or benefit in a foreign country.

- A domestic C corporation is required to reduce the tax basis in its SFC stock by an amount equal to the 100 percent DRD. This rule is only applicable for purposes of determining whether the domestic C corporate shareholder has a loss on the sale or disposition of its SFC stock. The purpose of this rule is to prevent duplicative tax benefits: the first in the form of the 100 percent DRD and the second in the form of a loss on the sale of stock. Theoretically, the distribution for which the 100 percent DRD is being taken reduces the value of the SFC stock, thereby causing or contributing to a loss on the subsequent stock sale.

- Special types of dividends that are eligible for the 100 percent DRD include:

- Section 1248 dividends

- Gains on the sale of lower-tier controlled foreign corporations treated as dividends under IRC Section 964(e)

- DRD-eligible dividends indirectly received through a partnership

Section 245A explicitly grants the U.S. Treasury Secretary the authority to prescribe regulations to carry out the provisions of this section. To date, no such regulations have been issued.

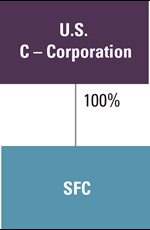

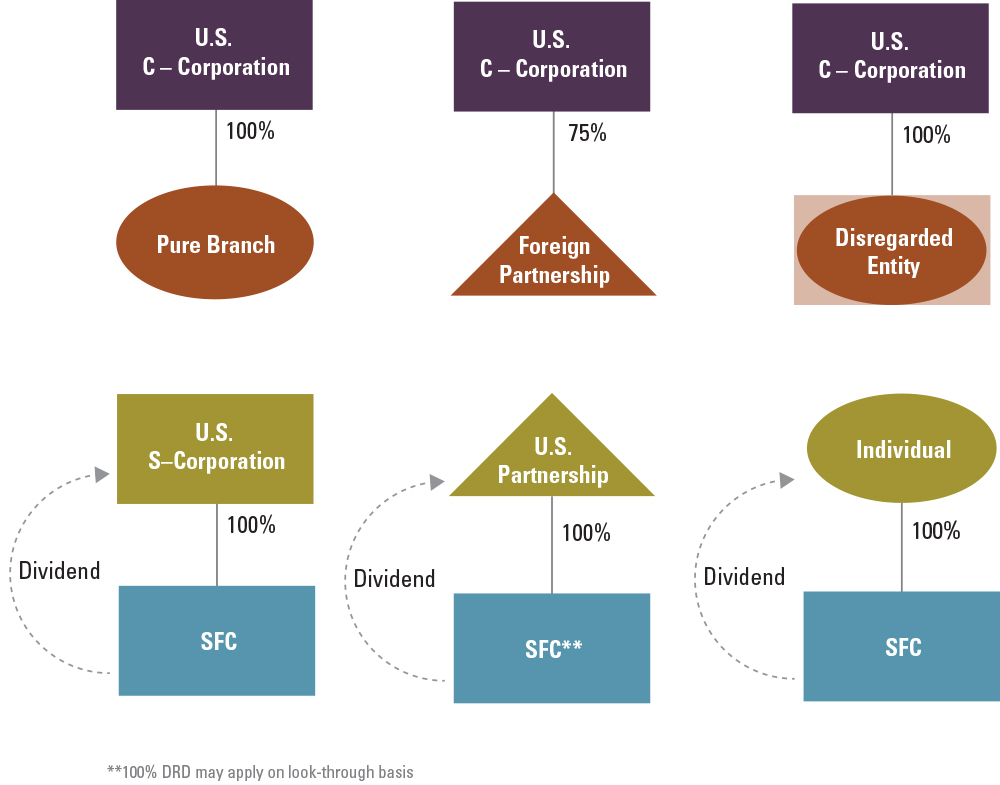

These illustrations may help simplify the exceptions and qualifications.

Situations where the 100 percent DRD may apply

Situations where the 100 percent DRD does not apply

Other considerations related to the 100 percent DRD

If your corporation is seeking to make offshore investments through foreign corporations, you should carefully review whether the 100 percent DRD is available to exclude earnings repatriated to the United States from federal income taxation.

You must be a domestic C corporation and own at least 10 percent vote or value of the stock in the SFC paying the dividend in order to qualify for the 100 percent DRD. Be sure to review whether your SFCs generate Subpart F income or hybrid dividends, as this type of income is not eligible for the 100 percent DRD.

Noncorporate entities or individuals investing in SFCs from nontreaty countries should consider making such investments through a U.S. C corporation. Dividends paid by a U.S. C corporation to individual shareholders would be taxed at the lower qualified dividends tax rate. The qualified dividend tax rate does not apply to dividends received by individual shareholders directly from SFCs located in nontreaty countries.

How we can help

CLA’s global tax professionals can help you interpret and apply the new law’s provisions into your corporation’s tax plan. We can work with you to take advantage of the tax reform legislation’s many benefits and comply with its requirements.