Investors may qualify for tax deferral benefits on existing capital gains and capital gain exemption on Opportunity Zone funds held for 10 years or more.

From the perspective of certain investors, one of the most significant pieces of the Tax Cuts and Jobs Act could be the creation of Qualified Opportunity Zones (QOZ).

Dig into the key benefits through these four brief videos.

Investors sitting on unrealized capital gains can benefit from generous tax savings when they invest those gains in projects in a state-identified QOZ. Several options are available, each offering multiple tax deferral benefits on existing capital gains and the potential for capital gain exemption on investments held for 10 years or more.

The goal: revitalization of economically distressed areas

The goal of the Opportunity Zone program is to revitalize specific areas in each state by incenting long-term investments into projects there. The two primary areas being targeted are distressed inner-city communities and specific rural areas. Each governor was asked to identify up to 25 percent of the state’s low-income census tracts and then submit choices for certification by the U.S. Department of Treasury (DOT).

The final list of designated census tracts was released by the DOT in June 2018. It is believed that the legislation will help revitalize these areas through investments in housing and other economic development.

Tax benefits for Qualified Opportunity Zone fund investors

The basic rules for the Opportunity Zone program (IRC Section 1400Z-1 and 1400Z-2) provide that an investor who has a capital gain in real estate, stocks, bonds, a closely held business, and most other assets, can sell those assets and temporarily defer their tax liability for up to 10 years by investing into a Qualified Opportunity Zone fund (QOF).

Under IRC Section 1400Z-2, capital gains can be deferred if they result from an actual or deemed sale or exchange of assets, and if the gain would be recognized no later than December 31, 2026. The gain must not arise from a sale or exchange from a related person.

The investment in a QOF must take place within 180 days from the date capital gains are realized (although watch the timing of the 180-day deferral rules). There is no limit on the amount of gain eligible for this deferral.

The investor’s initial basis in the gain invested in the QOF is zero. If the QOF investment is held for five years, the investor can take a 10 percent step-up in basis. An additional 5 percent step-up in basis is granted to deferred gain on the earlier of the date the investor sells or exchanges the QOF investment or December 31, 2026.

If the QOF investment is held 10 years, the investor’s basis in the investment equals its fair market value on the date the investment is sold or exchanged. Consequently, the investor’s gain on the sale of its QOF investment in excess of the investor’s original basis is permanently excluded.

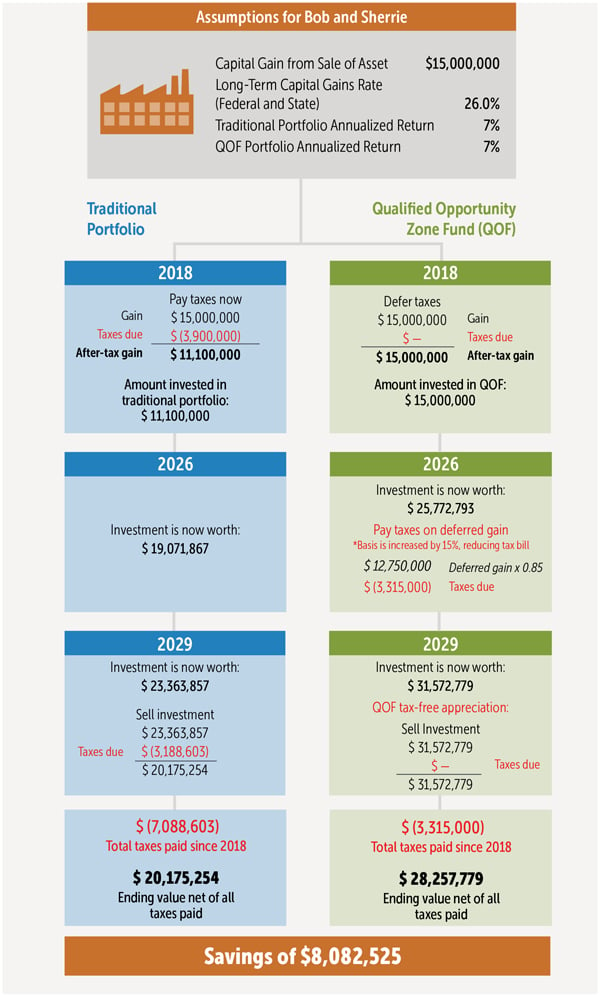

An example of how a Qualified Opportunity Zone investment works

Meet Bob and Sherrie. They have owned a manufacturing company for the past 20 years, and recently sold the business for $20 million dollars.

Their basis in the business is $5 million, resulting in a capital gain of $15 million. They can defer 100 percent of their tax liability on the $15 million gain by rolling it into a QOF within 180 days of the closing of the sale.

They will eventually have to pay tax on the $15 million gain. However, if they hold the QOF investment until December 31, 2026, they will receive a step-up in basis of 15 percent and pay tax on just 85 percent of the $15 million.

Assuming that the new QOF investment grows at a 7 percent compounded annual rate, it would double in value over a 10-year period. If the investment is held for 10 years, Bob and Sherrie can sell it and pay no tax on the gain. In other words, Bob and Sherrie’s $15 million investment would have grown to $30 million under this scenario.

The couple would also receive favorable treatment on the income received during that 10-year investment. A new depreciation schedule would be applied to the new property, sheltering much of the income for the first five to 10 years with no impact on the basis of the real estate owned.

A St. Paul, Minnesota, Opportunity Zone project includes a Courtyard by Marriott Hotel, restaurant and 130-unit apartment project next to the Excel Energy Center.

Three primary types of Qualified Opportunity Zone fund

Qualified Opportunity Zone funds are defined in the Internal Revenue Code as any investment vehicle organized as a corporation or partnership that is designed to benefit from a certified QOZ project. At least 90 percent of its assets must be in QOZ property.

At this time there is no formal approval process for an entity to become a QOF; instead, an eligible taxpayer self-certifies by attaching Form 8996 to federal income tax returns.

Investors can choose a specific project or a diversified fund. Various structures allow investors to do either depending on what they are attempting to accomplish, their resources and expertise, and their investment timeframe.

Pros and Cons of Opportunity Zone Fund Investment Vehicles

| Investment Vehicle | Description | Pros | Cons |

|---|---|---|---|

| Direct Project Investment |

|

|

|

| Single Purpose Entity (SPE) |

|

|

|

| Closed-End Qualified Opportunity Zone Fund |

|

|

|

Additional details about Opportunity Zone investing

- All capital gains, both short and long term, will be eligible for QOF investment.

- Proceeds from a partnership or a percentage stake can be re-invested in a limited liability corporation and still qualify for QOF investment upon the sale of the interest in that partnership.

- Investors do not need to place 100 percent of the proceeds of an asset sale into the QOF investment to qualify. Only the capital gain portion of the asset sale, or any fractional portion of the sale, can be invested. For example: an asset is sold for $10 million with a basis of $2 million. The $8 million gain would be eligible to receive the tax benefits of a QOF investment.

- Most QOFs will have minimum investment amounts of $100,000 to $1 million, but there is no maximum.

- Cash placed in a QOF will not receive the tax-free gain status if held for 10 years. Invested funds must come from a capital gain from the sale of an asset to receive the tax deferral and tax benefits of the QOZ investment.

- A taxpayer uses Form 8949 to makes an election to defer capital gains in a QOF investment.

- An investor may make a QOF investment as late as June 2027 and still get a 10-year step-up in basis treatment.

- Investors who have realized capital gains as early as January 2018 may still qualify for QOZ investment if it was a pass-through entity (i.e., LLC, LLP, S corporation).

- The deadline to invest 2018 capital gains into an Opportunity Zone was June 28, 2019.

How we can help

QOZ investments join CLA’s growing array of alternative investments that can diversify your portfolio and (potentially) bring higher returns. Our business and individual tax planning professionals and wealth advisors are immersed in the real estate field, the investment market, tax reform, and the industries where our clients do businesses. Once we understand your goals, we can help you make a difference in your community. Whatever road leads you to Opportunity Zones, CLA is right there with you.

Watch our webinar about taking advantage of the Opportunity Zone tax incentives.