Performance of the Bascom I private investment fund far exceeded expectations, giving CLA clients greater confidence that they can achieve their financial goals.

June, 12, 2017 — CliftonLarsonAllen Wealth Advisors, LLC (CLA Wealth Advisors), is pleased to announce that Bascom Value Added Apartment Investors, LLC (Bascom I), a real estate private investment fund, has sold its last property and closed out the fund. Bascom I, the first real estate private investment recommended by CLA Wealth Advisors, has delivered a 25 percent average annualized return in 5.5 years (individual investor returns will vary). For every dollar invested, Bascom I investors received $2.41 in return.

Download White Paper: Private Investments: Potential Rewards for Individuals and Institutions

CLA Wealth Advisors invested $30.82 million of client assets into Bascom I and is expected to receive $74.00 million in aggregate return over the life of the fund, once all funds are distributed.

“We are pleased with the outstanding performance of Bascom I,” says Tony Hallada, managing principal, CLA Wealth Advisors. “In researching private fund investment opportunities to recommend for our clients, we look for places in the current market that show opportunities, then seek out firms working in those spaces that have a strong track record and a risk and return philosophy that matches our own. We were bullish on the residential apartment market when we recommended Bascom I to our clients in 2012. Those who agreed with our outlook and invested are achieving returns above our original expectations. The success of the investment provides many of our clients with greater confidence that they can achieve their goals within their financial and estate plans.”

Bascom I was formed by The Bascom Group, LLC, in 2011 with the intention of raising $50 million in commited capital to acquire a diversified portfolio of Class B and Class C apartments in target markets in California, the Rocky Mountains, and the Southwest, Pacific Northwest, and Southeast regions of the United States. The fund, which is structured as a limited partnership, was created to capitalize on the then-demand for affordable housing while buying apartments at attractive prices after the Great Recession.

Six properties were purchased in 2012 and 2013 in Salt Lake City, Utah; Denver, Colorado; Flagstaff, Arizona; Fullerton, California; Avondale, Arizona; and Garden Grove, California. The last of the properties was sold in March 2017.

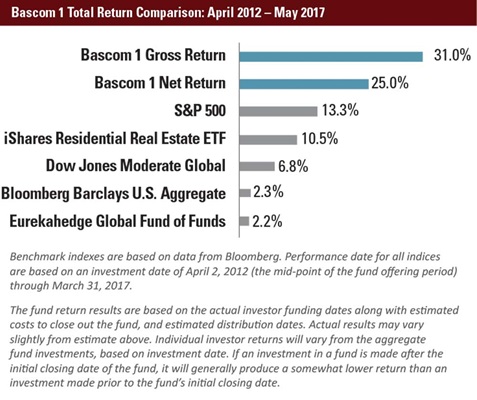

The 25 percent actual annualized return is nearly double the performance of the S&P 500 (13.3 percent) over the same five-year period. The fund had targeted a 14 to 16 percent return at its inception in 2012.

Committed to private investments

CLA Wealth Advisors is committed to expanding its private investment options to individual and institutional investment clients. In addition to Bascom, the firm’s private investment platform includes the following funds, which are no longer open for new investments.

- Altus Realty Income Fund ― Office and industrial properties

- Arden Real Estate Partners ― Hotels and offices

- Liberty Hospitality Fund ― Limited service hotels

Risks of private investing

This announcement is neither an offer to sell nor a solicitation of an offer to buy any securities, nor does it constitute the rendering of any investment advice to the reader. Private fund investments are offered only through an offering memorandum, which explains fully all of the implications and risks of the offering of securities to which it relates. Private investments involve a high degree of risk, including, but not limited to, a lack of liquidity and the potential loss of investment principal. There is no guarantee that the stated objectives of any private investment fund will be met. Private investment fund offerings are not filed with or reviewed by any securities regulatory agency. Past performance is no assurance of future results. Private fund investing is for sophisticated investors who meet certain asset or income levels, which vary by private fund, and who can afford the complete loss of their investment.

About CLA

CLA exists to create opportunities for our clients, our people, and our communities through industry-focused wealth advisory, digital, audit, tax, consulting, and outsourcing services. With nearly 9,000 people, more than 130 U.S. locations, and a global vision, we promise to know you and help you. CLA (CliftonLarsonAllen LLP) is an independent network member of CLA Global. See CLAglobal.com/disclaimer. Investment advisory services are offered through CliftonLarsonAllen Wealth Advisors, LLC, an SEC-registered investment advisor.