Paycheck Protection Program rules are complex and continue to change. The first wave of the PPP loan forgiveness process is underway. Properly working through the forgiveness application and guidance may be the most important step for borrowers.

CLA (CliftonLarsonAllen LLP) announced today that it has new solutions to help borrowers tackle Paycheck Protection Program loan forgiveness.

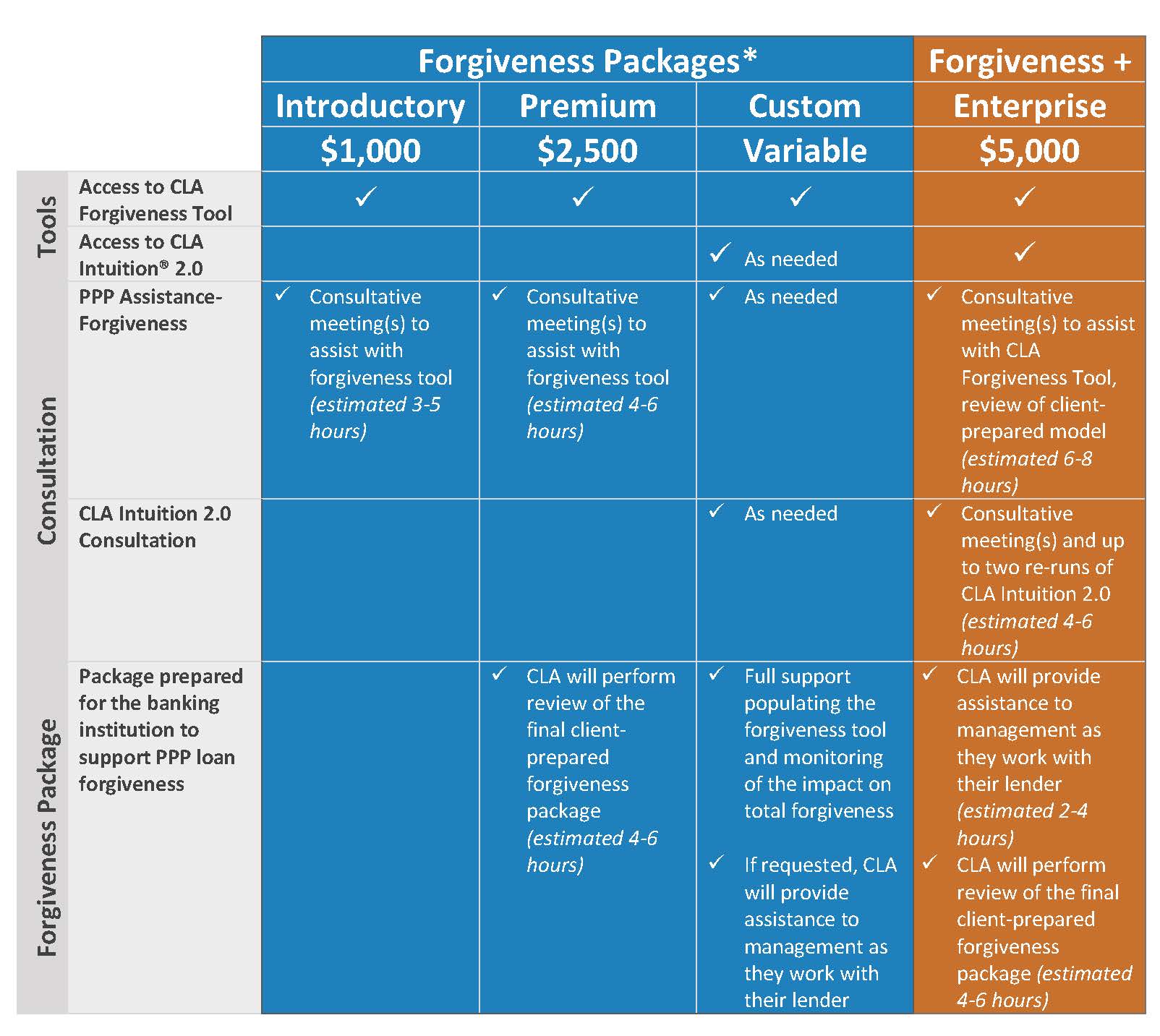

PPP guidance is released frequently and the related calculations are complex. CLA is offering forgiveness packages to guide borrowers and lenders through the process effectively and efficiently. The forgiveness packages involve innovative tools and virtual consultations with experienced professionals from across the nation to reduce the stress of the process.

“The forgiveness application and related support package is the most important step in the PPP process,” said Elly Barrineau, managing principal of CLA’s specialized advisory services practice. “We’re here to help, whether it’s a short consultation with an experienced professional to get you started, or with full support throughout the process. Best of all, our virtual meetings mean you can work with us from the comfort of your home.”

CLA has detailed knowledge of the entire program, from the PPP loan application and documentation to providing guidance borrowers need to navigate the benefits and understand the risk landscape.

Innovative tools

The CLA Forgiveness ToolSM guides borrowers through the detailed PPP loan forgiveness calculations and supporting documentation that goes with the forgiveness application. During online meetings, CLA professionals help borrowers understand what portions are mandatory versus elective.

Some packages include access to CLA Intuition® 2.0, a scenario-modeling tool that allows users to plan ahead and respond effectively to changes during challenging times. In addition to bringing financial clarity, the interactive modeling dashboards show the financial impact of decisions under various scenarios.

Complete support

“The real power comes in consulting with knowledgable professionals who have a dedicated focus on the PPP,” said Barrineau. “No tool alone can bring enough clarity around the PPP rules and process. The CLA team picks up where a tool leaves off.”

Experienced professionals can help borrowers plan an organized approach to completing Form 3508 and assembling the necessary supporting records. The CLA team can also help borrowers evaluate the most advantageous approach to counting FTEs between the standard and simplified methods.

CLA’s forgiveness packages were designed to match the support borrowers need with a level that brings the most value.

[Click image to enlarge]

CLA offers financial tools to help lenders and borrowers navigate PPP loan forgiveness. CLA professionals also share updates and insight as part of their COVID-19 Resource Center and on their livestream series.

To learn more, visit claconnect.com.

About CLA

CLA exists to create opportunities for our clients, our people, and our communities through industry-focused wealth advisory, digital, audit, tax, consulting, and outsourcing services. With nearly 9,000 people, more than 130 U.S. locations, and a global vision, we promise to know you and help you. CLA (CliftonLarsonAllen LLP) is an independent network member of CLA Global. See CLAglobal.com/disclaimer. Investment advisory services are offered through CliftonLarsonAllen Wealth Advisors, LLC, an SEC-registered investment advisor.