In this issue of Market and Economic Outlook: Market volatility is expected to continue as interest rates inch higher, corporate profits shrink, and manufacturers ma...

Making predictions about capital markets is much like going to Vegas; it may be fun, but it’s a gamble. There’s nothing reliable about any market predictions, particularly in the short run. Why? Because investor psychology and momentum tend to factor heavily into the markets over short periods, whereas economic activity tends to drive financial asset pricing over the longer term. Not surprisingly, we have more confidence in our long-run forecasts than in any view we may express for periods shorter than a few years. In other words, we have a pretty good understanding of the market’s potential over the next 10 years, but we wouldn’t venture to predict what path we’ll take to get there from here.

With this understanding, in this issue of Market and Economic Outlook, we offer support of our long-range view that the sun may not be shining brightly today, but the storm clouds aren’t gathering, either. As evidence, we offer the following:

| Positives | Negatives |

|---|---|

|

|

First quarter sees high volatility in capital markets

As noted in previous issues of Market and Economic Outlook, we believe that the post-financial crisis period of relative calm in U.S. markets appears to be ending. The first quarter of 2016 reinforces that view. In the U.S., stocks fell sharply in January before rallying in mid-February. Indeed, in January the bellwether S&P 500 shed more than 5 percent and the technology-heavy NASDAQ lost nearly 8 percent (Morningstar). Not surprisingly, volatility, as measured by the VIX (Chicago Board Options Exchange Volatility Index), spiked at the same time.

One striking statistic that underscores this uncertainty is the occurrence of “1 percent days” — single trading days in which the market rises or falls 1 percent or more. Bloomberg reports that through the first 48 trading days of the year, 26 were 1 percent days, the highest rate since 1938. Nevertheless, as of the end of March, the markets and volatility have largely settled down to more benign levels, lending evidence to the idea that markets are very hard to predict short term.

What accounts for such a turbulent start to the year? As is always the case, there are innumerable factors and cross currents affecting the U.S. and world capital markets. Let’s look at several key themes that we are following closely and believe are materially impacting global markets.

Stormy forecast for corporate profits

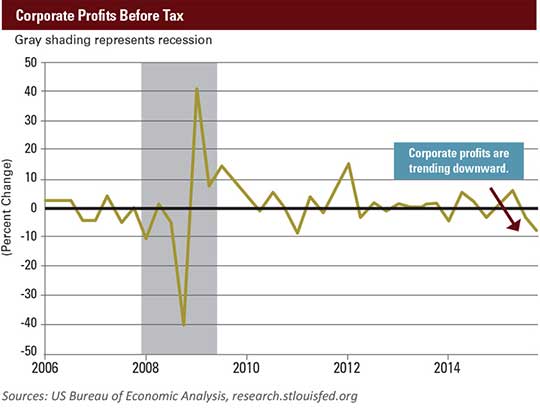

A worsening outlook for corporate profits (after record high levels) is something we have been writing about for some time. A March 25 report from the Bureau of Economic Analysis adds to our concern. It detailed an alarming 11.5 percent dive in the year-over-year growth rate of corporate earnings for the fourth quarter of 2015.

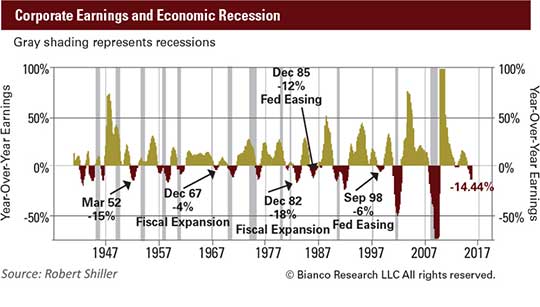

Earnings have now declined in four of the last five quarters. This is troubling because there is a high correlation between falling earnings and economic recessions. In fact, there have been 12 U.S. recessions since 1940 and earnings turned negative during (or just after) all 12. This phenomenon is detailed in the chart below. Gray-shaded periods indicate recessions and the negative earnings are graphed below the 0 percent line.

Note, however, that there are several instances where earnings turned negative without precipitating recession. Why? It is not widely recognized, but recessions occur most often as a normal byproduct of an interest-rate-raising cycle engineered by the Federal Reserve in an effort to tame inflationary pressures. Higher interest rates and slowing credit expansion naturally lead to a slow-down in employment, inducing recession. Conversely, recessions do not tend to occur when the Fed applies very loose monetary policy. In this instance, the decline in earnings growth is more a reflection that the U.S. has experienced nearly seven years of steady earnings expansion, though admittedly, the expansion has been less than desired.

Earnings are still strong, but they may have topped out. Nevertheless, a decline in earnings does not reflect a slowing in the U.S. economy as it illustrates the challenges to further growth. While a modest decline in earnings does not guarantee a recession, we are concerned about the ability of corporations to maintain top-line revenues and grow profits in the current environment.

Interest rates: Is ZIRP merely a stop on the road to NIRP?

Perhaps, like us, you are bemused (and sometimes annoyed) by the ever-expanding list of financial acronyms created by media and Wall Street (e.g., FANG, BRIC, and others). One such acronym is ZIRP (zero interest-rate policy). Here in the United States we have been in ZIRP since 2008, when the Federal Reserve, in response to the financial crisis, effectively made short-term interest rates 0 percent. ZIRP has been a boon for borrowers and the bane of savers. Borrowers have benefitted from ZIRP by getting loans with shockingly low interest rates (from a historical perspective). Savers, however, have been punished under ZIRP by receiving essentially nada on their bank savings accounts and short-term CDs.

The utterly counterintuitive concept that confronts us now is that zero is not the floor for interest rate policy. That fact gives us another new acronym: NIRP, or negative interest-rate policy. No fewer than five central banks currently are engaged in NIRP (Denmark, the European Central Bank, Japan, Sweden, and Switzerland), which creates a surreal situation in which correspondent banks pay interest to the central bank on unlent reserves. What is the central banks’ goal with NIRP? The punitive negative interest rate creates an incentive for banks to freely lend money out to individuals and businesses rather than holding it. This lending would then spur consumer spending and capital investment by business. At least, that’s the theory. NIRP is another example of the extraordinary and unprecedented maneuvers undertaken by central bankers around the world.

Some economists and market watchers speculate that the U.S. may someday face NIRP. We believe that is unlikely. However, we are also skeptical that the Fed will be able to normalize rates as quickly as they desire. While the U.S. is in far better shape economically than the rest of the world, growth is still anemic and inflation remains below targets. Central banks raise rates when they are worried about inflation, not when they’re still worried about deflation. We shall see.

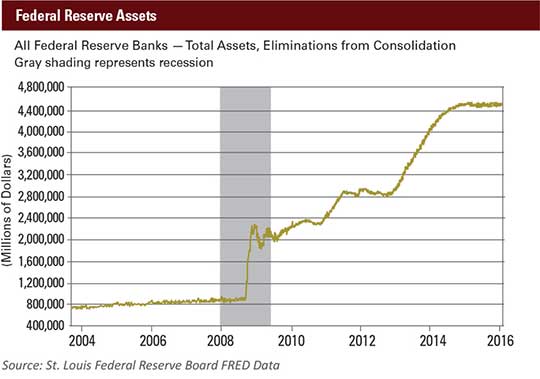

Regardless, the Federal Reserve has already engaged in extraordinary interventions of its own. One example is the Fed printing money to purchase assets (a.k.a., quantitative easing). The theory behind this action is that the asset purchases will support prices, which creates so-called “wealth effects” that increase investor confidence and generate robust economic activity.

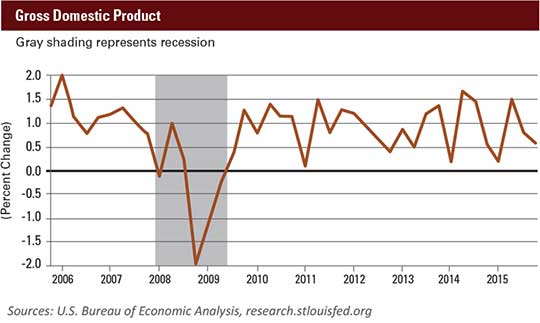

Although there is evidence that this program has helped support stock and bond prices, there is scant evidence that the “wealth effects” have translated to Main Street economic activities. See the chart below. The line represents the balance sheet of the Federal Reserve, and the gray shading represents the Great Recession. Due primarily to quantitative easing, we see how the central bank’s balance sheet has ballooned to nearly $4.5 trillion. Despite this astonishing amount of stimulus we must also consider the gross domestic product (GDP), which has not grown significantly, or at least as much as one would hope after receiving the “kitchen sink” treatment from monetary policy authorities.

It is fair to reiterate that the U.S. economy is in far better shape than Europe. The United States was also far more aggressive in applying extraordinary policy early into the Great Recession of 2008. While growth may not be as robust as desired, it is reasonable to conclude that the Fed has been far more successful in its growth mandate than other central banks.

We will only know the ultimate success of policies like ZIRP, NIRP, and quantitative easing in hindsight. It may be fair to say, though, that the remaining uncertainty created from the financial crisis and resulting extraordinary policies have contributed to the volatility of global capital markets, and will likely continue to do so.

It’s not all gloomy … the overall U.S. economy remains strong and resilient

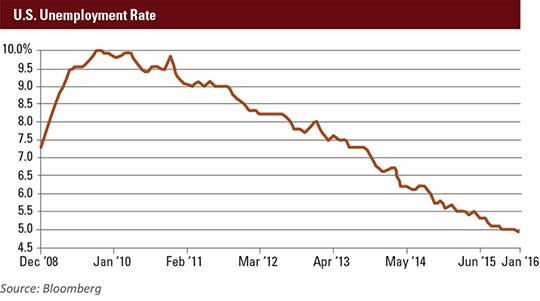

In pondering some of the concerns and volatility in markets, we want to reiterate the fact that there are plenty of data supporting a positive outlook for the U.S. economy and markets. One such data point is the strength of the U.S. jobs market. The unemployment figure, coming in at just 4.9 percent in February, continues to show improvement and is nearing what analysts deem full employment.

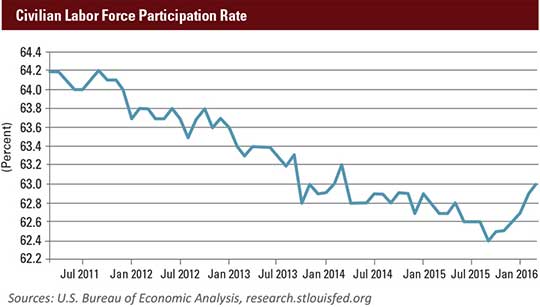

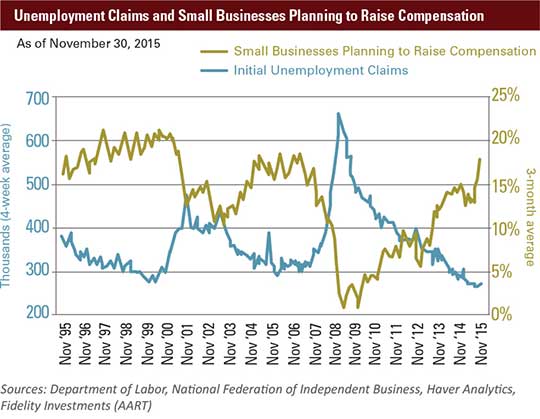

One related point — wage growth — is at long last showing some signs of improvement. According to data detailed in the graph below, an increasing number of small businesses are planning to raise compensation in response to the tight labor market. We find another bright spot in the labor force participation rate, which has increased for four consecutive months. This is a positive for wage earners and should, in turn, be a positive for consumer confidence and spending.

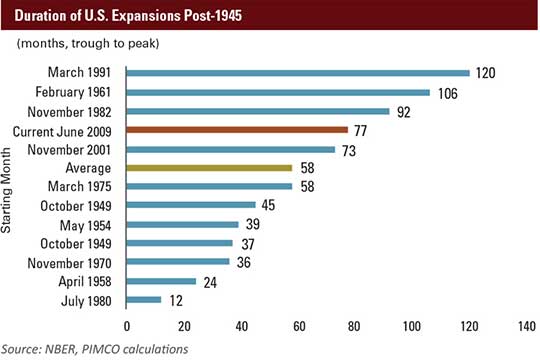

In the financial services business perhaps the only thing we like more than an acronym is a good adage. One of our favorites is: “Economic expansions (and bull markets) do not die of old age.” As shown in the following chart, although it may feel like a downturn is “overdue” as the economy has been growing uninterrupted for a long time, our current expansion is within a “normal” historical range and, in fact, could run much longer. Expansion and bull markets tend to last longer and go higher than many feel is possible.

Revenue and profit growth anticipated despite manufacturing slowdown

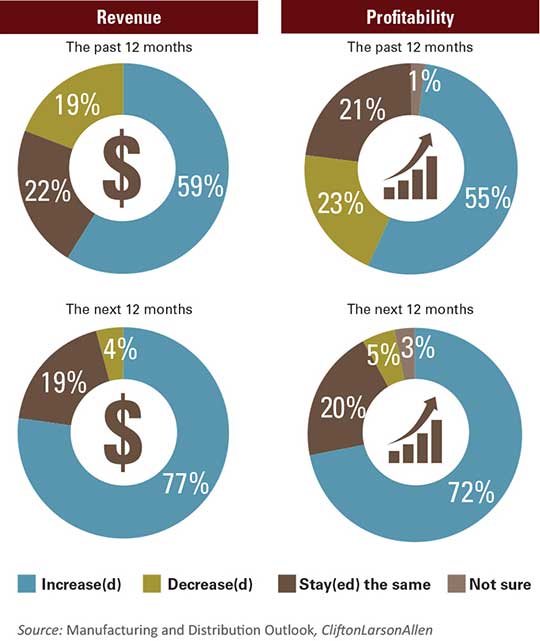

CLA’s recently released fifth annual Manufacturing and Distribution Outlook report indicates that, while manufacturing overall has been somewhat sluggish during the last quarter of 2015, leaders and owners in the industry remain optimistic about the year ahead.

“Manufacturers are cautiously optimistic,” says Samantha Metcalf, principal in manufacturing and distribution for CLA. She says activity, as measured by the Manufacturing ISM Report on Business, has been contracting since October 2015 and has continued through February 2016. The report for March shows the index reading above 50, which indicates a slight expansion and the highest level since June 2015. The downturn didn’t seem to deter participants in the CLA survey from remaining positive. Metcalf says survey respondents report that they are managing profitability and anticipating revenue growth.

Of the 600 CLA survey respondents, 77 percent said they believe their revenue will increase in the next 12 months, and 72 percent expect profitability to rise in the same period. In the previous year’s survey, 79 percent of respondents said they anticipated an increase in revenue, so the optimism is somewhat tempered. This year just 55 percent reported an increase in revenue. Twenty-two percent said their revenue stayed the same, and 19 percent reported lower revenue.

Metcalf points to factors weighing on manufacturing and distribution performance, which include slowing in key markets such as energy and agriculture; U.S. manufactured exports decreasing due to a strong U.S. dollar and other global economic challenges; still-cautious consumers; and the ongoing skilled workforce shortage.

Samantha Metcalf

Principal,

Manufacturing and Distribution

“There are many things impacting manufacturers. However, the owners we talk to tell us that while they are following marketplace trends, they are focusing on staying flexible and making good business decisions,” she says. “Many of them are having a successful year because they are managing the things they can control, such as working capital levels, capital spending, and labor costs.”

The survey revealed another important issue: A projected surge in leadership and ownership changes. Metcalf says 40 percent of survey respondents anticipate a leadership change, and one-third of those also anticipate an ownership transition. Such fundamental shifts can have a significant impact on business and should not be left to chance.

“A lot of companies are saying they are hoping the successors will be family members, but what we are really stressing to our clients is the need to understand the options and remain flexible,” concludes Metcalf. “For many business owners, the desired outcome will not be the actual outcome unless they proactively and thoughtfully take steps to position themselves and their business for the desired transition.”

Diversification and a reminder: U.S. stocks are not the only game in town

Many investors tend to fixate on the returns of U.S. large company stock indices, such as the Dow Jones Industrial Average or the S&P 500. This is perhaps a natural outcome of the media’s tendency to focus chiefly on these indices and the fact that the constituent companies of large cap indices are big brands and household names. You could say this is a benign phenomenon except that it fosters the misconception that just one slice of the global stock universe, such as the 30 stocks in the Dow, represents “the market” and is, therefore, a valid benchmark for a diversified investment portfolio. It is not.

This has proven especially problematic over the last several years as a globally diversified equity portfolio — i.e., one exposed to both large and small companies, plus developed international and emerging market stocks — has lagged the performance of the S&P 500.

| Calendar Year Total Return Percent | |||

|---|---|---|---|

| 2015 | 2014 | ||

| Diversified Equity Portfolio | 100% Equity Blend¹ | -1.2 | 6.4 |

| S&P 500 Index | U.S. Large Cap Index | 1.4 | 13.7 |

| MSCI EAFE | International Developed Markets Index | -0.8 | -4.9 |

| MSCI EM | Emerging Markets Index | -14.9 | -2.2 |

| Russell 2000 | U.S. Small Cap Index | -4.4 | 4.9 |

When experiencing returns such as these, it is wise to recall the granddaddy of all investment axioms: Past performance is not a guarantee of future results. This would also have been helpful to recall at the end of 2009. At that point, going back a full ten years, the returns of U.S. large cap stocks were negative, while other equity asset classes produced positive returns. The investor who abandoned a prudent diversification policy by bailing on U.S. stocks after 2009 — based on past performance —did themselves no favors.

| Return for Period of January 2000 – December 2009 | Total Return % (Cumulative) | |

|---|---|---|

| Diversified Equity Portfolio | 100% Equity Blend¹ | 18.5 |

| S&P 500 Index | U.S. Large Cap Index | -9.1 |

| MSCI EAFE | International Developed Markets Index | 20 |

| MSCI EM | Emerging Markets Index | 159.9 |

| Russell 2000 | U.S. Small Cap Index | 40.9 |

Source: Morningstar

¹Hypothetical 100 percent equity blend consists of 53 percent S&P 500, 26 percent MSCI EAFE, 8 percent MSCI EM, 13 percent Russell 2000

It is not possible to invest directly in an index. Neither index nor portfolio returns reflect any expenses that may be associated with the management of an actual portfolio. Past performance does not guarantee future results.

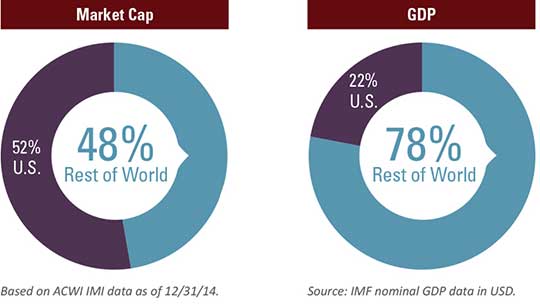

The support for diversifying internationally can be found in global market capitalization and economic growth data.

It is interesting to note the U.S. stock market’s value represents 52 percent of the world’s total capitalization (shares multiplied by price). However, in terms of economic output (gross domestic product), the United States is under one quarter of the world’s total. The continued rapid growth and superior demographics of emerging markets (e.g., China, Brazil, and India) will mean that our share of the worldwide total will shrink over time.

As we have written before, current valuation metrics clearly favor international and emerging markets over U.S. stocks. In addition, investors benefit greatly from improved diversification by owning small company and non-U.S. stocks. Investors who don’t properly diversify outside of the United States are missing a large universe of opportunity. Worse, they may be facing concentration risks going forward.

In terms of our outlook for the rest of 2016, it seems likely that we will see a continuation of the heightened market volatility we experienced during the first quarter. The concerns around a Chinese slowdown, U.S. corporate earnings, and the reaction of global markets to central bank policy shifts may make for a turbulent year.