Many investors like the positive returns of 2016; most could do without some of the volatility. And of course, no crystal ball can see what 2017 will bring.

As the corks popped on New Year’s Eve, investment-minded revelers may have raised a toast to the returns of 2016. Nearly all major investment categories finished in positive territory for the calendar year; a 60/40 diversified portfolio provided a pleasing 7 percent gain. There were points during the year when such a positive outcome seemed unlikely. In fact, January gave us one of the worst starts ever for U.S. stocks, and globally (MSCI All Country World Index), stocks were down 13 percent. Happily, those losses were recouped by the end of the first quarter.

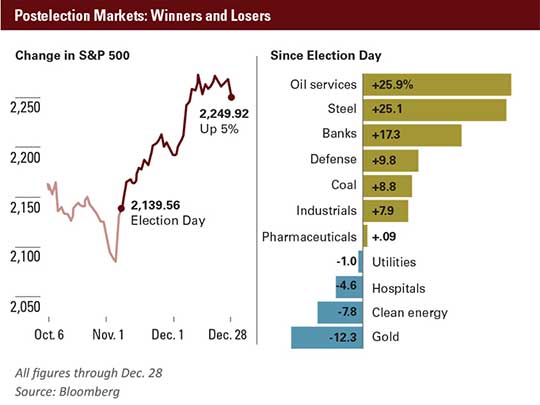

Summer 2016 brought a significant political surprise emanating from the U.K. — Brexit. Britain’s vote to leave the European Union briefly sent shock waves through world markets before calm returned and markets recovered. The pollsters and so-called experts were dead wrong on the Brexit referendum. Similarly, the election of Donald Trump as U.S. president was something that polling and prognosticators did not see coming. After a steep sell-off in the hours immediately following the election, stocks quickly recovered and have mostly soared since.

In a nutshell, 2016 was a year that featured some fear-inducing volatility and unpredictable events that temporarily created panic. Patient investors, however, were rewarded for maintaining a disciplined, long-term focus.

| Positives | Negatives |

|---|---|

| Employment is strong | Future expected returns are below historical averages; U.S. stocks, specifically, are no longer cheap |

| Housing prices continue to firm | Brexit-related uncertainty over U.K. and Eurozone economies and markets |

| Auto sales remain strong | Geopolitical concerns; specifically, terrorism |

| Energy costs, gasoline, natural gas prices low | Fear of slowing Chinese economy and impact on global economy |

| Low financing costs | |

| Improved forecast for corporate earnings |

Fourth Quarter and Year-to-Date Index Returns (%)

| Index Name | Capital Markets Segment | 4Q 2016 | 2016 |

|---|---|---|---|

| Barclays U.S. Aggregate | U.S. Broad Market Bonds | -2.98 | 2.65 |

| S&P 500 | U.S. Large Cap | 3.82 | 11.96 |

| Russell 2000 | U.S. Small Cap | 8.83 | 21.31 |

| MSCI EAFE | Non-U.S. Developed Markets | -0.71 | 1.00 |

| MSCI EM | Emerging Markets | -4.16 | 11.19 |

| Hypothetical 60/40 Portfolio | Diversified Mix of Indexes | 0.33 | 7.10 |

Mixed results for U.S. and world bonds

The broad U.S. bond market finished in positive territory despite having a very rough fourth quarter. Other segments of the bond market experienced some significant volatility. World government bonds (as measured by the Citi WGBI non-U.S. dollar) fell more than 10 percent in the fourth quarter due to a strengthening U.S. dollar, but finished nearly flat for the year. Emerging market bonds finished up more than 10 percent (JPM EMBI Global index). Junk bonds, which got shellacked in 2015, in part due to the collapse in energy prices, posted strong gains in 2016. Their 17.5 percent gain for the year (BofA ML U.S. High Yield Master II Index) was the best return in non-investment grade bonds since 2009, when junk bonds snapped back fiercely in the wake of the financial crisis.

U.S. stocks reverse, internationals end flat

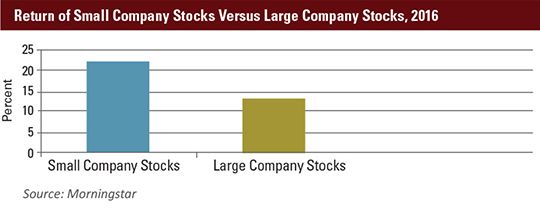

2016 was a year of trend reversal with regard to the returns of U.S. stocks as defined by size and relative price (value versus growth stocks). Small cap stocks (Russell 2000) outperformed large caps (S&P 500) by more than 9 percent, the largest small cap outperformance since 2010.

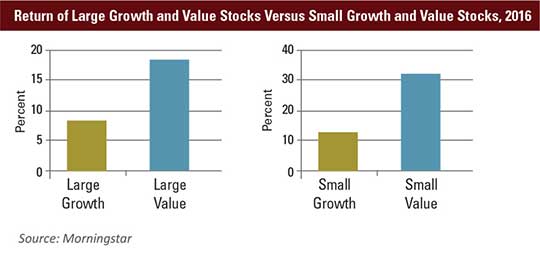

With regard to relative price, value stocks provided much higher returns than growth stocks (Russell indices), the first time that has occurred in several years. The divergence between small growth and small value was especially wide.

One reason for optimism in U.S. stocks is improving corporate earnings. In the April 2016 Market and Economic Outlook, we said that deteriorating earnings were problematic for the economy and the markets. This period of negative earnings growth appears to be ending, and that bodes well for investors.

International stocks were essentially flat for the fourth quarter, and the key developed stock markets index, MSCI EAFE, finished with a tepid 1 percent gain for 2016. Returns from Europe (without the U.K.) were 0.3 percent and Japan was up 2.7 percent in U.S. dollar terms (MSCI). Currency fluctuations affect how international investments perform, and the strengthening of the U.S. dollar versus the pound sterling had a dramatic effect in 2016. The MSCI United Kingdom stock index was up more than 19 percent in local currency, but finished flat for the year in U.S. dollar terms — the net result that matters to U.S. Investors.

Currency fluctuations helped generate better returns in some key emerging markets. Brazil was up 37 percent in local currency, but was up 67 percent in U.S. dollar terms. Russia, meanwhile, was up 35 percent in local currency, but the index in U.S. dollar terms was up 56 percent. Despite a loss in the fourth quarter, the diversified emerging markets index posted an 11 percent or greater gain for 2016.

Home country bias and diversification

We’ve extolled the benefits of diversification many times. We’ve also noted how maintaining diversification can be psychologically challenging at times. One such time is when U.S. large cap stocks are outperforming international stocks. Investors tend to fixate on our own market, usually the large cap Dow Jones Industrial Average or the S&P 500. The psychological difficulty can move some investors to mistakenly believe that:

- A single large cap domestic stock index is an appropriate benchmark for a diversified portfolio (it is not)

- Diversification “isn’t working” because the S&P is beating other investment categories and they should abandon or reduce their target international allocation (they should not)

U.S. stocks (as measured by the S&P 500) beat international last year by approximately 11 percent. This marks the fourth consecutive year and the sixth time in the last seven calendars years it has done so (See below). It’s worth looking back to 2002, though, and noting that international beat U.S. stocks seven out of the eight subsequent years. We cannot, nor can anyone, predict when this cycle of U.S. relative outperformance will end, but we can be sure that it will, and prudently diversified portfolios will benefit.

Interest rates impact bond markets

The fourth quarter was ugly for U.S. investment-grade bonds. With a 4 percent loss, November was the worst month since the 1990 inception of the Bloomberg Barclays U.S. Aggregate Total Return Index (Bloomberg). The Aggregate Bond Index, up strongly in the first half of the year, gave up most of those gains, finishing with a return of 2.65 percent. The yield on the bellwether 10-year Treasury note reached 2.5 percent in December, a steep increase from earlier in the year.

We wrote at some length on the Federal Reserve in the October 2016 Market and Economic Outlook. The Fed finally hiked interest rates by 0.25 percent on December 1. Although the December rate increase was expected and therefore “priced in,” the bond market had a pronounced reaction to the Fed’s forecast of three more rate hikes in 2017, which caused bond prices to drop across short-to-medium maturities.

Experiencing drawdowns — a price drop from a peak value — is never comfortable, and in our experience, seems especially alarming for bond investors. Part of this is psychological. Investors sometimes forget that bonds — although far less volatile than stocks — are not risk-free. Prices can and do drop on occasion. We may excuse investors for forgetting this, however, because returns from U.S. investment-grade bonds, for a variety of reasons, have been relentlessly positive in recent decades. There have been very few years in which bonds have lost money, and those losses have been low in magnitude. Going back 27 calendar years to 1990, bonds (as measured by the Aggregate Bond Index) have had only three years of negative returns, with the worst return being a mere -2.9 percent (1994). It’s no wonder, then, that the 4 percent drop in November left investors somewhat rattled.

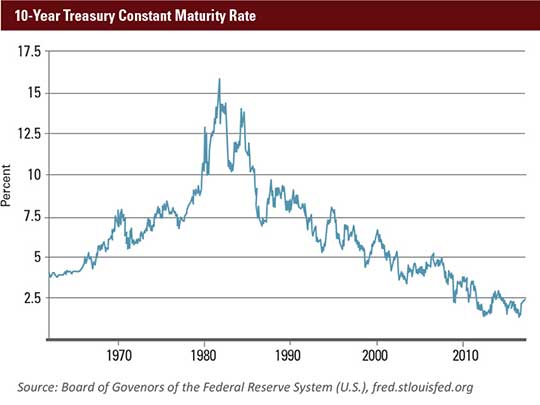

In the years to come, bond investors may want to prepare for more volatility, and less satisfying returns than those of previous decades. Bonds have benefitted from a long epoch of falling rates, dating back to the early 1980s. A quick reminder of a central tenant of fixed income investing: as interest rates fall, bond prices rise. The corollary, though, is that as interest rates rise, bond prices fall. Traditional fixed-income investments retain their value as a portfolio diversifier, but investors should not expect future returns to be nearly as high as they’ve been in recent decades.

Implications of the Trump presidency for investments

As we alluded to in a November 2016 Special Report, we are agnostic on politics as it relates to the capital markets. However, we do believe it’s necessary to analyze what the possible implications are of the Trump presidency on the economy and markets.

In the immediate aftermath of the election, U.S. equities surged. Stocks in the oil, steel, and bank industries especially benefitted from the surprise victory. Stocks related to clean energy and hospitals experienced heavy selling. Gold, generally seen as a safe haven asset, was the biggest post-election loser.

In terms of specific policies that the Trump administration and Republican-controlled Congress will pursue, it’s all conjecture at this point. This issue of Market and Economic Outlook will be published right around the time of the inauguration. The policies that the Trump administration chooses to focus on during the first 100 days will help us all glean more. Having said that, we have some thoughts on a few issues and their possible impact on markets and the economy.

Deregulation — Enthusiasm over a new era of deregulation may be summed up by Michael Hintze, founder of CQS Investment Management, who was quoted by Bloomberg on November 11 as saying: “More deregulation than at any other time since Reagan’s presidency is certainly on the agenda.” On the campaign trail, Trump promised to scuttle Dodd-Frank (a wide-ranging, complex financial services law passed in the wake of the financial crisis) and to issue a temporary moratorium on all new U.S. regulations. Proponents view this stance as pro-growth. Many leaders of Wall Street firms and other financial industry companies have been critical of the Dodd-Frank Act and would welcome its repeal.

John Zasada, a principal for financial institutions with CLA, said financial institutions and community banks invested a lot of time and energy implementing the rules required by Dodd Frank Act. “All they can do is approach it as business as usual and wait and see,” he said.

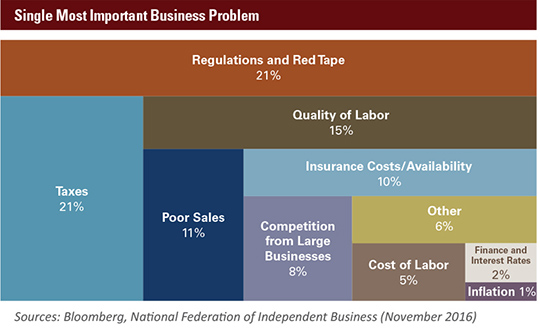

A Bloomberg survey indicates that small businesses in general clearly view regulations and red tape as a major problem.

Taxes — Although specifics in some areas are still lacking, Trump has stated that he’d like to lower taxes across the board for individuals and businesses. Highlights on the individual tax side include: fewer brackets and filing categories, a larger standard deduction, and lowering the top marginal rate from 40 percent to 33 percent (Tax Policy Center, November 15, 2016).

On the business side, Trump has proposed lowering the tax rate from the current 35 percent to 15 percent for all businesses. House Republicans, meanwhile, want a 20 percent tax rate for corporations and 25 percent rate for partnerships and similar entities.

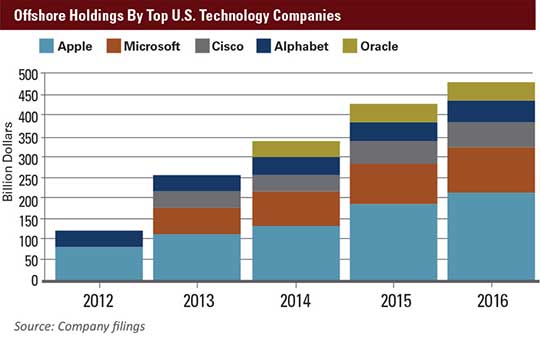

Trump and House Republicans have also proposed a policy to get U.S. companies who have booked profits abroad, and thereby skirted taxation, to repatriate those assets and pay taxes at a reduced rate. Complicated cross-border transactions and booking profits in tax havens are estimated to cost the U.S. Treasury tens of billions per year in lost tax receipts.

Proponents of Trump’s tax policies tout them as pro-growth, saying they will help all taxpayers by stimulating the economy. Opponents view the cuts as too costly, believing that reduced revenues will create huge budget deficits that will hurt the economy.

Infrastructure — Building and repairing roads, bridges, airports, and other assets is likely a subject where both parties can agree. There is a clear need for upgrades and improvements. The American Society of Civil Engineers gave U.S. infrastructure a D+ on its 2013 report card, and estimated that $3.6 trillion in investment is needed by 2020. In addition, the average age of “fixed assets’ in 2015 was 22.8 years, the oldest on record since this data was first collected in 1925.

But as always, the devil is in the details. Trump’s senior policy advisers have said they believe infrastructure projects could be self-financing by offering income tax credits to private companies, and then taxing the wages paid to construction workers to offset the revenue lost to income tax credits. Some question whether this scheme is realistic. On top of that, the tolls that may be required to make road projects profitable are hugely unpopular in many places. Republicans in Congress have generally proven to be mostly averse to infrastructure spending, as seen in its rejection of President Obama’s infrastructure spending proposals during his terms.

The consensus view of the new president’s policies is that they may usher in a new era of stronger growth, but with attendant issues of higher inflation and higher interest rates. Infrastructure spending, lower tax rates, and deregulation may stimulate the economy and improve consumer and business confidence. There are potential negative side effects, however, of slashing tax rates while increasing spending, including budget deficits and rising inflation. The potential for policy surprises remains, and we will continue to monitor actions in Washington that may affect the markets.

Darrel J. Mullenbach, principal in construction and real estate with CLA, said conversations with clients and industry professionals suggest high expectations for growth in all construction segments throughout 2017. Most contractors anticipate hiring additional workers.

“There is some concern that capacity may be limited by the availability of qualified skilled workers,” Mullenbach said. “Demand for skilled workers may result in an increase in construction costs. Interest rates are also expected to increase, but continued growth in the economy could outweigh those increases and have minimal impact on construction investment.”

A hopeful, constructive outlook for 2017

We are aware that risks and uncertainties — both political and economic — abound here and around the globe. The U.S. economy, however, remains strong and resilient. Stock market valuations, although not cheap, are not unreasonably expensive. Corporate earnings are growing and pro-growth policies may further stimulate the economy. Having closed the books on a fruitful 2016 in the capital markets, we look forward to 2017 with hope and remain constructive in our outlook.

We wish you all a happy and healthy 2017.

CliftonLarsonAllen Wealth Advisors, LLC

Investment Committee

connect@CLAconnect.com