We have pinpointed some of the most common Closing Disclosure completion errors to help financial institutions comply with TRID standards.

Since October 3, 2015, TILA RESPA Integrated Disclosures (TRID) have been required for residential mortgage transactions. Over the course of the year, CLA has been tracking TRID completion, and we have outlined common Closing Disclosure (CD) completion errors to help residential mortgage lenders meet compliance standards.

Many CD completion errors stem from mistakes made when completing the Loan Estimate counterpart sections, so both documents should be reviewed carefully by lenders.

Financial institutions should remember that the Consumer Financial Protection Bureau’s (CFPB) initial reviews of TRID compliance will mainly check that lenders are making good faith efforts by monitoring their TRID compliance and correcting errors. While the CFPB’s press release stated that examiners won’t be focusing on technical errors, it is important to follow the Bureau’s instructions to comply with these new standards.

Closing Disclosure Page 1: General Information and Projected Payments

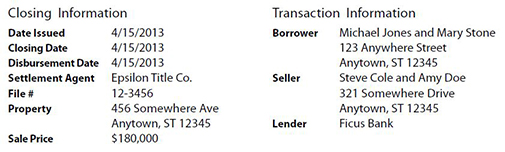

The General Information section located at the top of page 1 of the CD includes closing information, transaction information, and loan information. Incorrect completion or the omission of the issue date of the CD, the settlement agent name, or the seller’s address for a purchase transaction are the most common oversights in this section.

Of these issues, the most critical is the incorrect completion or omission of the CD issue date, which could lead to the appearance that the initial CD was not provided to the consumer with sufficient time prior to consummation as required. In circumstances where it is necessary to issue a revised CD after the initial CD has been issued, the issue date of the revised CD must be updated to reflect the date it was actually issued.

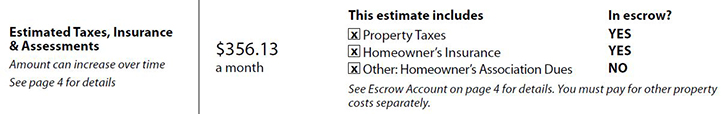

The most common errors found in the Projected Payments section related to the Estimated Taxes, Insurance & Assessments section, including mistakes made to homeowner’s association dues, are identical to the common errors noted for the Loan Estimate.

Closing Disclosure Page 2: Loan Costs and Other Costs

Similar to the Loan Estimate, the CD’s Section A. Origination Charges should only include those items payable to each creditor and loan originator for originating and extending the credit. Previously, the GFE Block 1 and HUD Line 801 origination charge included certain third party fees. Misplacement of these third party charges in Section A is a common error; fees paid to third parties are required to be disclosed in Section B. Services You Cannot Shop For. Examples of these types of third party fees include document preparation fees paid to a third party, Mortgage Electronic Registration Systems registration fees, or IRS tax transcript fees.

Additionally, the bundling of title services charges in the Loan Costs section and the omission of the “title” designation for services relating to settlement or title insurance appear commonly on the Loan Estimate and the CD’s Loan Costs counterparts.

Placement of services that were disclosed in the Loan Estimate Section C, for which the consumer was permitted to select a service provider, are commonly shown in the incorrect section of the CD. When the consumer is permitted to shop for certain services disclosed in Loan Estimate Section C and selects the service provider listed by the lender on the Service Provider list, those items must be shown in CD Section B and are included in the 10 percent tolerance calculation.

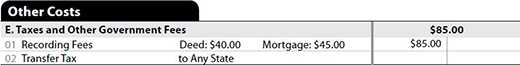

The Other Costs section of the CD, Section E. Taxes and Other Government Fees, commonly includes errors on recording charges and transfer taxes. Recording fees must all be shown as a bundled charge on Line 01; however, only the recording fees for the deed, if any, and mortgage must be shown itemized in the description. Transfer taxes, if any, must reflect the payee as the government entity assessing the charges. The name of the government entity assessing the charges shown on the CD is not necessarily the same name as the payee that must be reflected on the actual check used to pay the transfer tax.

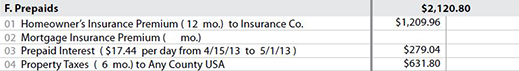

Section F. Prepaids includes those items that are required by the lender to be paid in advance, such as homeowner’s insurance premiums or property taxes. These prepaid items must show the period of time covered by the amount collected.

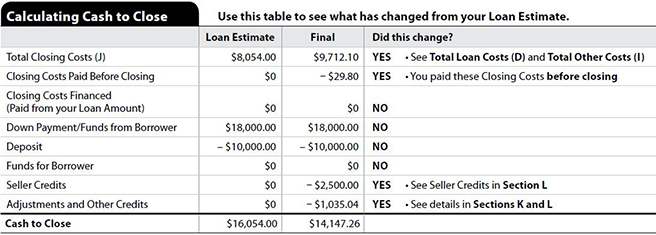

Closing Disclosure Page 3: Calculating Cash to Close

Page 3 of the CD includes the Calculating Cash to Close table, which presents multiple opportunities for completion errors, including:

- The Loan Estimate column not reflecting the figures as disclosed on the last issued Loan Estimate

- Missing explanations in the “Did this change?” column when a change did occur, as indicated by the word YES

- Not identifying where a change resulted in a tolerance cure shown as a Section J. Total Closing Costs lender credit

- Formatting the table so that it is inconsistent with the format used for the Calculating Cash to Close table in the Loan Estimate

Closing Disclosure Page 4: Loan Disclosures

Loan Disclosure section items concerning the dispositions for Assumption, Demand Feature, Negative Amortization, and Partial Payments are often omitted in error on this page. These boxes must not be left blank and must indicate whether or not the loan may be assumed, if there is a demand or negative amortization feature, and whether partial payments will be accepted, and if so, how they will be applied.

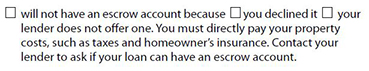

Additionally, under circumstances where an escrow account will not be established, the questions in the Escrow Account section concerning the reasons for not having an escrow account are commonly left uncompleted.

Closing Disclosure Page 5: Loan Calculations and Contact Information

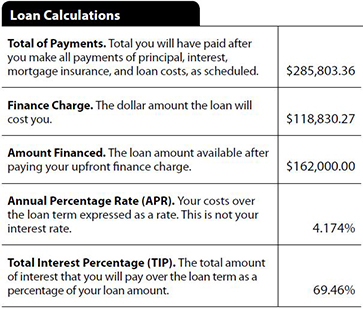

The Loan Calculations table has taken the place of the former TIL disclosure to reflect the loan’s Annual Percentage Rate (APR) calculation. Most errors occur in this section when the appropriate CD page 2 charges have not been identified as finance charges to be used to calculate the Amount Financed. The definition of finance charges has not changed with TRID; however, these errors may stem from lender’s new TRID software not yet flagging the appropriate items as finance charges due to naming convention or other reasons.

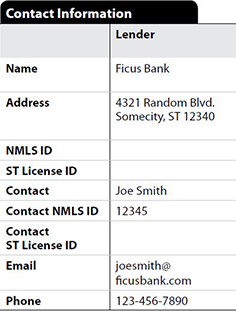

Errors in the Contact Information section on page 5 stem from various levels of incompletion. Most commonly, a contact individual is not identified for the Lender or Settlement Agent. This section must also include either an email address or a phone number for the contact listed.

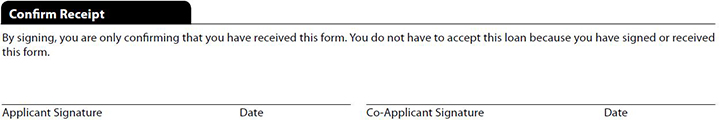

Confirm Receipt: Closing Disclosure and Loan Estimate

We have seen many lenders using the Confirm Receipt section format disclosure for both the Loan Estimate and Closing Disclosure, even when they do not require consumer signatures. The CFPB has made an alternative form available for lenders to use where signatures are not required. Confirmation of receipt is generally documented elsewhere, as lenders seek to confirm the exact date consumers received the disclosures in order to meet the strict TRID timelines.

Per the CFPB’s Guide to the Loan Estimate and Closing Disclosure forms, “If the creditor does not include statement line or the consumer’s signature, add a statement to the Other Disclosures concerning Loan Acceptance that states: “You do not have to accept this loan because you have received this form or signed a loan application.” (§§ 1026.38(s)(2), 1026.37(n)(2)).

How we can help

Correct completion of the Closing Disclosure is a critical step to help maintain compliance with the TRID regulation requirements. CLA’s mortgage advisory services team can help by providing compliance oversight, mortgage disclosure regulatory compliance review services, mortgage quality control, and employee education to help residential mortgage lenders meet industry quality standards.