The cash conversion cycle (ccc) translates your construction company’s financial information into a tool that can help you make strategic investment decisions.

Banks and sureties routinely perform liquidity calculations, such as net working capital, current ratio, quick ratio, and “days sales outstanding,” when doing their periodic assessments of your financial statements. While it’s true these balance sheet measurements can give you a rough indication of your overall liquidity, it is difficult to translate them into a way that assesses and controls cash flow on a contract-by-contract basis. A better way of looking at liquidity is called the cash conversion cycle, which analyzes the cash coming into and going out of your business and can help you make smarter decisions and monitor projects more effectively.

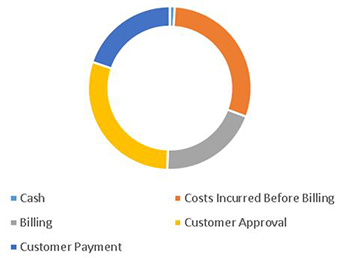

Steps in the cash conversion cycle

A construction contract begins with cash. What happens next depends on the terms of the contract, but tends to follow this pattern:

![]()

Using the cash conversion cycle is not difficult. The analysis looks at timing of cash flows. It provides a clear picture of your financial situation at any point in time, and more importantly, it offers concrete information about the management of cash flows over the lifespan of a contract.

Step one: simple measurement

The simple approach is to measure the days from cash out to cash in by adding up the days from cash outlay to cash receipt. The following is an example of the simple approach:

| Total Days in Cash Conversion Cycle | |

|---|---|

| Payroll (immediate outlay) costs to billing date (typically) | 30 days |

| Billing date to billing approval (typically) | 20 days |

| Billing approval to payment (typically) | 30 days |

| Total | 80 days |

80 days x average net daily cash outflow = total cash outflows before inflow occurs

Here is a chart illustrating these times in the cash conversion cycle

Cash Conversion Cycle

Note that we do not take accounts payable into account yet. There are two payment scenarios in construction, namely set number of days to pay (e.g., net 30) and pay when paid. These add to the magnitude and timing of outlays, but usually not the duration.

Complicating factors

Several factors influence the cash conversion cycle. The first is retainage. Even though you have completed work with a value of x, you only receive a part of it (.9 x in the case of 10 percent retainage). In addition, retainage can be held on subcontractors if written into their contracts, but is usually not held on suppliers. Circumstances sometimes allow for a reduction of the total cash outlay, such as payment for stored material, payment for mobilization, and agreed upon front loading of the schedule of values portion of the billing documents.

The simple approach gives us a feel for the cash cycle, but what really matters is how much cash you have tied up in the contract, and how it changes over time. The net outlay amount and the cash flow profile improve the accuracy and usefulness of your financial information.

Step two: net cash outlay approach

The outlay amount takes into account both magnitude and timing of cash flows.The net investment is as follows:

This will yield a dollar investment at a given point in time. Note that it includes all of the effects of the cash conversion cycle, including all of the complicating factors. It is a net number, and can be either negative (net outflow) or positive (net inflow).

Most modern construction accounting software packages will have a report that can show this value at the contract level. A shortcut approximation can be calculated as follows:

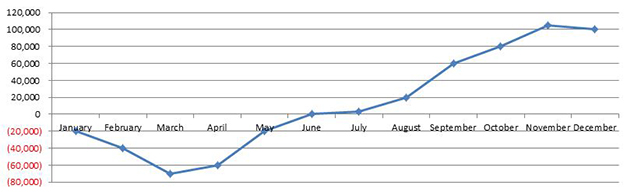

Step three: the cash profile

To manage working capital, you need a management tool. Contracts tend to follow a cash flow profile. The initial investment usually diminishes over time as more of the contract is performed and paid for by the customer. At some point, depending on achieved margin over cost, (or items like retainage payment terms.), the contract net cash flow goes from negative cash flow (net outlay) to positive cash flow (net excess cash over outlay). At the end of the project, the cash flow will equal the actual gross profit.

Toward the end of the project, the cash flow may even exceed the final cash flow, but due to punch list and warranty costs, the cash flow profile may before the contract is closed. A typical cash profile of a contract with a gross profit of $100,000 might look like this:

Net Cash Outlay

Just as the most important control tool in managing the profitability of contracts is the budget, the most important control tool in managing the working capital invested in a contract is the net cash outlay budget. A net cash outlay budget can be developed from another management tool, the resource-loaded project schedule. This schedule should be used for the timing of outflows (costs), and inflows should be projected using the billing information shown in the contract.

Step four: tying information together

It is most useful to know the cash profile of all projects at a given time. The net working capital is a function of these net positive and negative job cash positions. When viewed over time, this is the best way to assess overall company liquidity. It is also the basis of the cash budget, which is most useful for predicting when outside cash is needed, and when excess cash will be available. This is the kind of information that is useful for making key decisions, one of which is determining when investment is appropriate. This information provides one valuable piece of the puzzle needed to determine return on investment.