Strategically plan for current expected credit loss (CECL) by pairing an interactive, user-friendly tool with consulting support from CLA professionals.

What’s on your mind?

- Estimating the impact of CECL on capital planning, strategic planning, and budgeting for your financial institution

- Determining how much your institution’s current reserve balances will need to increase

- Helping management and board members understand your institution’s CECL requirements

Experience our client-focused approach

Regardless of your implementation date for the Financial Accounting Standards Board’s (FASB) new credit loss model, your institution is likely already discussing how the new guidance will affect your current reserve levels.

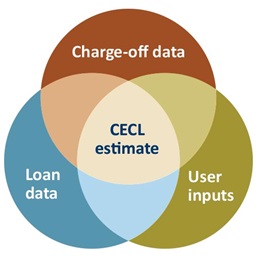

As the preferred vendor of Spotlight Financial, we are utilizing the Bank Trends and CU Metrics CECL allowance calculator, which is continually evolving to help financial institutions calculate the new ALLL accounting standard. This interactive tool collects quarterly charge-off and loan data from your regulatory reports, allowing you to apply specific quantitative adjustments to data using your institution’s specific user inputs to determine the sensitivity of CECL. Over time, the calculator will continue to add functionality, refining the results for your institution.

CECL tools and implementation consulting services

In addition to the CECL allowance calculator, you will receive CECL implementation consulting assistance from CLA professionals who know and work closely with financial institutions. Together, we can:

- Teach leaders in your institution how to use the CECL allowance calculator

- Help management or board members understand CECL concepts

- Evaluate CECL models, including data requirement identification and retention

- Access our CECL resources to help create a plan to meet the compliance requirements

Note: The CECL Calculator is a web-based model owned, operated and maintained by Spotlight Financial, Inc. and is designed for use by smaller, non-complex organizations with standard loan portfolios. CLA is a preferred vendor of Spotlight Financial, Inc. and does not have any ownership interest in Spotlight Financial, Inc. or the CECL Calculator. CLA makes no representations, warrantees or assurances related to the CECL Calculator for analysis of the impact of Accounting Standards Update No. 2016-13 Financial Instruments – Credit Losses (“ASU No. 2016-13”) by an organization on its operations, regulatory reporting, and allowance levels or the accuracy of the CECL Calculator as a calculation of the allowance for loan and lease losses in accordance with ASU No. 2016-13 or GAAP.