In this issue of Market and Economic Outlook: Patience and diversification are still the key investor strategies as volatile markets, slowly rising interest rates, and falling energy prices converge for a shaky start to the New Year.

The first week of January saw the worst start ever for the Dow Jones Industrial Average. The S&P 500 and world stock markets have not fared much better; the S&P 500 is down about 8 percent year-to-date through mid-January. However, long-term stock investors should expect these occasional declines even though they are painful as they occur.

Looking back, we can see that the last few years in the U.S. stock market have been remarkably calm, with most volatility to the upside. But last fall, we had the first 10 percent decline in more than three years. History tells us that 10 percent corrections tend to occur about every 12 months, so we were long overdue. The question is, why is the market falling? We believe that several factors are at work here:

- Decreased expectations for Chinese economic growth (the second largest economy in the world)

- Federal Reserve is now on a path to higher interest rates

- A strong U.S. dollar impacting exports

- The continuing decline in oil prices and commodities overall

- High stock valuations relative to history

- Credit markets tightening, especially in the energy space

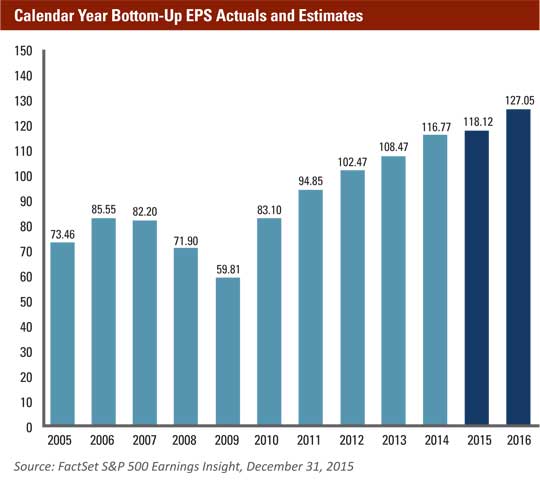

- Corporate earnings expectations being lowered

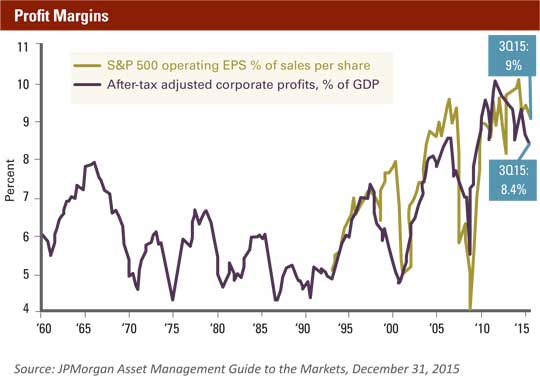

A contentious presidential election may also be weighing in. We will probably need to see some stabilization in oil prices and the U.S. dollar to help boost the flat corporate earnings growth we saw in 2015. Corporate earnings are the life blood for stocks and traction in earnings should help relieve the current swoon.

If this correction turns into a bear market (a decline lasting at least four months), what can we expect? Again, history tells us that bear markets typically last about one year with a total drawdown of 25 percent. Generally, corrections do not turn into bear markets unless accompanied by an economic recession, which does not appear likely at this time. The good news in this is that future return expectations will be higher when the swoon ends. Furthermore, our portfolios are diversified with global stocks, bonds, and in some cases, private placement real estate. By utilizing several asset classes, we may get an opportunity to rebalance portfolios back to their original allocation levels (sell high, buy low).

| Bear Markets (12/31/1948 — 12/31/15) | |

|---|---|

| Occurences | 13 |

| Average Length (months) | 14 |

| Average Annual Return | -21.5% |

| Average Cumulative Return | -24.6% |

A bear market is defined as a decline lasting at least four months.

Source: Putnam Research, using S&P 500 data

Here's a quick look at some of the positives and negatives as we begin 2016.

| Positives | Negatives |

|---|---|

|

|

Energy price collapse affects stock and bond markets

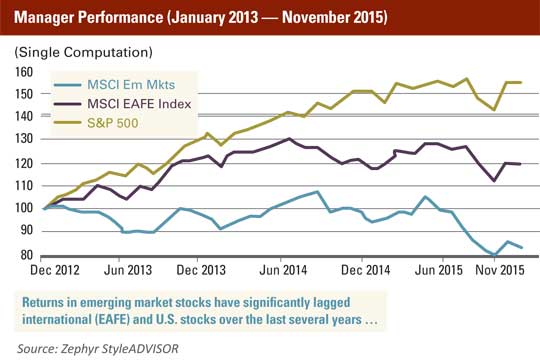

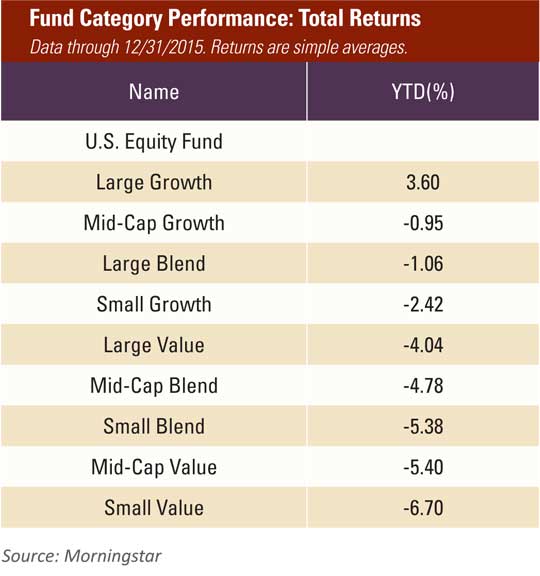

Oil and energy-related investments have experienced severe downturns as oil prices fell on world markets, impacting both the stock and bond markets. U.S. large-company investors are roughly even for the year (2015), while international, U.S. small company, and ‘value’ investors are sitting on 5 to 15 percent losses (2015).

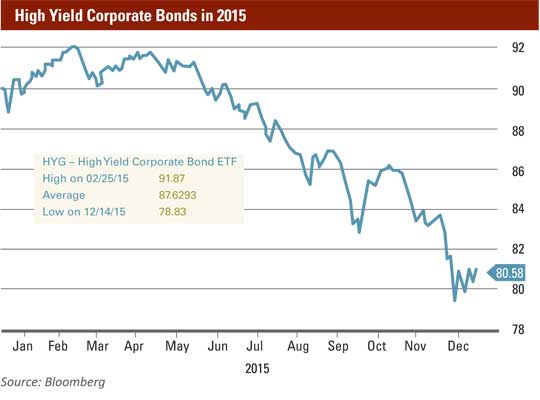

The impact of oil’s steep price decline on energy sector stocks has been widely reported. What is less well-known is that 20 percent of the high-yield corporate bond market is issued by energy companies. These bond prices are down significantly in the last three months and investors are scrambling to protect their high-yield bonds through the options market.

The carnage in high-yield bonds, and specifically in the energy sector, may have created some attractive long-term opportunities. Marc Lasry, chief executive of Avenue Capital Group, recently said that investing in energy debt at presently depressed prices is a “once-in-a-lifetime opportunity” for investors who can afford to wait a few years before cashing out.

Market thinks the Fed will go slow following rate hike

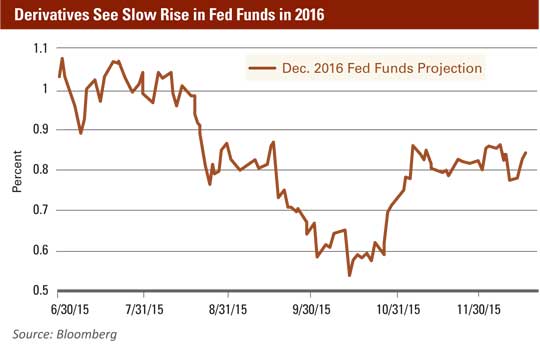

The derivatives market is pricing in roughly two 0.25 percent increases in the federal funds rate versus the Federal Reserve, which expects four 0.25 percent increases for 2016. This is a fair assessment by market participants as the Fed has overestimated economic growth consistently over the last several years. Interest rate derivative traders see the federal funds rate at 0.83 percent by the end of 2016 versus the Federal Reserve at 1.375 percent (based on minutes from the last Fed meeting).

Why is the path to higher interest rates important? Bond market returns. While higher interest rates have been a popular prediction for years, bonds do much better in a slow-rising interest rate scenario than a fast-rising interest rate scenario. Despite expectations of very modest returns from bonds going forward, we believe bonds continue to play a key role in diversified portfolios.

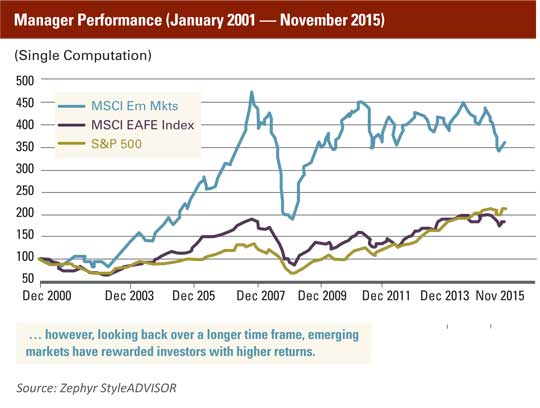

Diversification with U.S. and overseas stocks

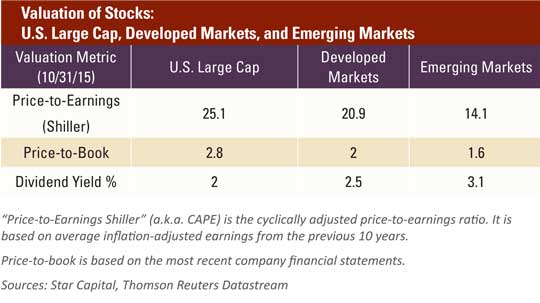

The U.S. stock market has been kind to capital (investors) over the last several years. Why invest anywhere else? In a word: valuations. The outsized returns of the U.S. stock market relative to the world have made domestic stocks more expensive than overseas stocks, especially emerging markets. Markets don’t go straight up. The U.S. stock market is no exception, and some reversion to the mean should be expected. While U.S. stocks should remain a cornerstone in diversified portfolios, a meaningful allocation to overseas companies is prudent in our view, given the valuation advantage.

Agribusiness fights for its place on the global stage

Rod Mauszycki, a CliftonLarsonAllen principal serving agribusiness and cooperatives, says that agribusiness is struggling. But tough times on the farm are not necessarily due to domestic production. Ag commodity prices — and therefore farm income — are subject to global pressures.

“Our farmers are competing with producers in Brazil, Russia, and Canada to name a few,” says Mauszycki. “As the U.S. dollar rises, it is cheaper for worldwide market participants to purchase from countries other than the United States.”

China is a good example. With the country de-coupling from the U.S. currency earlier this year, it is cheaper to buy grain and other commodities from non-U.S. suppliers.

Rod Mauszycki, Principal, Agribusiness and Cooperatives

Global stocks of some commodities are also impacting prices. For example corn inventories are at a 28-year high. With large supplies and flat demand, U.S. corn exports are down 50 million bushels from 2014 to 2015. This is due primarily to Brazil and Canada stepping in with better prices. With more grain on the domestic market, prices fall. Mauszycki says he expects pricing pressures to continue for the next couple of years.

“We’re telling clients to plan and control input costs, and make sure that they have cash flow so they’re not in a situation where they’re dependent on loans,” Mauszycki explains. He adds that agriculture is typically highly leveraged, so an increase in interest rates will definitely be felt.

Mauszycki says the farm bill passed late in 2015 is a bright spot for agribusiness since it acts as sort of a quasi-governmental insurance policy for low prices. He believes the Trans-Pacific Partnership (TPP) trade agreement should also help by alleviating the advantage that government subsidies give producers in other countries.

Real estate returns complement stock and bond portfolios

The past year was frustrating for many investors. Within the equities category, ‘value’ style strategies (regardless of company size) trailed their ‘growth’ peers by wide margins (see table below). As previously noted, fixed income, investment grade bonds returned less than 1 percent while high yield bonds suffered losses. Real assets, such as energy, natural resources, and master limited partnerships (MLPs) ended 2015 with steep losses of 20 to 30 percent. One asset that increased in value in 2015 was U.S. single family homes (+5 percent). Our clients who meet the Security and Exchange Commission’s accredited and qualified investor requirements have access to direct-owned real estate in hotels, office buildings, and apartment complexes. These private real estate offerings can complement stock and bond portfolios and provide a compelling return opportunity.

FANG stocks were up…really up

One defining aspect of 2015 was that the market was very “narrow,” meaning only a small handful of stocks were up big while most stocks were negative. The four stocks that have become known by the acronym “FANG” (Facebook, Amazon, Netflix, Google) had outsized returns in 2015. Charles Schwab reports that if you were to exclude those four stocks, the large cap S&P 500 index would have been down 4.8 percent last year. A narrow market is sometimes seen as a bearish sign.

FANG Performance Versus Broad U.S. Market

NOTE: Only use tables for tabular data, not for layout.

| Name | Symbol | 2015 Return % |

|---|---|---|

| Facebook Inc., Class A | FB | 34 |

| Amazon.com Inc. | AMZN | 118 |

| Netflix Inc. | NFLX | 134 |

| Google (Alphabet Inc.) | GOOG | 45 |

| Broad U.S. market (S&P 500) | 1 |

Returns rounded to nearest whole percent.

Source: Morningstar

Corporate earnings hit a rough spot

Corporate earnings stalled for 2015 on a stronger U.S. dollar (which hurts exports) and lower energy earnings. Stabilization in the U.S. dollar and oil may be needed for corporate profits to reach historical 5 to 6 percent annual growth.

As noted earlier, world stock markets have opened the New Year under pressure. In fact, the U.S. stock market’s first two weeks are the worst start since 1928.

There will always be reasons for worry and concern in the markets. With the upcoming presidential election, flat profit growth, and a rising interest rate environment, there are certainly headwinds. However, value is also being created in the energy space, commodities, high-yield bonds, and emerging markets. Last fall, we had our first 10 percent correction in U.S. stocks in more than three years. We did not have to wait another three years for the next correction, it’s here. While the stock swoon could certainly get worse, this is difficult to see without the U.S. economy slipping into recession. Our banks and consumers are in much better shape than 2008 and while China and oil are concerning, it pales in comparison to the systemic risk the financial system faced in 2008. A diversified portfolio comprised of stocks, bonds, and real estate, and customized to meet your individual financial goals, is a well-known and accepted strategy for preserving and growing wealth over time.

We wish you good health, wealth, and a prosperous New Year.